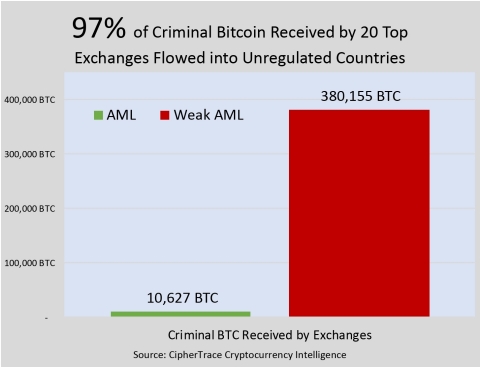

MENLO PARK, Calif.--(BUSINESS WIRE)--Efforts to enact and enforce strong cryptocurrency Anti-Money Laundering (AML) regulations are drastically reducing criminal activity on digital currency exchanges, according to new research released today in the CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report. The study revealed that 97 percent of direct bitcoin payments from criminals went to exchanges in countries with weak anti-money laundering laws.

Nearly five percent of all bitcoin sent to poorly regulated exchanges comes from criminal activity before the money is moved, undetected, into the global financial payments system. In fact, these exchanges have laundered a significant amount of bitcoin, totaling 380,000 BTC or $2.5 billion at today’s prices.

“This extensive research shows that regulation does have a direct correlation in hindering criminal activity, and we are on the right track to instill further trust in the crypto ecosystem,” commented Dave Jevans, CEO, CipherTrace and co-chair of the Cryptocurrency Working Group at the APWG.org. “We will see the opportunities to launder cryptocurrencies greatly reduced in the coming 18 months as cryptocurrency AML regulations are rolled out globally.”

The report covers the latest legislative changes, as governments around the world are ramping up cryptocurrency AML regulation and enforcement, many by the end of this year. For example, US FinCEN recently clarified its stance on regulation, subjecting crypto-to-crypto exchanges to the Bank Secrecy Act (BSA) rules, focusing on mixing services and enlisting the help of the IRS. The European Commission’s 5th Anti-Money Laundering Directive (AMLD 5) was also entered into force in July and will require G20 nations to comply with strict AML regulations. “Different geographies are competing on regulations and trying to become ‘trusted’ digital currency hubs in order to grow their economies,” added Jevans.

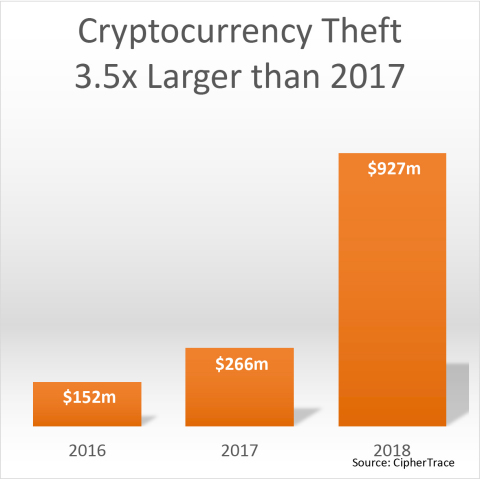

2018 Cryptocurrency Thefts Near One Billion Dollar Mark

During the first three quarters of this year, the report shows $927 million of cryptocurrency reported as stolen from exchanges. The $166 million in reported thefts since the second quarter report was driven by an emerging trend toward more frequent and smaller cyberattacks by sophisticated thieves. CipherTrace estimates that total stolen cryptocurrency reported is expected to hit well over $1 billion by the end of the year – currency that needs to be laundered.

The CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report provides an in-depth state-of-the-market look at criminal activity and the status of AML regulations by jurisdiction. The report presents an unprecedented quantitative analysis of 45 million transactions at 20 top cryptocurrency exchanges globally between January 2009 until September 20, 2018, and identifies criminal funds from dark markets, extortion, malware, mixer/tumbler/money laundering sites, ransomware, and terrorist financing.

To download the CipherTrace 2018 Q2 Cryptocurrency Anti-Money Laundering Report visit: https://ciphertrace.com/crypto-aml-report-2018q3

About CipherTrace

CipherTrace develops cryptocurrency Anti-Money Laundering, cryptocurrency forensics, and blockchain threat intelligence solutions. Leading exchanges, banks, investigators, regulators and digital asset businesses use CipherTrace to trace transaction flows and comply with regulatory anti-money laundering requirements, fostering trust in the cryptocurrency economy. Its quarterly CipherTrace Cryptocurrency Anti-Money Laundering Report has become an authoritative industry data source. CipherTrace was founded in 2015 by experienced Silicon Valley entrepreneurs with deep expertise in cybersecurity, eCrime, payments, banking, encryption, and virtual currencies. The U.S. Department of Homeland Security Science and Technology (S&T) and DARPA initially funded CipherTrace, and it is backed by leading Silicon Valley venture capital investors. Visit www.ciphertrace.com for more information or follow the company on Twitter: @CipherTrace and LinkedIn: /company/CipherTrace