PORTLAND, Ore.--(BUSINESS WIRE)--PWCC Marketplace, the largest seller of investment-caliber trading cards, has released its latest research on investment returns from vintage and modern trading cards. PWCC’s data show that as an alternative or nontraditional investment class, trading cards have consistently outperformed stocks in a variety of market conditions over the past decade.

PWCC obtains original sales data through a partnership with VintageCardPrices.com and uses its own proprietary software to capture trading card value. PWCC has been collecting and tracking these figures since 2008.

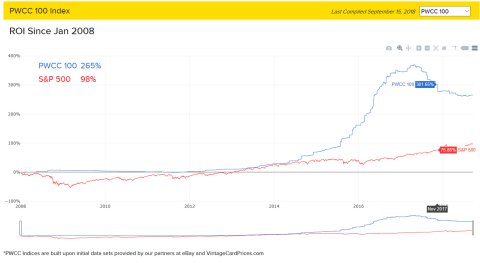

The company has created a set of indices, including the PWCC Top 500 and the PWCC Top 100, that show how these different subsets of the market – the 500 and 100 most valuable trading cards (as defined by sales price, trading velocity and other factors)– have tracked against the S&P 500.

As of September 15, the PWCC Top 500 index achieved a 10-year return on investment of 164 percent and a five-year ROI of 135 percent. The PWCC Top 100 performed even better, achieving a 10-year ROI of 265 percent (see accompanying figure) and a five-year ROI of 199 percent. Both scenarios represent a significant outperformance of the S&P 500 over the same periods.

These strong growth figures demonstrate why trading cards are transitioning from what was once purely a hobby into a legitimate alternative asset class.

“Even in a bull market, trading cards—both modern and vintage—have continued to outperform stocks, generating superior rates of return across multiple time horizons,” said Brent Huigens, CEO of PWCC. “Like fine art, trading cards have always offered aesthetics and fun, but now we can combine that aspect with the data and analytics of the stock market to help collectors maximize their ROI. And unlike art and other alternative investments, trading cards are extremely accessible even to small investors.”

Investment-oriented buyers and sellers demand increased transparency as well as tools and technologies that facilitate secure, informed transactions. PWCC, which Huigens founded in 1998 to provide an efficient, secure and predictable marketplace, has built its reputation – and grown to more than $50 million in annual revenue – by meeting these demands. The company currently trades approximately 200,000 cards per year, making it the largest online auction platform for trading cards.

PWCC sets itself apart from other auction houses by offering buyers and sellers reduced transaction costs, faster turnaround times, increased liquidity and greater transparency, along with a commitment to handle every trade with the highest level of integrity and care. The company is preparing to expand its suite of services for investment-minded traders by providing secure storage, fulfillment and access to capital.

About PWCC Marketplace

Since 1998, PWCC has provided buyers and sellers of both vintage and modern graded trading cards with an efficient, secure and predictable marketplace. Compared to traditional, more fragmented auction environments, PWCC offers technology-driven efficiencies in line with electronic financial exchanges, including reduced transaction costs, faster turnaround times, increased liquidity and greater transparency. PWCC’s proven platform provides collectors and investors with the most trusted way to invest in trading cards. Find out more and follow live auctions at www.pwccmarketplace.com.