NEW YORK--(BUSINESS WIRE)--Viacom Inc. (NASDAQ: VIAB, VIA) today reported financial results for the third quarter of fiscal 2018 ended June 30, 2018.

Bob Bakish, President and Chief Executive Officer, said, “Viacom produced another quarter of strong progress, with clear evidence that our turnaround is delivering results and that our evolution into a truly global, multiplatform, brand- and IP-driven entertainment company is well underway. Paramount Pictures is revitalized, with outstanding box office performance and growing television production revenues driving substantial gains in profitability. Our Media Networks brands posted significant gains in both linear flagship share and digital consumption, in addition to sequential improvements in domestic affiliate revenue growth.

“In the quarter, Viacom concluded a strong advertising upfront that combined robust price increases, as well as improved packaging that included increased demand for our advanced marketing solutions. Additionally, we continued to diversify our business with growth in worldwide live event attendance and the expansion of a cross-company studio production initiative that leverages our sizable creative assets and global capabilities to drive incremental opportunities.

“This improvement in operating performance -- combined with meaningful actions over the past 18 months to de-lever our balance sheet -- have resulted in a stronger credit profile to help support Viacom’s return to long-term sustainable growth. We remain focused on building this momentum with an even stronger September quarter as we continue to position Viacom for the future.”

FISCAL YEAR 2018 RESULTS

| (in millions, except per share amounts) |

Quarter Ended June 30, |

B/(W) |

Nine Months Ended June 30, |

B/(W) | ||||||||||||||||||||||||

| 2018 | 2017 | 2018 vs. 2017 | 2018 | 2017 | 2018 vs. 2017 | |||||||||||||||||||||||

|

GAAP |

||||||||||||||||||||||||||||

| Revenues | $ | 3,237 | $ | 3,364 | (4 | )% | $ | 9,458 | $ | 9,944 | (5 | )% | ||||||||||||||||

| Operating income | 752 | 746 | 1 | 1,925 | 1,784 | 8 | ||||||||||||||||||||||

| Net earnings from continuing operations attributable to Viacom | 511 | 680 | (25 | ) | 1,302 | 1,197 | 9 | |||||||||||||||||||||

| Diluted EPS from continuing operations | 1.27 | 1.69 | (25 | ) | 3.23 | 2.99 | 8 | |||||||||||||||||||||

|

Non-GAAP* |

||||||||||||||||||||||||||||

| Adjusted operating income | $ | 767 | $ | 805 | (5 | )% | $ | 2,125 | $ | 2,165 | (2 | )% | ||||||||||||||||

| Adjusted net earnings from continuing operations attributable to Viacom | 475 | 471 | 1 | 1,259 | 1,201 | 5 | ||||||||||||||||||||||

| Adjusted diluted EPS from continuing operations | 1.18 | 1.17 | 1 | 3.12 | 3.00 | 4 | ||||||||||||||||||||||

|

* Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

||||||||||||||||||||||||||||

Revenues in the third fiscal quarter decreased 4% to $3.24 billion. Operating income grew 1% to $752 million, principally driven by a restructuring charge in the prior year quarter and improvement in Filmed Entertainment operating results. Adjusted operating income decreased 5% to $767 million in the quarter. Net earnings from continuing operations attributable to Viacom declined to $511 million, primarily due to the gain on sale of an investment in EPIX in the prior year quarter. Adjusted net earnings from continuing operations attributable to Viacom increased 1% to $475 million in the quarter. Diluted earnings per share decreased $0.42 to $1.27 in the quarter, and adjusted diluted earnings per share increased $0.01 to $1.18.

MEDIA NETWORKS

Media Networks increased its momentum with growth in television share, significant gains in digital consumption and live event attendance, sequential improvement in domestic affiliate revenue growth and savings from cost transformation initiatives.

Media Networks revenues decreased 2% to $2.50 billion in the quarter, as a 17% increase in worldwide ancillary revenues to $158 million was more than offset by a 4% decrease in worldwide advertising revenues to $1.19 billion and a 3% decrease in worldwide affiliate revenues to $1.15 billion. Domestic and international revenues each declined 2% in the quarter to $1.99 billion and $509 million, respectively. Excluding a 2-percentage point unfavorable impact from foreign exchange, international revenues were flat in the quarter.

Domestic advertising revenues decreased 3% to $922 million, reflecting lower linear impressions, partially offset by higher pricing and growth in Advanced Marketing Solutions revenues, which increased 33%. International advertising revenues decreased 4% to $269 million, driven by an unfavorable impact from foreign exchange. Excluding a 5-percentage point unfavorable impact from foreign exchange, international advertising revenues increased 1% in the quarter.

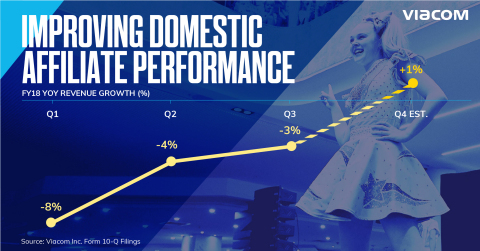

Domestic affiliate revenues decreased 3% to $978 million, a sequential improvement of 100-basis points from the prior quarter. Excluding the impact of SVOD revenues in the quarter, domestic affiliate revenues were flat. International affiliate revenues declined 2% to $175 million in the quarter.

Domestic ancillary revenues increased 31% to $93 million, driven by revenues from live events and consumer products, while international ancillary revenues increased 2% to $65 million.

Benefits from cost transformation initiatives helped drive a 2% decrease in SG&A expenses for the quarter.

Adjusted operating income for Media Networks decreased 8% to $799 million in the quarter, primarily reflecting lower segment revenues.

Performance highlights:

-

Viacom flagship brands grew year-over-year audience share for the

fifth consecutive quarter, and Viacom continues to hold the top share

of basic U.S. cable viewing among key demos, including Adults 18-34,

African Americans 18-49 and Kids 2-11, among others.

- MTV was the fastest growing network in primetime among the top 50 broadcast and cable channels in the Adults 18-34 demo for the quarter. It has increased year-over-year primetime ratings for four straight quarters -- its best streak in seven years -- and, collectively with VH1, held nine of the top 10 unscripted cable series this year. The second season premiere of Floribama Shore in July 2018 brought in nearly 1 million viewers, with ratings up double-digits from its series debut.

- BET posted its highest-rated third quarter since 2014 -- up 24% in C3 among Adults 18-49 -- culminating in the 2018 BET Awards, cable’s #1 awards show for the fourth straight year.

- Comedy Central produced its biggest year-over-year primetime ratings gain for a quarter since fiscal 2014. The network continued to broaden its audience base, growing year-over-year ratings among women 18-49 for seven consecutive months as of July 2018.

- The premiere week of Nickelodeon’s Double Dare averaged 1.4 million viewers, making it the most-watched series debut on kids’ TV so far in 2018.

- Paramount Network’s Yellowstone is the most watched scripted cable series of 2018 after The Walking Dead, with an average audience of approximately 4.4 million viewers in Live+3.

- VH1 has delivered 12 consecutive quarters of year-over-year share growth. Franchise favorite RuPaul’s Drag Race garnered 12 Emmy nominations in 2018 -- the most for any unscripted series on TV.

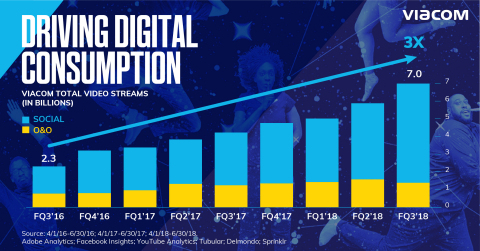

- Viacom Digital Studios continues to drive tremendous growth in digital consumption of its content, increasing quarterly total video views and watch-time 112% and 104% year-over-year, respectively. Since the third quarter of fiscal 2016, the company has tripled its total digital video streams across O&O and social platforms to 7.0 billion in the quarter. Additionally, Nick’s Noggin app has flourished on Amazon Prime Video Channels, with strong subscriber growth since its launch on the platform in May 2018.

- The company secured distribution of leading Viacom brands on the new AT&T Watch entertainment-only skinny bundle service. The partnership expands the broad representation of Viacom networks across the AT&T subscriber footprint through a new, differentiated platform that targets mobile users.

- Viacom’s Media Networks is quickly executing on the company’s studio production strategy to create and license content for digital and linear partners. Viacom International Studios launched in the quarter, uniting the extensive production capabilities of Telefe and majority-owned Brazilian comedy brand Porta dos Fundos with those of Viacom’s Latin American brands. VIS is already producing shows for Netflix, Amazon, Telemundo and Fox, among others. In the U.S., Nickelodeon delivered its first title under a multi-year agreement with Netflix to produce and license animated series Pinky Malinky. And MTV Studios, launched in June, will capitalize on one of the TV industry’s largest libraries of youth-focused and music-related IP in the world that -- up until now -- has been largely untapped.

- Accelerating the growth of Viacom’s live events business, Bellator formed a nine-figure, multi-year distribution partnership with global sports streaming service DAZN that positions the league to become an even more significant player in MMA. The sixth annual BET Experience attracted 165,000 attendees, and cable’s #1 comedy brand also continued to build success in live events, with more than 45,000 fans attending Comedy Central’s second annual Clusterfest in June 2018.

FILMED ENTERTAINMENT

Paramount Pictures is delivering on its turnaround, with strong current quarter releases driving domestic theatrical revenues up 58%, continuing growth in television production and increasing profitability.

Filmed Entertainment revenues decreased 9% to $772 million in the quarter, as a 20% increase in domestic revenues to $464 million was more than offset by a 33% decline in international revenues to $308 million. Theatrical revenues were down 21% to $208 million principally due to lower carryover revenues. Domestic theatrical revenues grew 58%, driven by the strong performance of current quarter releases A Quiet Place and Book Club, while international theatrical revenues decreased 58%, reflecting comparisons against the release of Transformers: The Last Knight and Ghost in the Shell in the prior year quarter. Licensing revenues increased 35% to $404 million in the quarter, primarily due to the release of Paramount Television product, including the second season of 13 Reasons Why. Domestic licensing revenues were up 122%, while international licensing decreased 8%. Home entertainment revenues declined 45% to $119 million, reflecting the mix and number of titles in release. Domestic and international home entertainment revenues decreased 47% and 41%, respectively. Ancillary revenues decreased 38% to $41 million, with domestic and international ancillary revenues down 40% and 27%, respectively.

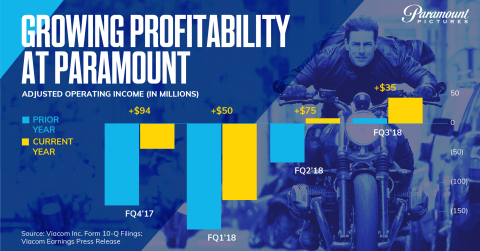

Filmed Entertainment reported adjusted operating income of $44 million in the quarter compared to $9 million in the prior year quarter, an improvement of $35 million that reflects lower operating expenses and higher domestic revenues driven by the strong performance of current quarter releases and television production.

Performance highlights:

- Paramount Pictures has improved adjusted operating income in six consecutive quarters, and was profitable in the second and third quarters of fiscal 2018.

- A Quiet Place has grossed more than $188 million domestically to date, making it the second highest grossing horror film in the U.S. over the past decade. The film has so far earned more than $332 million at the worldwide box office at a production cost of approximately $20 million.

- Released in May 2018, Book Club has gone on earn more than $68 million to date at the domestic box office -- more than six times its acquisition cost of $10 million.

- The fourth quarter release of Mission: Impossible - Fallout grossed nearly $330 million globally in its first two weekends -- the biggest opening ever for the franchise. The film has received universal acclaim, with critics hailing it as the best in the series.

- Looking ahead to the fall, Paramount Players and BET will release Tyler Perry’s Nobody’s Fool -- starring Tiffany Haddish and Tika Sumpter -- followed by the studio’s November 2018 release of World War II horror film Overlord, produced by J.J. Abrams. Including the recently announced live-action adaptation of the iconic Nickelodeon series Rugrats, Paramount Players has already slated at least five branded feature films with Viacom’s leading media networks.

- In all, Paramount’s fiscal 2019 slate will nearly double the number of worldwide theatrical releases compared to fiscal 2018.

- Paramount Television has continued to drive substantial growth in licensing revenues from hit series, including the second season of 13 Reasons Why. The Alienist, which Paramount produced for TNT, received six Emmy nominations, including Outstanding Limited Series. And Amazon ordered a second season of Tom Clancy’s Jack Ryan well before the series premieres in August 2018. Paramount TV is expected to double its production output in 2019, and currently has 19 series ordered or in production.

BALANCE SHEET AND LIQUIDITY

Continued progress in operating performance over the last 18 months, including increased Filmed Entertainment profitability, sequential improvement in domestic affiliate revenue growth and strong gains in Viacom International Media Networks, combined with de-levering actions taken, are driving an improved credit outlook.

The Company’s cash balance was $929 million at June 30, 2018, a decrease from $1.39 billion at September 30, 2017. In the nine months, net cash provided by operating activities increased $343 million, or 52%, to $997 million, free cash flow increased $380 million, or 74%, to $895 million and operating free cash flow increased $347 million, or 63%, to $895 million.

At June 30, 2018, total debt outstanding was $10.09 billion, compared with $11.12 billion at September 30, 2017, a reduction of $1.03 billion.

About Viacom

Viacom is home to premier global media brands that create compelling entertainment content - including television programs, motion pictures, short-form content, games, consumer products, podcasts, live events and social media experiences - for audiences in 183 countries. Viacom’s media networks, including Nickelodeon, Nick Jr., MTV, BET, Comedy Central, Paramount Network, VH1, TV Land, CMT, Logo, Channel 5 (UK), Telefe (Argentina), Colors (India) and Paramount Channel, reach approximately 4.3 billion cumulative television subscribers worldwide. Paramount Pictures is a major global producer and distributor of filmed entertainment. Paramount Television develops, finances and produces original programming for television and digital platforms.

For more information about Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s company blog (blog.viacom.com), Twitter feed (twitter.com/viacom) and Facebook page (facebook.com/viacom).

Cautionary Statement Concerning Forward-Looking Statements

This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: the public acceptance of our brands, programs, motion pictures and other entertainment content on the various platforms on which they are distributed; technological developments, alternative content offerings and their effects in our markets and on consumer behavior; the potential for loss of carriage or other reduction in the distribution of our content; significant changes in our senior leadership and the ability of our strategic initiatives to achieve their operating objectives; economic fluctuations in advertising and retail markets, and economic conditions generally; evolving cybersecurity and similar risks; the impact of piracy; increased costs for programming, motion pictures and other rights; the loss of key talent; competition for content, audiences, advertising and distribution; fluctuations in our results due to the timing, mix, number and availability of our motion pictures and other programming; other domestic and global economic, political, business, competitive and/or regulatory factors affecting our businesses generally; changes in the Federal communications or other laws and regulations; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2017 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at www.viacom.com.

|

VIACOM INC.

CONSOLIDATED STATEMENTS OF EARNINGS (Unaudited) |

||||||||||||||||||||

|

Quarter Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||||||

| (in millions, except per share amounts) | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||

| Revenues | $ | 3,237 | $ | 3,364 | $ | 9,458 | $ | 9,944 | ||||||||||||

| Expenses: | ||||||||||||||||||||

| Operating | 1,681 | 1,788 | 4,925 | 5,551 | ||||||||||||||||

| Selling, general and administrative | 738 | 756 | 2,249 | 2,205 | ||||||||||||||||

| Depreciation and amortization | 51 | 53 | 159 | 167 | ||||||||||||||||

| Restructuring and related costs | 15 | 21 | 200 | 237 | ||||||||||||||||

| Total expenses | 2,485 | 2,618 | 7,533 | 8,160 | ||||||||||||||||

| Operating income | 752 | 746 | 1,925 | 1,784 | ||||||||||||||||

| Interest expense, net | (138 | ) | (155 | ) | (428 | ) | (469 | ) | ||||||||||||

| Equity in net earnings of investee companies | 2 | 47 | 5 | 78 | ||||||||||||||||

| Gain on sale of EPIX | — | 285 | — | 285 | ||||||||||||||||

| Other items, net | (9 | ) | (2 | ) | (15 | ) | (37 | ) | ||||||||||||

| Earnings from continuing operations before provision for income taxes | 607 | 921 | 1,487 | 1,641 | ||||||||||||||||

| Provision for income taxes | (93 | ) | (233 | ) | (158 | ) | (417 | ) | ||||||||||||

| Net earnings from continuing operations | 514 | 688 | 1,329 | 1,224 | ||||||||||||||||

| Discontinued operations, net of tax | 11 | 3 | 23 | 3 | ||||||||||||||||

| Net earnings (Viacom and noncontrolling interests) | 525 | 691 | 1,352 | 1,227 | ||||||||||||||||

| Net earnings attributable to noncontrolling interests | (3 | ) | (8 | ) | (27 | ) | (27 | ) | ||||||||||||

| Net earnings attributable to Viacom | $ | 522 | $ | 683 | $ | 1,325 | $ | 1,200 | ||||||||||||

| Amounts attributable to Viacom: | ||||||||||||||||||||

| Net earnings from continuing operations | $ | 511 | $ | 680 | $ | 1,302 | $ | 1,197 | ||||||||||||

| Discontinued operations, net of tax | 11 | 3 | 23 | 3 | ||||||||||||||||

| Net earnings attributable to Viacom | $ | 522 | $ | 683 | $ | 1,325 | $ | 1,200 | ||||||||||||

| Basic earnings per share attributable to Viacom: | ||||||||||||||||||||

| Continuing operations | $ | 1.27 | $ | 1.69 | $ | 3.23 | $ | 3.00 | ||||||||||||

| Discontinued operations | 0.03 | 0.01 | 0.06 | 0.01 | ||||||||||||||||

| Net earnings | $ | 1.30 | $ | 1.70 | $ | 3.29 | $ | 3.01 | ||||||||||||

| Diluted earnings per share attributable to Viacom: | ||||||||||||||||||||

| Continuing operations | $ | 1.27 | $ | 1.69 | $ | 3.23 | $ | 2.99 | ||||||||||||

| Discontinued operations | 0.02 | 0.01 | 0.06 | 0.01 | ||||||||||||||||

| Net earnings | $ | 1.29 | $ | 1.70 | $ | 3.29 | $ | 3.00 | ||||||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||||||

| Basic | 402.8 | 402.0 | 402.6 | 399.1 | ||||||||||||||||

| Diluted | 403.3 | 402.6 | 402.9 | 400.0 | ||||||||||||||||

| Dividends declared per share of Class A and Class B common stock | $ | 0.20 | $ | 0.20 | $ | 0.60 | $ | 0.60 | ||||||||||||

|

VIACOM INC.

CONSOLIDATED BALANCE SHEETS (Unaudited) |

||||||||||

| (in millions, except par value) |

June 30, 2018 |

September 30, 2017 |

||||||||

| ASSETS | ||||||||||

| Current assets: | ||||||||||

| Cash and cash equivalents | $ | 929 | $ | 1,389 | ||||||

| Receivables, net | 3,149 | 2,970 | ||||||||

| Inventory, net | 916 | 919 | ||||||||

| Prepaid and other assets | 579 | 523 | ||||||||

| Total current assets | 5,573 | 5,801 | ||||||||

| Property and equipment, net | 875 | 978 | ||||||||

| Inventory, net | 3,851 | 3,982 | ||||||||

| Goodwill | 11,610 | 11,665 | ||||||||

| Intangibles, net | 311 | 313 | ||||||||

| Other assets | 941 | 959 | ||||||||

| Total assets | $ | 23,161 | $ | 23,698 | ||||||

| LIABILITIES AND EQUITY | ||||||||||

| Current liabilities: | ||||||||||

| Accounts payable | $ | 305 | $ | 431 | ||||||

| Accrued expenses | 764 | 869 | ||||||||

| Participants’ share and residuals | 774 | 825 | ||||||||

| Program obligations | 654 | 712 | ||||||||

| Deferred revenue | 317 | 463 | ||||||||

| Current portion of debt | 23 | 19 | ||||||||

| Other liabilities | 460 | 434 | ||||||||

| Total current liabilities | 3,297 | 3,753 | ||||||||

| Noncurrent portion of debt | 10,065 | 11,100 | ||||||||

| Participants’ share and residuals | 414 | 384 | ||||||||

| Program obligations | 465 | 477 | ||||||||

| Deferred tax liabilities, net | 350 | 294 | ||||||||

| Other liabilities | 1,254 | 1,323 | ||||||||

| Redeemable noncontrolling interest | 245 | 248 | ||||||||

| Commitments and contingencies | ||||||||||

| Viacom stockholders’ equity: | ||||||||||

| Class A common stock, par value $0.001, 375.0 authorized; 49.4 and 49.4 outstanding, respectively | — | — | ||||||||

| Class B common stock, par value $0.001, 5,000.0 authorized; 353.7 and 353.0 outstanding, respectively | — | — | ||||||||

| Additional paid-in capital | 10,132 | 10,119 | ||||||||

| Treasury stock, 393.1 and 393.8 common shares held in treasury, respectively | (20,562 | ) | (20,590 | ) | ||||||

| Retained earnings | 18,247 | 17,124 | ||||||||

| Accumulated other comprehensive loss | (811 | ) | (618 | ) | ||||||

| Total Viacom stockholders’ equity | 7,006 | 6,035 | ||||||||

| Noncontrolling interests | 65 | 84 | ||||||||

| Total equity | 7,071 | 6,119 | ||||||||

| Total liabilities and equity | $ | 23,161 | $ | 23,698 | ||||||

|

VIACOM INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

||||||||||

|

Nine Months Ended June 30, |

||||||||||

| (in millions) | 2018 | 2017 | ||||||||

| OPERATING ACTIVITIES | ||||||||||

| Net earnings (Viacom and noncontrolling interests) | $ | 1,352 | $ | 1,227 | ||||||

| Discontinued operations, net of tax | (23 | ) | (3 | ) | ||||||

| Net earnings from continuing operations | 1,329 | 1,224 | ||||||||

| Reconciling items: | ||||||||||

| Depreciation and amortization | 159 | 167 | ||||||||

| Feature film and program amortization | 3,402 | 3,475 | ||||||||

| Equity-based compensation | 45 | 52 | ||||||||

| Equity in net earnings and distributions from investee companies | 2 | (11 | ) | |||||||

| Gain on sale of EPIX | — | (285 | ) | |||||||

| Deferred income taxes | 27 | (118 | ) | |||||||

| Operating assets and liabilities, net of acquisitions: | ||||||||||

| Receivables | (211 | ) | (504 | ) | ||||||

| Production and programming | (3,373 | ) | (3,252 | ) | ||||||

| Accounts payable and other current liabilities | (384 | ) | (139 | ) | ||||||

| Other, net | 1 | 45 | ||||||||

| Net cash provided by operating activities | 997 | 654 | ||||||||

| INVESTING ACTIVITIES | ||||||||||

| Acquisitions and investments, net | (90 | ) | (358 | ) | ||||||

| Capital expenditures | (102 | ) | (139 | ) | ||||||

| Proceeds from asset sales | 57 | 108 | ||||||||

| Proceeds from sale of EPIX | — | 593 | ||||||||

| Proceeds from grantor trusts | 7 | 52 | ||||||||

| Net cash provided by/(used in) investing activities | (128 | ) | 256 | |||||||

| FINANCING ACTIVITIES | ||||||||||

| Borrowings | — | 2,569 | ||||||||

| Debt repayments | (1,000 | ) | (3,300 | ) | ||||||

| Dividends paid | (241 | ) | (239 | ) | ||||||

| Exercise of stock options | 2 | 172 | ||||||||

| Other, net | (70 | ) | (64 | ) | ||||||

| Net cash used in financing activities | (1,309 | ) | (862 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (20 | ) | (2 | ) | ||||||

| Net change in cash and cash equivalents | (460 | ) | 46 | |||||||

| Cash and cash equivalents at beginning of period | 1,389 | 379 | ||||||||

| Cash and cash equivalents at end of period | $ | 929 | $ | 425 | ||||||

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION

The following tables reconcile our results of operations reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for the quarter and nine months ended June 30, 2018 and 2017 to adjusted results that exclude the impact of certain items identified as affecting comparability (non-GAAP). We use consolidated adjusted operating income, adjusted earnings from continuing operations before provision for income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to Viacom and adjusted diluted earnings per share (“EPS”) from continuing operations, as applicable, among other measures, to evaluate our actual operating performance and for planning and forecasting of future periods. We believe that the adjusted results provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare Viacom’s results with those of other companies and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with accounting principles generally accepted in the United States of America, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before provision for income taxes, provision for income taxes, net earnings from continuing operations attributable to Viacom and diluted EPS from continuing operations as indicators of operating performance, and they may not be comparable to similarly titled measures employed by other companies.

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Quarter Ended June 30, 2018 |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings

Attributable to |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 752 | $ | 607 | $ | 93 | $ | 511 | $ | 1.27 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring and related costs (2) | 15 | 15 | 4 | 11 | 0.03 | |||||||||||||||||||||

| Discrete tax benefit (3) | — | — | 47 | (47 | ) | (0.12 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 767 | $ | 622 | $ | 144 | $ | 475 | $ | 1.18 | ||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Nine Months Ended June 30, 2018 |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 1,925 | $ | 1,487 | $ | 158 | $ | 1,302 | $ | 3.23 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring and related costs (2) | 200 | 200 | 48 | 152 | 0.38 | |||||||||||||||||||||

| Gain on extinguishment of debt (4) | — | (25 | ) | (6 | ) | (19 | ) | (0.05 | ) | |||||||||||||||||

| Gain on asset sale (5) | — | (16 | ) | — | (16 | ) | (0.04 | ) | ||||||||||||||||||

| Investment impairments (6) | — | 46 | 10 | 36 | 0.09 | |||||||||||||||||||||

| Discrete tax benefit (3) | — | — | 196 | (196 | ) | (0.49 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 2,125 | $ | 1,692 | $ | 406 | $ | 1,259 | $ | 3.12 | ||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Quarter Ended June 30, 2017 |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 746 | $ | 921 | $ | 233 | $ | 680 | $ | 1.69 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring and programming charges (7) | 59 | 59 | 21 | 38 | 0.09 | |||||||||||||||||||||

| Gain on extinguishment of debt (4) | — | (16 | ) | (5 | ) | (11 | ) | (0.03 | ) | |||||||||||||||||

| Gain on sale of EPIX (8) | — | (285 | ) | (96 | ) | (189 | ) | (0.47 | ) | |||||||||||||||||

| Investment impairment (6) | — | 10 | 4 | 6 | 0.01 | |||||||||||||||||||||

| Discrete tax benefit (3) | — | — | 53 | (53 | ) | (0.12 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 805 | $ | 689 | $ | 210 | $ | 471 | $ | 1.17 | ||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Nine Months Ended June 30, 2017 |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 1,784 | $ | 1,641 | $ | 417 | $ | 1,197 | $ | 2.99 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring and programming charges (7) | 381 | 381 | 135 | 246 | 0.62 | |||||||||||||||||||||

| Loss on extinguishment of debt (4) | — | 20 | 7 | 13 | 0.03 | |||||||||||||||||||||

| Gain on sale of EPIX (8) | — | (285 | ) | (96 | ) | (189 | ) | (0.47 | ) | |||||||||||||||||

| Investment impairment (6) | — | 10 | 4 | 6 | 0.02 | |||||||||||||||||||||

| Discrete tax benefit (3) | — | — | 72 | (72 | ) | (0.19 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 2,165 | $ | 1,767 | $ | 539 | $ | 1,201 | $ | 3.00 | ||||||||||||||||

(1) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented.

(2) In the second quarter of fiscal 2018, we launched a program of cost transformation initiatives to improve our margins, including an organizational realignment of support functions across Media Networks, new sourcing and procurement policies, real estate consolidation and technology enhancements. We recognized pre-tax restructuring and related costs of $15 million and $200 million in the quarter and nine months ended June 30, 2018, respectively. The charges included severance charges of $123 million and exit costs principally resulting from vacating certain leased properties of $40 million in the nine months, and $15 million and $37 million in the quarter and nine months, respectively, of related costs comprised of third-party professional services.

(3) The net discrete tax benefit in the quarter ended June 30, 2018 was principally related to a tax accounting method change granted by the Internal Revenue Service and the release of tax reserves with respect to certain effectively settled tax positions. In addition to the items in the quarter, the net discrete tax benefit in the nine months ended June 30, 2018 was principally related to tax reform, as well as the measurement of the deferred tax balances from the retroactive reenactment of legislation allowing for accelerated tax deductions on certain qualified film and television productions.

The net discrete tax benefit in the quarter ended June 30, 2017 was principally related to the reversal of a valuation allowance on capital loss carryforwards in connection with the sale of our investment in EPIX and the release of tax reserves with respect to certain effectively settled tax positions. In addition to the items in the quarter, the net discrete tax benefit in the nine months ended June 30, 2017 included the reversal of valuation allowances on net operating losses upon receipt of a favorable tax authority ruling.

(4) We redeemed senior notes and debentures totaling $1.039 billion in the nine months ended June 30, 2018. As a result, we recognized a pre-tax extinguishment gain of $25 million.

We redeemed senior notes and debentures totaling $3.3 billion in the nine months ended June 30, 2017, of which $1.0 billion was redeemed in the quarter ended June 30, 2017. As a result of these transactions, we recognized a pre-tax extinguishment gain of $16 million in the quarter ended June 30, 2017 and a pre-tax extinguishment loss of $20 million in the nine months ended June 30, 2017.

(5) We completed the sale of a 1% equity interest in Viacom18 to our joint venture partner for $20 million, resulting in a gain of $16 million in the nine months ended June 30, 2018.

(6) We recognized impairment losses of $46 million in the nine months ended June 30, 2018 and $10 million in the quarter and nine months ended June 30, 2017 resulting from the write-off of certain cost method investments.

(7) We recognized pre-tax restructuring and programming charges of $59 million and $381 million in the quarter and nine months ended June 30, 2017, respectively, resulting from the execution of our flagship brand strategy and strategic initiatives at Paramount.

(8) During the quarter ended June 30, 2017, we completed the sale of our 49.76% interest in EPIX, resulting in a gain of $285 million.

The following table reconciles our net cash provided by operating activities (GAAP) for the quarter and nine months ended June 30, 2018 and 2017 to free cash flow and operating free cash flow (non-GAAP). We define free cash flow as net cash provided by operating activities minus capital expenditures, as applicable. We define operating free cash flow as free cash flow, excluding the impact of the cash premium on the extinguishment of debt, as applicable. Free cash flow and operating free cash flow are non-GAAP measures. Management believes the use of these measures provides investors with an important perspective on, in the case of free cash flow, our liquidity, including our ability to service debt and make investments in our businesses, and, in the case of operating free cash flow, our liquidity from ongoing activities.

|

Reconciliation of net cash provided by operating activities

to free cash flow and operating free cash flow (in millions) |

Quarter Ended June 30, |

Better/

(Worse) |

Nine Months Ended June 30, |

Better/

(Worse) |

||||||||||||||||||||||||||

| 2018 | 2017 | $ | 2018 | 2017 | $ | |||||||||||||||||||||||||

| Net cash provided by operating activities (GAAP) | $ | 698 | $ | 249 | $ | 449 | $ | 997 | $ | 654 | $ | 343 | ||||||||||||||||||

| Capital expenditures | (38 | ) | (44 | ) | 6 | (102 | ) | (139 | ) | 37 | ||||||||||||||||||||

| Free cash flow (Non-GAAP) | 660 | 205 | 455 | 895 | 515 | 380 | ||||||||||||||||||||||||

| Debt retirement premium | — | — | — | — | 33 | (33 | ) | |||||||||||||||||||||||

| Operating free cash flow (Non-GAAP) | $ | 660 | $ | 205 | $ | 455 | $ | 895 | $ | 548 | $ | 347 | ||||||||||||||||||