NEW YORK--(BUSINESS WIRE)--Chase today announced that customers can now get cash through their phone’s mobile wallet at nearly all of its 16,000 ATMs nationwide, as well as access to all ATM vestibules outside of the branch.

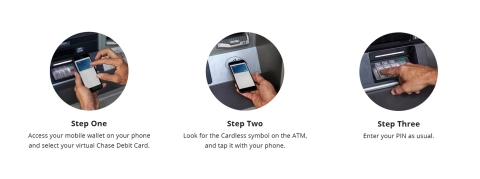

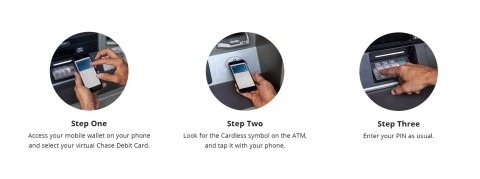

Beginning today, customers no longer need a physical debit card or access code for authentication and can simply “tap” their smartphone on the ATM to easily and securely access money on the go.

Cardless ATM access is available to all customers with a Chase debit or Liquid card that can be easily uploaded to their phone’s mobile wallet through the Chase Mobile® app.

“Cardless no longer means cashless,” said Sol Gindi, Chief Administrative Officer of Consumer Banking at Chase. “As more of our customers are using digital wallets to pay, we’re pleased to be able to provide them with the same experience at the ATM.”

Chase continues to invest in technology that allows customers to bank entirely from their phone. In addition to taking out cash, customers can now pay millions of merchants with Chase Pay®, deposit checks through Chase QuickDeposit℠, or pay friends and family through Chase QuickPay® with Zelle®.

To learn how to add a debit card to your mobile wallet and start using cardless ATMs, please visit: https://www.chase.com/digital/atms/cardless-nfc.