NEW YORK--(BUSINESS WIRE)--Assurant, Inc. (NYSE: AIZ), a global provider of risk management solutions, today announced it has finalized a $1.3 billion¹ 2018 property catastrophe reinsurance program, reducing the company’s financial exposure and protecting 2.9 million homeowners and renters policyholders against severe weather and other hazards.

2018 reinsurance premiums for this program are estimated to be $121 million1,2, compared to $126 million in 2017. This reduction is mainly driven by Assurant’s declining catastrophe exposure within its lender-placed insurance offering. Coverage was placed with more than 40 reinsurers that are all rated A- or better by A.M. Best.

“In 2017, our catastrophe reinsurance program proved strong and resilient, absorbing over $600 million in total gross losses, and more importantly Assurant was able to support policyholders during their time of need,” said Michael P. Campbell, President, Assurant Global Home.

“This year, we’ve secured comprehensive catastrophe coverage with attractive terms and conditions due to our risk management expertise and strong relationships with our reinsurance partners,” he added. “Assurant is not only dedicated to providing protection to our policyholders but also to our shareholders, as we gradually reduce our overall net loss retention, in conjunction with our declining exposure, over time.”

1 Amount includes extension of the 2017 Latin America protection which will renew on September 1, 2018 and is subject to changes in coverage amount, retention and cost.

2 Actual reinsurance premiums will vary if exposure changes significantly from estimates or if reinstatement premiums are required due to catastrophe events.

2018 Catastrophe Program Components

-

U.S. per-occurrence catastrophe coverage includes:

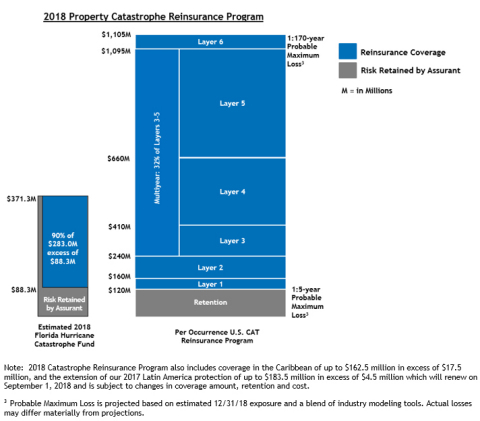

- A main reinsurance program providing $985 million of coverage in excess of a $120 million retention. The main U.S. tower protects the company’s projected probable maximum loss (PML) for approximately a 1 in 170-year storm. As a result, the probability of exceeding the top of the program in one year is less than 1 percent3.

- Multiyear reinsurance contracts covering 32 percent of the $855 million layers in excess of $240 million.

- All layers of the program allow for one automatic reinstatement and include a cascading feature that provides multi-event protection in which higher coverage layers drop down as the lower layers and reinstatement limit are exhausted.

- Florida Hurricane Catastrophe Fund coverage for losses up to 90 percent of $283 million in excess of a $88 million retention. In the event of a Florida hurricane, this coverage will be utilized prior to the main U.S. reinsurance program. After applying coverage, any remaining losses would then be eligible for recovery within our main tower. The program is covered for gross Florida losses of up to $1.4 billion which is approximately a 1-250-year Florida event based on projected modeled loss estimates. Utilizing both the coverage from the U.S. tower and the Florida Hurricane Catastrophe Fund, the maximum retention for a Florida event would be $120 million.

-

International per-occurrence catastrophe coverage increased as

Assurant continues to expand its business in select property markets.

Specifics include:

- Caribbean protection of up to $162.5 million in excess of a $17.5 million retention, and Latin America protection of up to $183.5 million in excess of a $4.5 million retention which is an extension of 2017’s protection that will renew on September 1, 2018 and is subject to changes in coverage amount and retention.

- In these regions, Assurant’s product offerings are primarily residential dwelling policies covering the structure and contents.

Historical Loss and Global Housing Net Earned Premium Information

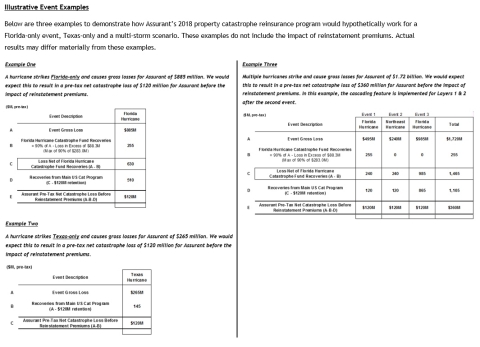

Several features noted above also provided comprehensive coverage in 2017 and protected the company against significant losses from multiple storms. Despite over $600 million in gross losses last year, mostly associated with Hurricanes Harvey, Irma and Maria, Assurant retained only $295 million of pre-tax losses ($192 million after-tax), demonstrating the effectiveness of the catastrophe reinsurance program. This was net of reinsurance and client profit sharing adjustments, as well as reinstatement and other premiums.

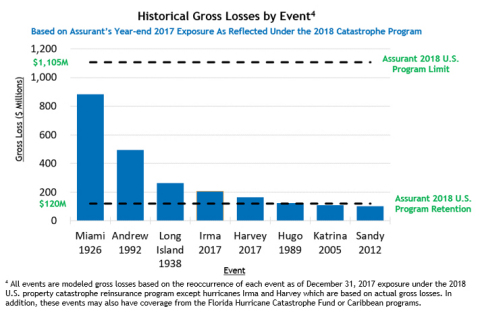

To further exemplify the resilience of the 2018 program, the Company tested the program against several of the most significant historical catastrophes since recording began in the 1850s using an industry leading catastrophe model. The modeling assumes the same geographic path of each hurricane and illustrates that to the extent these events were to recur today, Assurant’s loss would be well within the U.S. catastrophe reinsurance program’s limit.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a global provider of risk management solutions, protecting where consumers live and the goods they buy. A Fortune 500 company, Assurant focuses on the housing and lifestyle markets, and is among the market leaders in mobile device protection and related services; extended service contracts; vehicle protection; pre-funded funeral insurance; renters insurance; lender-placed homeowners insurance; and mortgage valuation and field services. Assurant has a market presence in 21 countries, while its Assurant Foundation works to support and improve communities. Learn more at assurant.com or on Twitter @AssurantNews.

Safe Harbor Statement

Some of the statements included in this news release constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update any forward-looking statements in this news release as a result of new information or future events or developments. For a detailed discussion of risk factors that could affect our results, please refer to the risk factors identified in our annual and periodic reports filed with the U.S. Securities and Exchange Commission.