BOSTON--(BUSINESS WIRE)--Debt levels are reaching record highs in the country—but is this having an emotional toll on American households? According to Fidelity Investments®’ latest Couples & Money study, more than half of the couples surveyed carried debt into their relationship—and for those that did, four in ten admitted it had a negative impact. Whether couples bring debt into their marriage is not really the issue, however, it’s how they handle it. Unfortunately, for those who say they are concerned about debt today, nearly half also admit that money is their biggest relationship challenge.

The study, which has been conducted since 2007 and is unique in testing agreement between married partners on communication and knowledge of finances, uncovers several disconnects related to managing and paying off debt. For couples who brought debt into the relationship, almost half (49 percent) contradict each other on whose responsibility it is to pay off that debt. Encouragingly, though, respondents are more likely to feel responsible for taking on their other half’s debt (55 percent) rather than expecting their partner to pay off theirs (33 percent).

Aside from debt, the study revealed other misunderstandings and knowledge gaps, even though most couples claim to communicate either exceptionally or very well. This runs the gamut from simple disconnects: one in five can’t agree how long they’ve been together, to more serious issues—one in seven couldn’t accurately report their other half’s employment status. Other disconnects include:

- Retirement: More than four in ten couples disagree when asked about what age they plan to retire. In addition, more than half (54 percent) differ on how much should be saved by the time they reach retirement to maintain their current lifestyle. Alarmingly, nearly half (49 percent) said they have “no idea”—including 46 percent of Baby Boomers (born 1946-64), a generation swiftly approaching (or already in) retirement.

- Important account information: While a slight majority says they know their spouses’ passwords to bank, investment, credit card and social media accounts, roughly three in ten couples differ on whether they’ve actually provided this information to their significant other, suggesting there’s some confusion around matters of privacy. Boomers are most likely to share this information. In addition, one in five couples disagree on where important financial and legal papers are located, with Millennials least likely to both know where everything can be found. Generally, women are far more likely than men to know their spouse’s passwords and have access to everything.

“Couples who plan together tell us they feel financially strong, regardless of their age or length of relationship,” said Alexandra Taussig, senior vice president of lifetime client engagement at Fidelity. “Openly discussing financial matters helps people feel more confident, more closely aligned and better equipped to take on the future. Working together, couples can help each other build financial confidence in their ability to manage, should the day come they have to do it on their own.”

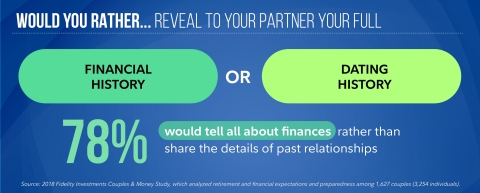

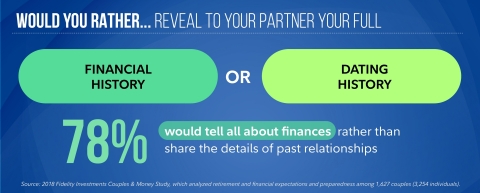

The good news is that study results showed a willingness to have these constructive conversations, with two-thirds of couples indicating they already discuss some aspect of their finances at least monthly. Furthermore, at least compared to other conversations, most couples are willing to be open and candid (See graphic on “Couples and Money: Financial History.”)

American Couples Want Less Stress in their Lives

(See graphic on “Couples and Money: Stress Free.”)

That doesn’t mean most couples are actually leading financially stress-free lives. When asked what tops their list of money concerns, couples identify the following worries:

- Debt and education. Perhaps not surprisingly, debt is an issue for many Americans, particularly Millennials, who voice concerns about paying off both their general debt (36 percent) as well as student debt, in particular (24 percent). In addition, 47 percent of millennials say they are concerned about having enough money set aside to pay for their child’s future education.

- Having enough money saved for retirement. This concern tops the list for Generation X (born 1965-80) and Millennials (born 1981-1996), although the good news is that Boomers, who are closest to retirement, seem significantly less concerned.

- Paying for health care in retirement. This is a concern for 63 percent of Generation X and 51 percent of Boomers. Millennials are slightly less concerned, at 46 percent, which may be attributed to the fact that retirement is a long way away.

Even with these concerns, a majority of couples are feeling good about their personal economic well-being, perhaps because of the strengthening economy these past few years. When asked, 47 percent of Americans surveyed describe their households’ financial health as very good, with an additional 22 percent going so far as to say it’s excellent. In contrast, only 26 percent identify their household financial health as fair, with a mere five percent painting a bleaker picture.

It Takes Two: Divorcing Yourself from Debt Can Strengthen Your Relationship

The study also contains insights regarding the impact debt can have on a relationship, and the value of working together to overcome debt challenges. In fact, couples who identified “paying off debt” as a concern are more likely to have a host of other financial issues, which include communicating poorly, arguing more frequently and having difficulty starting conversations about money:

(See graphic on “Couples and Money: Debt Impact.”)

“We see over and over that dealing with debt is one of the biggest stressors in day-to-day life. Working as a team to put a financial action plan in place to address debt can help couples get out from under this burden, and as importantly bring more peace of mind to your household and relationship,” said Taussig. “It’s not the debt you bring into the relationship that matters, but how you work together to handle your debt over the long run.”

Financial Tips for Couples at Every Stage

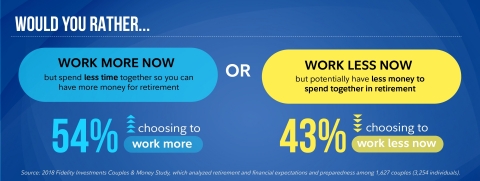

(See graphic on “Couples and Money: Work More or Work Less.”)

Fortunately, it doesn’t have to be an either/or option: couples can spend lots of quality time together now and have enough saved later to fuel their retirement dreams, if they stay on the same page and take time to plan their future together. To help with that, Fidelity asked couples what their best financial tips would be for newlyweds. The top answer: “save as early as possible for retirement,” followed by -- perhaps not surprisingly – “don’t take on more debt than you can possibly afford” and “make all financial decisions together.”

To help partners of all ages achieve their goals, Fidelity offers resources, including:

- A Viewpoints article on “4 money topics couples should talk about,” which provides additional information on essential financial questions every couple should ask. Other related Viewpoints articles include “How to Pay off Debt—and Save too,” “Five ways to protect what’s yours” and “Five financial tips for newlyweds.” Fidelity also offers a Financial check-up to help determine where you stand financially.

- Online retirement guidance and planning tools provide easy ways for couples to tell if they are on track to meet goals.

- People can discuss savings strategies with a Fidelity investment professional at one of Fidelity’s 197 Investor Centers or by calling 1-800- FIDELITY (1-800-343-3548).

- FidSafe offers a free and secure digital place to store, access and share important documents, such as a will, life insurance policies and birth certificates.

About the Study

The 2018 Fidelity Investments Couples &

Money Study (formerly known as the Couples Retirement Study) analyzed

retirement and financial expectations and

preparedness among 1,662 couples (3,324 individuals). Respondents were

required to be at least 22 years old, married or in a long-term

committed relationship and living with their respective partner, and

have a minimum household income of $75,000 or at least $100,000 in

investable assets. This online, biennial study was launched in 2007 and

is unique in that it tests agreement of both partners in a committed

relationship on communication, as well as their knowledge of finances

and retirement planning issues. Fidelity Investments was not identified

as the sponsor. GfK’s Public Affairs & Corporate Communications division

executed the study, which was fielded in April 2018. For more

information, a fact

sheet and couples

guide can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire

better futures and deliver better outcomes for the customers and

businesses we serve. With assets under administration of $7.0 trillion,

including managed assets of $2.5 trillion as of May 31, 2018, we focus

on meeting the unique needs of a diverse set of customers: helping more

than 27 million people invest their own life savings, 23,000 businesses

manage employee benefit programs, as well as providing more than 12,500

financial advisory firms with investment and technology solutions to

invest their own clients’ money. Privately held for 70 years, Fidelity

employs more than 40,000 associates who are focused on the long-term

success of our customers. For more information about Fidelity

Investments, visit www.fidelity.com/about.

Investing involves risk, including the risk of loss.

FidSafe® is not a Fidelity Brokerage Services LLC service. FidSafe is a service of XTRAC LLC, a Fidelity Investments company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.

500 Salem

Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport

Boulevard, Boston, MA 02110

849979.1.0

© 2018 FMR LLC. All rights reserved.