NEW YORK--(BUSINESS WIRE)--Natural resources are vital for businesses - and at the same time massively at risk across many industry sectors. Failure to manage the earth’s natural resources or “natural capital” has consequences that extend beyond direct effects on the environment. For businesses, it can bring new interruption and liability scenarios that wipe out profits as resource scarcity, regulatory action and pressure from communities and society grows. Allianz Global Corporate & Specialty (AGCS) presents these findings in its latest report Measuring And Managing Environmental Exposure: A Business Sector Analysis of Natural Capital Risk.

“Companies around the world are increasingly confronted with the negative implications of natural capital depletion,” says Chris Bonnet, Manager, Environmental, Social and Governance (ESG) Business Services, AGCS. “Sustainable use of natural resources is critical for the future success of most businesses. Yet while corporate awareness of their natural capital footprint is growing, many still need to gain a better understanding of the specific threats that can impact their industry sector and company in particular, as well as the mitigation options available.”

NATURAL CAPITAL RISK ANALYSIS BY INDUSTRY SECTOR

Danger Zone

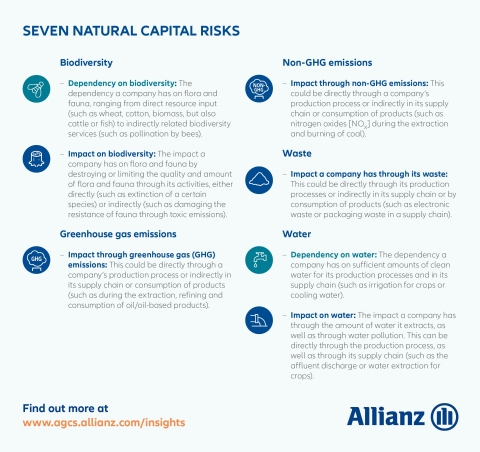

AGCS analyzed data on 2,500 companies from research provider MSCI ESG Research in order to assess the natural capital risk exposure in 12 industries. The oil & gas, mining, food & beverage as well as the transportation sectors rank highest in risk exposure, based on five factors – biodiversity, greenhouse gas (GHG) and non-GHG emissions, water and waste. All are in the "danger zone," of natural capital risks as these risks are, on average, greater than the mitigation options currently employed.

- Companies in the oil & gas and mining sectors have a high level of natural capital risk exposure due to the nature of their industry. Over 90% of global iron ore production is derived from areas that have a high risk of water stress and biodiversity impact1.

- Transportation falls into the “danger zone” due to its biodiversity impact and GHG and non-GHG emissions. Transportation-related carbon emissions have increased by 250% since 1970 and now account for 23% of all global emissions2. There is room for further steps to be taken by the sector, such as emissions control or mitigation measures to reduce overall impact on plant and wildlife.

- The food & beverage sector also ranks in the “danger zone” because of its high reliance upon natural capital in its supply chains. Despite the significant risk of supply disruption posed by water stress, only 20% of MSCI All Country World Index food products companies have begun to address this threat in their agricultural supply chains3. Plant and wildlife are often damaged by excessive use of pesticides, reducing fertility and increasing vulnerability to weather events, ultimately causing crop failure for suppliers of food companies.

Middle and Safe Haven Zones

- Seven industry sectors – construction, utilities, clothing/apparel, chemical, manufacturing, pharmaceutical and automotive rank in the “middle zone,” meaning risk and mitigation levels are approximately in balance. The telecommunications sector is the only sector to be classified in the “safe haven” zone, as it does not have a high level of risk exposure. There are tremendous opportunities for telecom companies to hedge natural capital risk in other sectors as digital management solutions can enable more efficient resource use.

THREE PHASES OF NATURAL CAPITAL RISK

According to the report, natural capital risks evolve through three phases before impacting the bottom line of a business:

- First Phase: Awareness of the risk grows;

- Second Phase: Natural capital risk will potentially start affecting individual companies in their supply chains or own operations through regulatory change or social pressure;

- Third Phase: Once the risk cannot be mitigated, it materializes, leading to damages such as liability costs, higher production expenses or business interruption, ultimately affecting the financial performance of the organization.

“The key question is how risks can be mitigated as early as possible – both on a technical operational level and in regard to overall enterprise risk management (ERM),” explains Bonnet. “Local water scarcity, for example, can be addressed by rainwater harvesting in day-to-day management or, on a more strategic level, by deciding not to expand an existing plant due to risk of water shortages.”

MANAGING NATURAL CAPITAL RISK

A significant number of companies have begun to address natural capital risk in their ERM. Factoring natural capital costs into business decision-making can also help companies anticipate potential threats. For example, when opening a new factory, factors such as future water availability and the administration of emerging emissions should be considered.

However, balancing risk management focused on today coupled with the management of emerging risks is challenging. Future and non-financial risks can easily be overlooked as companies focus on short-term targets. It can be difficult to measure, quantify and monetize these risks. Yet in the future it is expected that companies will have to actively disclose their natural capital risk exposure to governmental agencies and investors as standards evolve.

“With threats to the environment coming from many different areas, there will be no such thing as business as usual in the future,” says Bonnet. “Companies need to understand, quantify and even monetize their dependence on natural capital and the impacts their operations have on it to ensure their organizations are resilient and future-proof.”

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is the Allianz Group's dedicated carrier for corporate and specialty insurance business. AGCS provides insurance and risk consultancy across the whole spectrum of specialty, alternative risk transfer and corporate business: Marine, Aviation (incl. Space), Energy, Engineering, Entertainment, Financial Lines (incl. D&O), Liability, Mid-Corporate and Property insurance (incl. International Insurance Programs).

Worldwide, AGCS operates with its own teams in 34 countries and through the Allianz Group network and partners in over 210 countries and territories, employing almost 4,700 people of 70 nationalities. AGCS provides insurance solutions to more than three quarters of the Fortune Global 500 companies, writing a total of €7.4 billion gross premium worldwide in 2017.

AGCS SE is rated AA by Standard & Poor’s and A+ by A.M. Best. For more information please visit www.agcs.allianz.com or follow us on Twitter @AGCS_Insurance, LinkedIn and Google+.

Cautionary Note Regarding Forward-Looking Statements

1 MSCI ESG Research Industry Report: Non-precious metals, mining and steel, March 2017

2 MSCI ESG Research Industry Report: Road and rail transport, May 2017

3 MSCI ESG Research Industry Report: Food products, February 2017