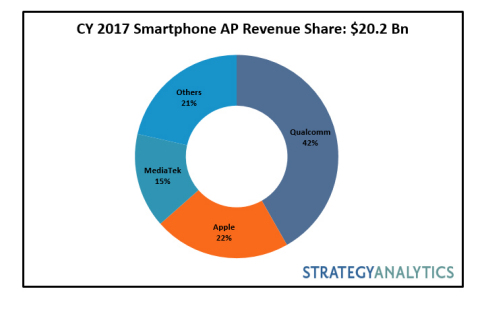

BOSTON--(BUSINESS WIRE)--The global smartphone Applications Processor (AP) market declined 5 percent year-over-year to reach $20.2 billion in 2017, according to Strategy Analytics Handset Component Technologies service report, “Smartphone Apps Processor Market Share 2017: MediaTek and Spreadtrum Nose Dive.”

According to this research report from Strategy Analytics, Qualcomm, Apple, MediaTek, Samsung LSI and HiSilicon captured the top-five revenue share spots in the global smartphone applications processor (AP) market in CY 2017. Qualcomm gained market share and finished the CY 2017 with 42 percent revenue share followed by Apple with 22 percent and MediaTek with 15 percent.

- Strategy Analytics estimates that 64-bit smartphone AP shipments grew 15 percent year-on-year in CY 2017 and accounted for 88 percent of total smartphone AP shipments in CY 2017, up from 71 percent in CY 2016.

- Apple, HiSilicon, Qualcomm and Samsung LSI all registered year-on-year shipment growth in 2017 while MediaTek and Spreadtrum saw their shipments decline sharply.

- Security, privacy and bandwidth factors are currently driving the on-device artificial intelligence (AI) chip trend as smartphone chip companies are integrating intelligence engines in their designs. The on-device AI chip landscape is highly fragmented. We think 2018 will be an experimental year for on-device AI chips and 2019 will see more clarity on future direction.

- In CY 2017, over 250 million smartphone APs shipped with native AI engines to enable machine learning (ML) applications such as 3D face detection, image recognition and Animoji.

- TSMC (Taiwan Semiconductor Manufacturing Company) manufactured two-thirds of smartphone APs in CY 2017, down from almost three-fourths in CY 2016. Despite the loss of Apple foundry business to TSMC, Samsung Foundry gained share in smartphone APs, helped by Qualcomm and Samsung LSI.

- 10 nm smartphone APs accounted for over 14 percent of total smartphone AP shipments in CY 2017, driven by Apple, HiSilicon, Qualcomm and Samsung LSI.

- Octa-core chips accounted for over 40 percent of total smartphone AP shipments in CY 2017.

Sravan Kundojjala, Associate Director at Strategy Analytics, commented, “Calendar year 2017 proved to be a very challenging year for low-cost and high volume players MediaTek and Spreadtrum as both companies saw their smartphone AP shipments and revenue decline sharply. For the first time in the last five years, both companies saw year-on-year smartphone AP shipments decline in 2017. This can be attributed to slow roadmap progress and sharp decline in 3G APs demand. This has resulted in share losses in the key Chinese market. Strategy Analytics believes that the 2018 will be a crucial year for both MediaTek and Spreadtrum.”

Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies service, added, “Despite increased vertical competition from both HiSilicon and Samsung LSI, Qualcomm gained market share and returned to shipment growth in 2017. Qualcomm’s flagship AP Snapdragon 835 and mid-range 600-series of APs all gained strong acceptance in CY 2017. Thanks to Qualcomm's increased strength in the mid-range with the Snapdragon 600 series, Qualcomm gained significant share at Chinese OEMs including Oppo, Vivo and Xiaomi at the expense of MediaTek in 2017. HiSilicon and Samsung LSI both expanded their product portfolio to cover multiple price points and registered a double-digit captive shipment growth in 2017.”

About Strategy Analytics

Strategy Analytics, Inc. provides the competitive edge with advisory services, consulting and actionable market intelligence for emerging technology, mobile and wireless, digital consumer and automotive electronics companies. With offices in North America, Europe and Asia, Strategy Analytics delivers insights for enterprise success. www.StrategyAnalytics.com