NEW YORK & LONDON & LISBON, Portugal--(BUSINESS WIRE)--OutSystems, the global leader in low-code rapid application development, today announced it has raised $360 million in an investment round from KKR and Goldman Sachs. The funding values the company at well over $1 billion, and the proceeds will be used to accelerate business expansion and for R&D in new advancements in software automation.

The OutSystems low-code platform enables customers to achieve significant efficiency gains in building and supporting enterprise-grade applications. By leveraging automation, artificial intelligence, and deep technology integrations, software developers and business users can build applications through an intuitive, visual interface, rather than traditional coding. Customers experience strong cost savings and create competitive advantages by developing custom applications in days and weeks versus months and years, despite a shortage of skilled developers.

Companies such as Toyota, Logitech, Deloitte, Ricoh, Schneider Electric, and GM Financial use the OutSystems low-code platform to rapidly develop custom applications that digitalize and differentiate their business. The platform can support a wide range of enterprise applications: from large, mission-critical solutions that replace aging legacy ERP/CRM systems, to mobile and web apps for internal processes, to customer experiences like online banking, account enrollment, and customer self-service.

OutSystems is widely regarded as the leader in its market due to the breadth and depth of the platform. The company serves thousands of customers globally and is recognized as one of the fastest-growing technology companies with revenues well above $100 million and growing at more than 70 percent annually.

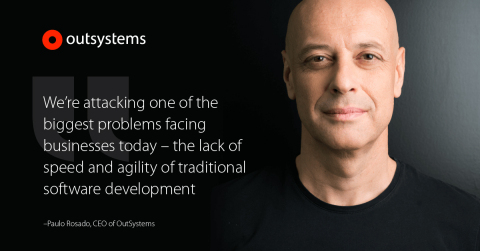

“We’re attacking one of the biggest problems facing businesses today -- the lack of speed and agility of traditional software development that is hindering digital transformation initiatives around the world,” said Paulo Rosado, OutSystems CEO. “We see companies struggle with this every day and we’re thrilled to be partnering with KKR and Goldman Sachs to solve this problem by bringing more innovation to our customers and re-defining the future of enterprise software development.”

“We believe we are in the early innings of what will be an extended period of significant growth in the low-code application development market, and we are very excited to be backing a category leader like OutSystems,” said Stephen Shanley, Director at KKR. Lucian Schoenefelder, Member at KKR, added: “OutSystems is a perfect fit with KKR’s strategy of supporting best-in-class technology entrepreneurs in their ambition to build global category leaders in large markets. We are very excited to partner with Paulo and his team and will make KKR’s global platform available to support the OutSystems expansion plans.”

“We found that we could point to every major industry sector and find excited and loyal OutSystems customers who have developed unique solutions and are adopting the platform across their organization,” said Kirk Lepke, Vice President at Goldman Sachs Private Capital Investing. Christian Resch, Managing Director at Goldman Sachs Private Capital Investing, added: “OutSystems is directly in line with what we seek for new investments: Support of exceptional founders and management teams in innovative businesses that offer a significant opportunity to create long-term value. We are very much looking forward to backing Paulo and the team to further expand this unique business.”

“The market potential we see with OutSystems is incredible,” said Mike Pehl, OutSystems board member and Managing Partner at Guidepost Growth Equity. “With customers in over 50 countries and nearly 250 partner integrators developing on the platform, it’s clear the low-code market has reached a tipping point, and OutSystems is the clear leader.”

“Founded in 2001, OutSystems has always had a strong vision for their platform and a strong company culture that promotes quality and transparency,” said Joaquim Sérvulo Rodrigues, OutSystems Board Member and Partner at Armilar Venture Partners. “Today, their technology is very advanced, creating a high barrier to entry for potential competitors. OutSystems has created a whole new market.”

“This funding comes on the heels of a record-breaking year for the company,” said Rosado. “OutSystems stands strong as the pioneer in low-code development. Having global investors the caliber of KKR and Goldman Sachs that share our vision for the future of revolutionizing software development sets us on a path of tremendous growth and innovation that will fundamentally change how organizations build software.”

KKR's investment was made through its Next Generation Technology Growth Fund.

About OutSystems

Thousands of customers worldwide trust OutSystems, the number one low-code platform for rapid application development. Engineers with an obsessive attention to detail crafted every aspect of the OutSystems platform to help organizations build enterprise-grade apps and transform their business faster. OutSystems is the only solution that combines the power of low-code development with advanced mobile capabilities, enabling visual development of entire applications that easily integrate with existing systems. Explore careers at OutSystems, named a Top Cloud Employer by Forbes three years in a row. Visit us at www.outsystems.com, or follow us on Twitter @OutSystems or LinkedIn.

About KKR

KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, growth equity, energy, infrastructure, real estate and credit, with strategic manager partnerships that manage hedge funds. KKR aims to generate attractive investment returns for its fund investors by following a patient and disciplined investment approach, employing world-class people, and driving growth and value creation with KKR portfolio companies. KKR invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business. References to KKR’s investments may include the activities of its sponsored funds. For additional information about KKR & Co. L.P. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

About Goldman Sachs Private Capital Investing

Goldman Sachs Private Capital Investing ("PCI") is Goldman Sachs' investment platform dedicated to providing long term capital to growth and middle-market companies throughout the US, Europe and Israel. The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

About Guidepost Growth Equity

Guidepost Growth Equity is a leading growth equity firm that partners with technology companies offering innovative solutions in large, dynamic markets including tech-enabled services, communications and infrastructure, and data and information services. Prior investments include Dyn (sold to Oracle), Jive Communications (sold to LogMeIn), ProtoLabs (IPO on NYSE), and WP Engine. Guidepost Growth Equity provides the flexible capital, operational support and strategic guidance necessary to support the continued success of growth-stage businesses.

About Armilar Venture Partners

Armilar Venture Partners manages more than 200 million euros of assets. Their worldwide companies provide innovative products and services that are improving our world, the way we live, and the way we do business. Since 2000, Armilar invested in more than 40 seed and early-stage companies and currently has four investment funds, each managed with a hands-on approach.