NEW YORK--(BUSINESS WIRE)--E*TRADE Financial Corporation (NASDAQ: ETFC) today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Results reveal a pronounced divide between generations when it comes to how respondents perceive the financial knowledge of recent grads:

- 88 percent of surveyed investors overall do not believe recent grads are very knowledgeable about saving and investing for retirement.

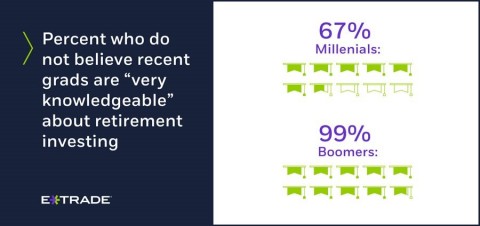

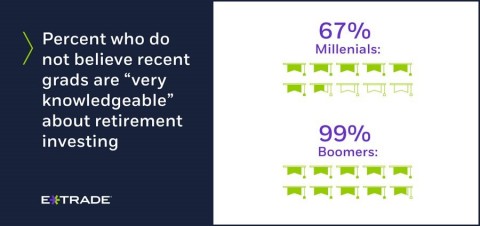

- 67 percent of Millennials do not believe recent grads are very knowledgeable.

- But when it comes to Baby Boomers, the number jumps to 99 percent.

Despite these perceptions, the data suggest that younger generations are in fact focused on investing for retirement:

- The top two pieces of financial advice from Millennials to recent grads are: Take advantage of a 401(k), and start a portfolio.

- Millennials are the only generation most likely to give the gift of a financial account to a recent grad—Gen Xers and Boomers prioritize cash as gifts.

“It’s understandable that retirement would not be top of mind for graduates during their college years,” commented Mike Loewengart, VP of Investment Strategy at E*TRADE Financial. “But as they enter the workforce, now is a great time to take that all-important first step in retirement investing, and ignite the immense power of compound interest, which is in their favor considering their time horizon. Starting to sock away even a small percentage of their paycheck now can pay serious dividends down the road.”

Mr. Loewengart provided some additional considerations for recent graduates as they enter the workforce:

- Employer matches carry a serious punch. The 401(k) contribution match that many employers offer is as close to free money as one will ever come in the investing world. It is probably the easiest way to seriously kick-start long-term investing. If one already gets a match, it may be worth ramping up contributions—even just a small amount.

- Some investing plans are automated. Avoid emotional investing pitfalls—like trying to time the market—by putting an investing and savings plan on autopilot. Automatic investing is based on the strategy of dollar-cost averaging, in which an investor commits a fixed dollar amount to a particular investment at regularly scheduled intervals. It’s a time-tested strategy that helps reduce risk by taking advantage of the natural ups and downs of the market.

- It’s more about the individual than it is about day-to-day market moves. Financial markets can get a little crazy from time to time. That’s why it’s so important to maintain a long-term point of view, defined by one’s unique goals, risk tolerance, and time horizon. Doing so can help prevent one from making sudden, ill-advised moves and allow for participation in the market’s long-term returns.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from April 1 to April 11 of 2018 among an online US sample of 947 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.18 percent at the 95 percent confidence level. It was fielded and administered by Research Now. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 64 percent male and 36 percent female, with an even distribution across online brokerages, geographic regions, and age bands.

|

Referenced Data |

||||||||

|

How knowledgeable do you think the nation's recent grads are when it comes to saving and investing for retirement? |

||||||||

| Age | ||||||||

| Total | 25–34 | 35–54 | 55+ | |||||

| Very knowledgeable | 12% | 33% | 5% | 1% | ||||

| Somewhat knowledgeable | 28% | 43% | 29% | 17% | ||||

| Only a little knowledgeable | 40% | 14% | 43% | 54% | ||||

| Not knowledgeable at all | 20% | 10% | 23% | 28% | ||||

| What advice would you give to a recent grad on managing their finances? | ||||||||

| Age | ||||||||

| Total | 25–34 | 35–54 | 55+ | |||||

| Take advantage of employer 401(k) plans | 72% | 58% | 77% | 86% | ||||

| Start a portfolio - no matter how small | 64% | 59% | 61% | 75% | ||||

| Spend less than you make | 64% | 43% | 66% | 81% | ||||

| Try not to take on additional debt | 57% | 40% | 58% | 70% | ||||

| Don't miss your student loan payments | 53% | 45% | 47% | 66% | ||||

| Create an emergency cash fund | 51% | 26% | 51% | 74% | ||||

| Other | 2% | 1% | 2% | 2% | ||||

| Which of the following gifts would you be most likely to give to a college graduate this year? | ||||||||

| Age | ||||||||

| Total | 25–34 | 35–54 | 55+ | |||||

| Cash | 48% | 31% | 48% | 61% | ||||

| Starting and/or funding a financial account (IRA, brokerage, money market account, etc.) | 29% | 45% | 27% | 22% | ||||

| Help with financial obligations (student loan payments, bills) | 26% | 39% | 28% | 18% | ||||

| Financial education tools (financial planning session, personal finance books, etc.) | 23% | 36% | 24% | 12% | ||||

| Shares of stocks, bonds, mutual funds, etc. | 22% | 33% | 20% | 14% | ||||

| Consumer items (clothing, vacation, etc.) | 14% | 12% | 16% | 12% | ||||

| Other | 2% | -- | 3.90% | 2.30% | ||||

| Nothing | 5% | 5% | 1.90% | 7.60% | ||||

“Millennial” defined as age 25–34 // “Gen X” defined as age 35–54 //

“Baby

Boomer” defined as age 55+

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are federal savings banks (Members FDIC). More information is available at www.etrade.com.

Automatic Investment Plans and dollar-cost averaging do not ensure a profit or protect against a loss in declining markets. Investors should consider their financial ability to continue their purchases through periods of low price levels.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2018 E*TRADE Financial Corporation. All rights reserved.

E*TRADE Financial Corporation and Research Now are separate companies that are not affiliated. E*TRADE Financial Corporation engages Research Now to program, field, and tabulate the study. Research Now Group, Inc. provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.researchnow.com.