HONG KONG--(BUSINESS WIRE)--Oasis Management Company Ltd. (“Oasis”) is manager to funds that beneficially own 9.9% of Alpine Electronics Inc. (TYO: 6816) (“Alpine” or the “Company”), making Oasis the Company’s largest shareholder after Alps Electric Co., Ltd. (TYO: 6770) (“Alps”).

On April 26, 2018, Alpine and Alps released their full year results and provided guidance for FY2019. Alpine’s results significantly outperformed and substantially beat forecasts that had already been revised up twice. Alpine’s full year operating profit beat its original forecast by 111%. On the other hand, Alps substantially revised down its guidance, forecasting a 17% drop in operating profit for FY19. Alpine is clearly outperforming Alps.

In addition to the other flaws in the valuation that Oasis pointed out previously, Alpine’s huge outperformance necessitates material changes to the valuations conducted by SMBC Nikko Securities on which the Share Exchange Ratio is based. It would be a grave breach of fiduciary responsibility to not adjust the Share Exchange Ratio, given these dramatically diverging performances. Alps, a business in decline, must not be allowed to steal Alpine, a business Alps desperately needs for growth, for less than what it is worth. Alpine’s shareholders should demand in excess of JPY4,000 per share for their Alpine stake.

Oasis has submitted three shareholder proposals to Alpine to be voted on at Alpine’s Annual General Meeting to be held at the end of June 2018 aimed at rectifying this unfairness, including proposals for two new director candidates and a special dividend.

We urge all investors to vote for our proposals and fight to protect their shareholder rights.

***

Why you should vote for Oasis’s proposed independent directors and the special dividend

We believe that Alpine’s management, Board of Directors, Outside Directors and Third-party Committee will be exploiting Alpine’s minority shareholders if they allow Alps to take over Alpine at such an unfair valuation that steeply undervalues the stakes held by minority shareholders.

Alpine’s management have such disregard for minority shareholders that they had the audacity to say in their earnings statement that the return of profits to shareholders is “an important management issue”.1 This statement is so deeply disingenuous we barely had the stomach to quote it.

By announcing their plans for the longest proposed merger in modern Japanese history in July 2017, Alps sought to lock in its takeover of Alpine at the lowest possible price to guarantee that it would not have to pay up for this positive performance, effectively robbing minority shareholders of this additional value. There is still time to stop them.

Alpine’s Minority Shareholders Continue to Lose Out

- Alpine ended the year with operating profits of JPY13.7 billion, an increase of 111% from its forecasts of JPY6.5 billion at the time the Share Exchange Ratio was agreed upon. In contrast, Alps reduced its forecasted operating profit for next year by 16.6% and net income by 21%.

- Alpine beat its most recent net income forecast by 55%, but didn’t raise dividends, while Alps missed their net income forecast by 6% and increased their dividend by 35% - to be paid out before the completion of the merger with Alpine. Alpine’s minority shareholders are clearly being shortchanged.

- At the time of the share exchange announcement, Alpine was expected to constitute 11% of Alps’ total operating profit, but amounted to 19% by the end of the year. Next year, it is expected to be at least 21.6%. Alps clearly undervalued Alpine’s contribution, and should revise the Share Exchange Ratio accordingly.

- Alpine is forecasting operating profit of JPY13 billion for next year, but we know how conservative they can be, considering the forecast JPY6.5 billion last year but achieved JPY13.7 billion in operating profit this year.

- No truly independent Third-party Committee or director would allow the Share Exchange Ratio to remain unchanged in light of Alpine’s outperformance and Alps’ underperformance.

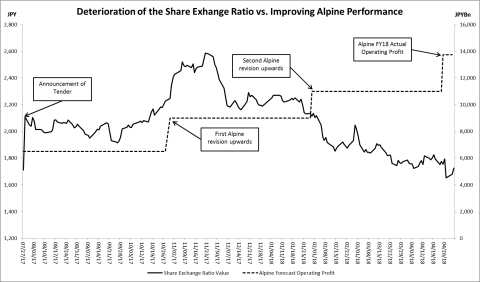

As can be seen in Figure 1, negative sentiment over Alps’ business and positive sentiment over Alpine’s growth have caused a significant divergence between the value of the Share Exchange Ratio and Alpine’s improving business fundamentals.

As of May 2, 2018, the value of the Share Exchange Ratio is JPY1,725 per share, just a 0.8% premium to Alpine’s stock price prior to the announcement of the share exchange. Since the announcement, Alpine’s fundamentals have substantially improved and led to an 111% increase in operating profit from the forecast at the date of the Share Exchange Ratio, just for the year ending March 31, 2018. Conversely, the anticipated progress of Alps’ business has been muddied by poor performance and a general slowdown in smartphone sales.

1 Translated from the Japanese

The flaws in the valuation are clear

- Alpine’s FY18 actual operating profit is higher than the implied FY20 operating profit that SMBC adopted in its valuation of the Share Exchange Ratio, and as a result, their model vastly undervalues Alpine.

- Further, Alps substantially reduced its forecasted operating profit for FY19 which has a material negative impact on the Alps valuation model adopted for the Share Exchange Ratio.

-

The comparable companies that SMBC employed for the valuation have

largely revised down their forecasts, verifying the negative

expectations that the market had of them at the time the Share

Exchange Ratio was announced. As such, they were not fair comparables,

then or now, and cannot be used to fairly value Alpine.

- 6773 Pioneer has revised down its operating profit forecast this year by 76%

- 6796 Clarion has revised down next year’s operating profit forecast by 59%

- 6632 JVC Kenwood beat its original forecasted operating profit by just 4.4%

- Even as the outlook for Alpine’s business has improved dramatically over the past 9 months, with earnings more than doubling, Alpine’s stock price has been weighed down by its connection to Alps’ declining business. Had Alpine’s stock been left to freely trade instead of being capped by Alps’ offer ratio, the market price for Alpine would be significantly higher. Alps has kept Alpine’s market price artificially low. The proposed Share Exchange Ratio is a 17% discount to Alpine’s current market price.

Alpine’s Third-party Committee is not truly independent

Hideo Kojima is a member of Alpine’s Audit and Supervisory Committee, an outside director of Alpine and a member of the Third-party Committee entrusted with ensuring that minority shareholders are protected in the proposed merger with Alps. Minority shareholders are heavily reliant on Kojima-san, however, we have found that Kojima-san has strong historical ties to Alps which we believe suggest he is far more interested in helping Alps get the best deal possible, and not minority shareholders.

Kojima-san was one of the Ernst & Young auditors mentioned in the Alps Japanese annual reports in Fiscal Year end March 2005 and March 2006. He was also the auditor of Alps Logistics (9055 JP), a 46.6% subsidiary of Alps, in the same years. He became the Statutory Auditor at Alpine in 2011 and a Director and Audit Committee Member in 2016. It is abundantly clear that Kojima-san has had an intimate relationship with Alps and its subsidiaries for many years, and is likely far more concerned with Alps’ wishes than he is with Alpine’s minority shareholders’ rights.

Kojima-san’s membership of the Third-party Committee has tainted the decisions made by the committee and the committee itself. We find his presence on the Third-party Committee to be in direct conflict with the spirit of the independence per the Supreme Court’s decision in the Jupiter Telecommunications case.

We call on Alpine to remedy the undervaluation

As we have demonstrated in our website, press releases and correspondence with Alpine, there have been significant flaws in both the process and the valuation leading to the share exchange agreement between Alps and Alpine. There are substantial questions over the independence of the valuation expert SMBC Nikko Securities, which with its affiliates has provided various services to the Alps group, and members of the Third-party Committee, such as Kojima-san, as highlighted above. It appears plainly to any outsider that the Share Exchange Ratio was set to favor Alps as much as possible, at the expense of Alpine minority shareholders.

We call on Alpine to change its attitude towards its minority shareholders and work with us to appoint an independent valuation agent and a new Third-party Committee that is acceptable to both Alpine and its minority shareholders. If Alpine truly believes that the valuation is fair then it should see no problem in doing this.

Why you should vote for the Oasis Shareholder Proposals

Shareholder Proposal 1 – Dividend of the Surplus

Oasis is asking shareholders to vote for a special dividend by Alpine of JPY325 per share.

A dividend of JPY325 will not remedy the undervaluation of the Share Exchange Ratio, but it will be a positive improvement. Support for the dividend will further demonstrate minority shareholder dissatisfaction, and push Alpine to renegotiate with Alps. This partially helps ameliorate the damage caused by the arbitrary allocation in the valuation of JPY30 billion to working capital, dividends and taxes, when Alpine does not appear to have needed more than JPY5.5 billion of cash-on-hand for working capital before, dividends are just JPY2.1 billion, and taxes are paid from operating cash flow.

Shareholder Proposal 2 – Appointment of a Director

Oasis is nominating Mr. Naoki Okada as an additional independent director to Alpine’s Board of Directors. Alpine’s current Board of Directors, including its independent directors, have failed in treating all shareholders equally and in protecting minority shareholders. We believe that it is wholly appropriate for minority shareholders to elect truly independent directors that will act in the best interest of all stakeholders, and not just Alps.

Mr. Okada is the President and Representative Director of AVL Japan K.K., the Japanese subsidiary of AVL, one of the largest powertrain engineering company in the world. Mr. Okada has grown the subsidiary into the second largest of all AVL affiliates. Mr. Okada has been heavily involved in business development at AVL, Continental Automotive Systems, Motorola Japan, TRW Automotive Japan and Sony Corporation.

Alpine stakeholders will benefit from Mr. Okada’s strong relationships with Japanese auto manufacturers as well as Korean companies, his expertise in sales and engineering roles, as well as his strong track record in developing new businesses with Japanese and Korean manufacturers at this critical time in the continued transformation of the automotive industry. In addition to protecting minority shareholders, we believe that the nomination of Mr. Okada will benefit all of Alpine’s stakeholders.

Shareholder Proposal 3 – Appointment of a Director and Audit Committee Member

Oasis is nominating Ms. Nao Miyazawa as an additional independent director to Alpine’s Board of Directors and as a member of Alpine’s Audit Committee. As stated above, Alpine’s current Board of Directors including its supposed independent directors has failed in treating all shareholders equally and in protecting minority shareholders. This is all the more true of the Audit and Supervisory Committee, which has the power to report directly to shareholders against management. Alpine’s Audit and Supervisory Committee has failed to effectively supervise Alpine’s management and protect all shareholders.

Ms. Miyazawa is an attorney at law at the OMM Law Office and was recently nominated as outside director of S-Pool (TYO:2471) receiving 100% of the vote. Ms. Miyazawa began her career at PIA Corporation, a listed company in Japan, where she was a manager before she registered as an Attorney of Law.

As a lawyer fully independent of Alpine, Ms. Miyazawa can rectify the failures of the current Audit Committee and make up for the questionable independence of Kojima-san as a member of the Audit Committee. Ms. Miyazawa will conduct the appropriate supervision and provide impartial advice to the Board of Directors that is in the best interests of all stakeholders, and not just Alps.

Further, her appointment would help bring much-needed diversity of perspective to Alpine’s board, which to date has never had a woman on the Board of Directors. Alpine’s board should diversify further by bringing in Miyazawa-San, not just because of her gender, but because she can contribute to the success of the company by providing diverse perspectives from the outside, to help the company overcome insularity and exclusivity and to enhance its global competitiveness.

VOTE FOR THE OASIS PROPOSALS

PROTECT ALPINE

***

Shareholders are encouraged to visit www.protectalpine.com to sign up for updates and learn how you can help. Shareholders may also contact us at protectalpine@oasiscm.com, or contact our Japanese legal counsel at Legal@protectalpine.com.

For media and all other inquiries, please contact thall@hk.oasiscm.com.

Oasis Management Company Ltd. manages private investment funds focused on opportunities in a wide array of asset classes across countries and sectors. Oasis was founded in 2002 by Seth H. Fischer, who leads the firm as its Chief Investment Officer. More information about Oasis is available at oasiscm.com. Oasis has adopted the Japan FSA’s “Principles of Responsible Institutional Investors” (a/k/a Japan Stewardship Code) and in line with those principles, Oasis monitors and engages with our investee companies.