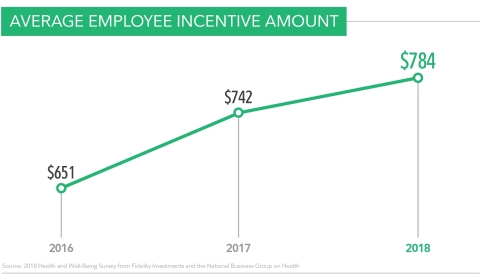

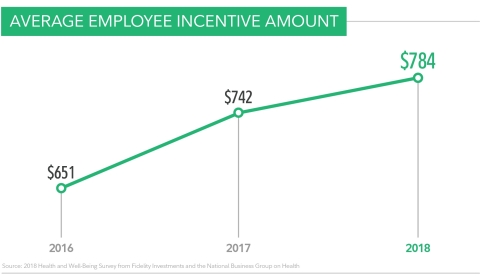

BOSTON--(BUSINESS WIRE)--According to the ninth annual Health and Well-Being Survey from Fidelity Investments® and the National Business Group on Health®, companies across the country will continue to leverage and expand well-being programs to create healthier and more productive workforces. Financial incentives continue to play a key role in the success of well-being programs: Nearly nine out of ten employers (86 percent, up from 74 percent in 2017) offer financial incentives as part of their well-being platform, and the average employee incentive amount increased to $784 for 2018, up from $742 in 2017, and a 50 percent increase from the average of $521 in 2013.

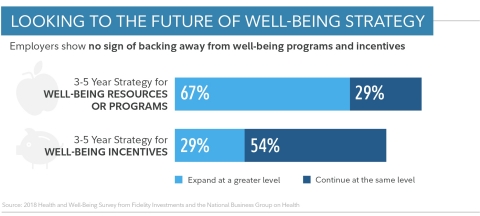

Financial incentives are expected to continue to be a key benefit within well-being platforms in the future, as 29 percent of employers indicated they plan to continue to increase the amount of financial incentives offered to employees over the next 3-5 years.

“The fact that companies continue to dedicate an increasing amount of resources to their corporate well-being programs indicates they are having a positive impact on overall workforce performance,” said Robert Kennedy, senior vice president, Fidelity Benefits Consulting. “These programs have evolved beyond traditional health and lifestyle activities to now include elements of Financial Security, Social/Emotional Well-being, and even Job Satisfaction. An employer’s well-being programs are now overwhelmingly viewed as a platform to improve employee engagement, increase worker productivity, and reduce absenteeism.”

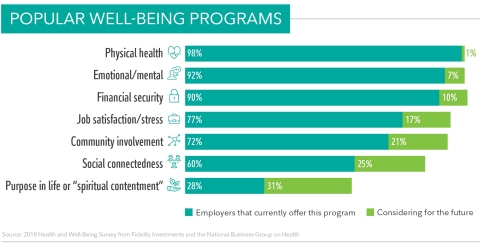

The survey also reveals that more than two-thirds (67 percent) of companies plan to expand their well-being initiatives over the next 3-5 years to include programs not specifically focused on physical health. In addition to traditional health-focused programs, such as weight management and smoking cessation, 92 percent of employers are expanding their well-being platforms to include emotional health programs, and 90 percent are now including financial wellness programs, such as debt management and budgeting. Other examples of increasingly popular non-health well-being activities include stress management training (77 percent), community involvement/volunteerism activities (72 percent) and social connectedness opportunities (60 percent).

“More employers are viewing holistic well-being as an integral part of their overall workforce strategy,” said Brian Marcotte, president and CEO of the National Business Group on Health. “The goal is to create a competitive advantage by deploying the healthiest, most productive, engaged and competitive workforce possible to boost business performance and empower great people and communities.”

As corporate well-being programs continue to expand and evolve, companies are exploring new communication channels to connect with employees, as well as finding ways to personalize content to increase engagement. Among employers that personalize communication based on specific employee profiles or workforce demographics, 85 percent indicate that employee engagement has increased. And while companies continue to use traditional communication channels, such as e-mail, internal websites and on-site promotions, nearly half of employers (48 percent) now use mobile applications to communicate with employees. In addition, 39 percent are utilizing social media as a communications platform, while 24 percent connect with employees via personalized text messages.

Opportunities to Extend Well-Being Programs to Global Workforce

As

an increasing percentage of multi-national companies take steps to

standardize their company’s benefits across different geographies, many

companies still need to focus on applying a global strategy to their

corporate well-being platform. While 44 percent of companies surveyed

extend their well-being program to other geographies, there are

interesting differences on how these companies deliver the programs:

only 10 percent of these companies offer a well-being program based on

their U.S. strategy, while 34 percent tailor their offerings for each

location. Another 42 percent don’t offer a well-being strategy for

employees in other geographies, but they do give local regions the

ability to implement a program based on their specific needs. An

additional 10 percent of companies surveyed indicated they had no

interest in offering a well-being program to employees outside of the

US. In terms of financial incentives, 10 percent of companies currently

offer employee incentives, and another 10 percent plan to offer

incentives in 2019. However, nearly half (48 percent) of companies

surveyed indicated they do not currently offer incentives and have no

plans to offer any in the future.

About the Survey

The 9th

annual survey on corporate Health & Well-being from Fidelity Investments®

and the National Business Group on Health® includes responses

from 162 jumbo, large and mid-sized organizations. The online survey was

fielded during November and December 2017 among National Business Group

on Health members and clients of Fidelity Investments.

About the National Business Group on Health

The

National Business Group on Health is the nation’s only non-profit

organization devoted exclusively to representing large employers’

perspective on national health policy issues and helping companies

optimize business performance through health improvement, innovation and

health care management. The Business Group leads initiatives to address

the most relevant health care issues facing employers today and enables

human resource and benefit leaders to learn, share and leverage best

practices from the most progressive companies. Business Group members,

which include 75 Fortune 100 companies, provide health coverage for more

than 50 million U.S. workers, retirees and their families. For more

information, visit www.businessgrouphealth.org.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$6.9 trillion, including managed assets of $2.5 trillion as of March 31,

2018, we focus on meeting the unique needs of a diverse set of

customers: helping more than 27 million people invest their own life

savings, 23,000 businesses manage employee benefit programs, as well as

providing more than 12,500 financial advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for 70 years, Fidelity employs more than 40,000 associates who are

focused on the long-term success of our customers. For more information

about Fidelity Investments, visit https://www.fidelity.com/about.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

The National Business Group on Health and Fidelity Investments are independent entities and are not legally affiliated.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.

500 Salem

St., Smithfield, RI 02917

844123.1.0

© 2018 FMR LLC. All rights reserved.