NEW YORK--(BUSINESS WIRE)--AXA, a leading financial protection company, today unveiled new research which found retirement savers actively want to discuss ways to protect their assets during periods of volatility and ensure they have enough income in retirement.

Public opinion and market research company, Greenwald & Associates, conducted the research on behalf of AXA US and The Insured Retirement Institute (IRI), surveying more than 1,000 individuals and 300 financial professionals.

The results uncovered several opportunities for financial professionals to drive deeper client satisfaction by proactively discussing protection against stock market downturns, guaranteed lifetime income options and by planning for healthcare expenses.

Key research findings include:

- Nearly 80 percent of individuals are interested in learning about an option that offers principal protection and the potential for growth.

- Fifty-six percent of individuals rate their financial professional highly when lifetime income is discussed, versus 34 percent who do so when lifetime income is not discussed.

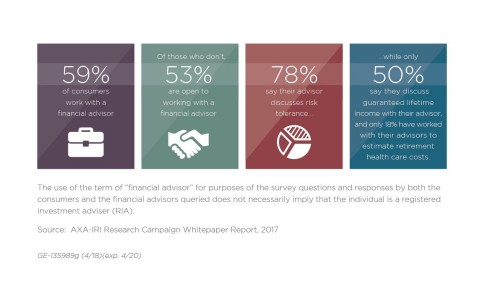

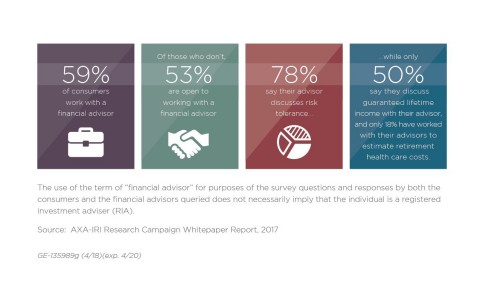

- However, only 50 percent of individuals say they discuss guaranteed lifetime income with their financial professional, compared to nearly 80 percent who discuss risk tolerance.

“Financial professionals play a key role in supporting their clients in reaching their retirement goals,” said Kevin Kennedy, head of the Individual Retirement business at AXA US. “Clients want their financial professionals to move beyond the standard risk tolerance questionnaire and engage them in a thorough discussion of options, including income planning for healthcare expenses.”

“There is also an opportunity,” Kennedy continued, “for financial professionals to explore options with their clients that can help give them access to market appreciation over the long-term while providing some protection from downside risk.”

The research also found that saving for retirement healthcare costs creates an additional opportunity for financial professionals to discuss principal protection options. Nearly 60 percent of individuals believe they are only somewhat or not very well prepared for a major health event. However, less than 20 percent of individuals reported they have worked with their financial professionals to estimate retirement healthcare costs.

Concerns over healthcare costs are compounded by the potential for inflation to chip away at their spending power. Ninety-two percent of individuals recognize inflation is likely to have an impact on expenses during retirement.

“This research underscores financial professionals’ pivotal role in helping retirement savers to gain comfort around their ability to withstand market volatility and the potential role of high quality annuity products in helping to achieve financial security,” said Catherine Weatherford, President and CEO, Insured Retirement Institute. “In return, financial professionals will be rewarded with higher client satisfaction.”

AXA US’s variable annuity portfolio includes principal protection features and guaranteed income solutions that can help financial professionals give their clients options to address their long-term needs. Depending on each unique need, these strategies can help individuals protect their wealth, help ensure an income source they cannot outlive and better weather large expenditures such as healthcare costs, while mitigating the impact of inflation.

- Structured Capital Strategies is a variable and index-linked deferred annuity contract designed for investors looking to protect their assets against a loss of up to 30 percent as well as invest for growth, up to a cap1.

- Retirement Cornerstone variable deferred annuity gives investors the ability to accumulate assets and protect retirement income, tax-deferred.

- Investment Edge variable deferred annuity offers tax-deferred growth potential, and tax-efficient distribution options.

Greenwald & Associates conducted the research in the fourth quarter of 2017. For more information, please see the white paper, Protection, Growth and Income: Helping Consumers Reach Retirement Goals, which includes the full research methodology, results and additional findings.

ABOUT AXA

As leading providers of retirement, insurance and investment strategies, the companies under the AXA U.S. brand name help empower their customers to live better lives. Established in 1859, AXA Equitable now has approximately 2.8 million customers nationwide. More than 4,700 AXA Advisors Financial Professionals create strategies to help individuals, families and small business owners move forward with confidence on their road to financial security. AXA U.S. is a brand name of AXA Equitable Financial Services, LLC and its family of companies, including AXA Equitable Life Insurance Company (AXA Equitable), MONY Life Insurance Company of America (MLOA) (AZ stock company, administrative office: Jersey City, NJ), AXA Advisors, LLC (member FINRA, SIPC) and AXA Distributors, LLC. AXA U.S. is part of the global AXA Group, a worldwide leader in financial protection strategies and wealth management, with 107 million clients in 64 countries. The obligations of AXA Equitable and MLOA are backed solely by their claims-paying ability. Find AXA on Facebook, Twitter and LinkedIn. For more information, visit www.axa.com.

IMPORTANT LEGAL INFORMATION AND CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING STATEMENTS

Annuities are long-term financial products designed for retirement purposes. In essence, annuities are contractual agreement in which payment(s) are made to an insurance company, which agrees to pay out an income or lump sum amount at a later date. There are contract limitations and fees and charges associated with annuities, administrative fees, and charges for optional benefits. A financial professional can provide cost information and complete details. Variable annuities are subject to fluctuation in value and market risk, including loss of principal. Structured Capital Strategies®, Retirement Cornerstone® and Investment Edge® variable annuities are issued by AXA Equitable Life Insurance Company, New York, NY 10104. Co-distributed by affiliates AXA Advisors, LLC and AXA Distributors, LLC (members FINRA, SIPC). Please consider the charges, risk, expenses, and investment objectives carefully before purchasing a variable annuity. For a prospectus containing this and other information, please contact a financial professional. Read it carefully before investing or sending money.

GE-135989 (4/18)(Exp. 4/20)

1 The investor will absorb the loss in excess of the protection limit, so there is a risk of substantial loss of principal.