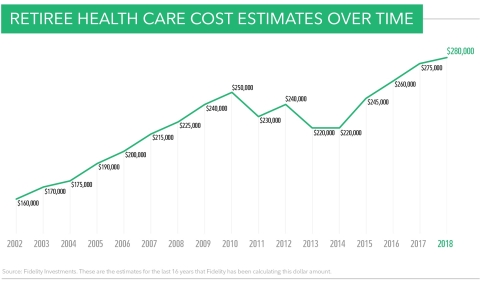

BOSTON--(BUSINESS WIRE)--A 65-year old couple retiring this year will need $280,0001 to cover health care and medical expenses throughout retirement, according to Fidelity Investments’ 16th annual retiree health care cost estimate. This represents a two percent increase from 2017 and a 75 percent increase from Fidelity’s first estimate in 2002 of $160,000.

For individuals retiring this year, using same assumptions and life expectancies used to calculate the estimate for a 65-year-old couple, a male will need $133,000 to cover health care costs in retirement, while females will need $147,000, primarily due to the fact that women are expected to live longer than men.

“Despite this year’s estimate remaining relatively flat, covering health care costs remains one of the most significant, yet unpredictable, aspects of retirement planning,” said Shams Talib, executive vice president and head of Fidelity Benefits Consulting. “It’s important for individuals to educate themselves and take steps while working to ensure they are prepared to address these costs. Otherwise, people risk having to dip into more of their savings than originally anticipated, potentially impacting their overall retirement lifestyle.”

Many of the metrics contributing to Fidelity’s annual retiree health care cost estimate are susceptible to shifts in the economic landscape and changes in government regulations. The two percent increase to this year’s estimate is the smallest annual increase since 2014, which indicates that many of the factors contributing to the estimate, such as prescription out-of-pocket drug expenses and Medicare premiums, have remained relatively flat over the last year. This moderation of estimated retiree health care costs coincides with increasing savings levels for many Americans – an analysis2 of 401(k) accounts managed by Fidelity indicates the average savings rate has increased almost 10 percent since 2013.

Additional Costs are Likely if Retirement Starts Prior to Medicare

Eligibility

Fidelity’s estimate is designed to calculate health

care expenses for a couple that retires at 65 and assumes both partners

are eligible for Medicare. However, many individuals decide to retire

before they reach 65, either voluntarily, due to health issues or a

work-related event.

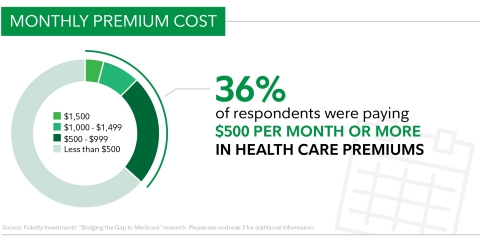

Fidelity recently polled3 more than 1,000 individuals between the ages of 50 and 64 who had retired within the last three years about how they planned to cover health care expenses until they are eligible for Medicare, as well as to understand how much they thought they would spend on health care in retirement. According to the survey findings, 56 percent of respondents retired earlier than expected and nearly one-third (30 percent) of those individuals retired early due to a health event affecting them or their spouse. Almost all respondents indicated they had some form of health care coverage to cover expenses until they were eligible for Medicare, but more than one-third (36 percent) of respondents were paying $500 per month or more in health care premiums.

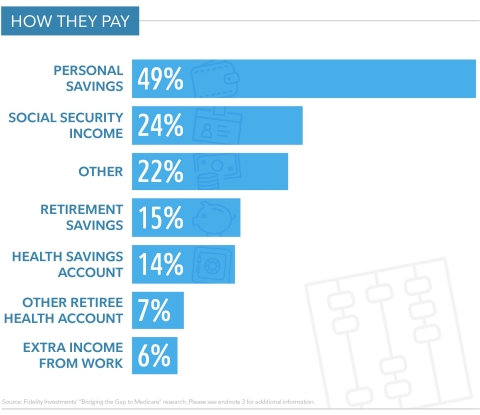

When early retirees were asked how they were paying for out-of-pocket premiums, co-pays and deductibles associated with insurance coverage, 49 percent indicated they were dipping into personal savings to cover these expenses. Nearly one-quarter (24 percent) were relying on Social Security income, or retirement savings (15 percent). Only 14 percent of respondents were using a health savings account (HSA) to cover these costs.

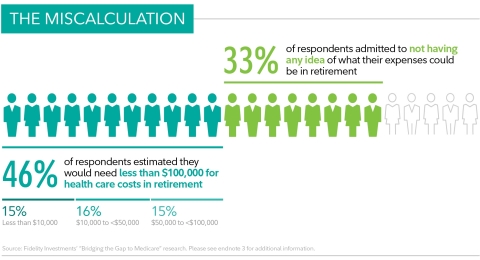

In the face of these additional costs, many early retirees could be underestimating what they may need to cover health care in retirement. Nearly half (46 percent) of respondents estimated they would need less than $100,000 for health care costs in retirement – while another 33 percent admitted to not having any idea of what their expenses could be in retirement.

“Individuals who are faced with the prospect of retiring early, regardless of the reason, will need to educate themselves on the options available to bridge the gap to Medicare eligibility to help pay for the extra health care expenses they’re likely to incur during this period,” added Talib.

Fidelity Resources can Help Prepare for Health Care Costs in

Retirement

Fidelity offers several educational resources to

help individuals understand and prepare for health care costs during

their working years and into retirement, including a Fidelity Viewpoints

article providing additional details on this year’s retiree health

care cost estimate and a video

with tips to help save money on health care costs in the years leading

up to retirement.

As an increasing number of employers offer HSAs, Fidelity has published a Viewpoints article with tips to make the most of an HSA, as well as a video highlighting tips for new health savings account holders. Fidelity has also published an age-based set of retirement savings guidelines that include health care expenses and are designed to help individuals understand how much they should have save by specific age milestones.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$6.9 trillion, including managed assets of $2.5 trillion as of February

28, 2018, we focus on meeting the unique needs of a diverse set of

customers: helping more than 27 million people invest their own life

savings, 23,000 businesses manage employee benefit programs, as well as

providing more than 12,500 financial advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for 70 years, Fidelity employs more than 40,000 associates who are

focused on the long-term success of our customers. For more information

about Fidelity Investments, visit https://www.fidelity.com/about.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.

500 Salem

St., Smithfield, RI 02917

842287.1.0

© 2018 FMR LLC. All rights reserved.

1 Estimate based on a hypothetical couple retiring in 2018,

65-years-old, with life expectancies that align with Society of

Actuaries’ RP-2014 Healthy Annuitant rates with Mortality Improvements

Scale MP-2016. Actual assets needed may be more or less depending on

actual health status, area of residence, and longevity. Estimate is net

of taxes: cost basis is assumed to equal market value. Estimate is

calculated as the assets required today in a taxable account with an

effective tax in retirement of 5%, an asset allocation of 30% equity,

50% bonds, and 20% cash, such that there is a 90% chance of being able

to pay for healthcare expenses through life expectancy. The Fidelity

Retiree Health Care Costs Estimate assumes individuals do not have

employer-provided retiree health care coverage, but do qualify for the

federal government’s insurance program, Original Medicare. The

calculation takes into account cost-sharing provisions (such as

deductibles and coinsurance) associated with Medicare Part A and Part B

(inpatient and outpatient medical insurance). It also considers Medicare

Part D (prescription drug coverage) premiums and out-of-pocket costs, as

well as certain services excluded by Original Medicare. The estimate

does not include other health-related expenses, such as over-the-counter

medications, most dental services and long-term care.

2

Analysis based on 22,400 corporate defined contribution plans and 15.3

million participants as of December 31, 2017. These figures include the

advisor-sold market, but exclude the tax-exempt market. Excluded from

the behavioral statistics are non-qualified defined contribution plans

and plans for Fidelity’s own employees.

3 Fidelity’s

“Bridging the Gap to Medicare” results based on an online survey that

was conducted among a random sample of 1,003 adults between the ages of

50 and 64 who had retired in the past three years. The survey was

fielded in November 2017 by Greenwald and Associates Inc., an

independent third-party research firm. The results of this survey may

not be representative of all adults meeting the same criteria as those

surveyed for this study.