COLUMBUS, Ga.--(BUSINESS WIRE)--According to the latest TSYS U.S. Consumer Payment Study, a range of emerging payment options are gaining widespread acceptance with consumers across age groups – especially ages 25 to 34. The seventh annual study, which examines attitudes and behaviors toward payments, focused on the willingness of consumers to use artificial intelligence-powered (A.I.) personal assistants to make purchases, acceptance of peer-to-peer (P2P) payment options and adoption rate of digital wallets, among other topics.

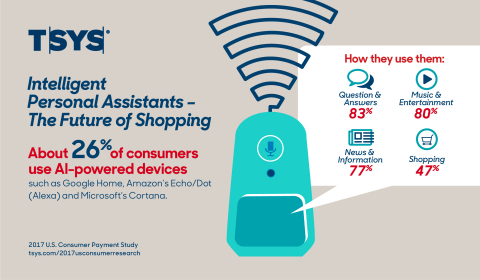

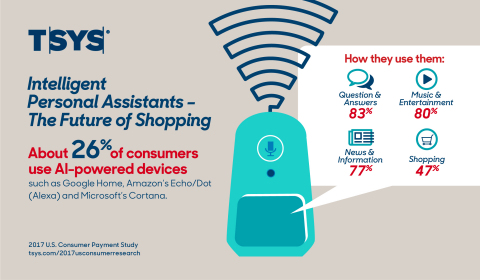

Twenty-six percent of survey respondents said they own an A.I. device — such as an Amazon Echo or Google Home. Within this group, 60 percent said they would use it to make purchases or payments, if available. That figure increases to 76 percent for consumers between ages 25 and 44.

Digital wallets are also experiencing a surge in popularity. Fifty-one percent of survey respondents are interested in using a mobile wallet instead of a payment card when checking out at a store, up 11 percentage points from 2016. Sixty-eight percent of those who have loaded a debit or credit card to a mobile wallet indicated they expect to make 50 percent or more of their in-store purchases using a digital wallet within two years.

In addition, 29 percent of survey respondents have used a P2P payment service such as PayPal, Venmo or Zelle. Among those ages 25 to 34, that number rises to 45 percent.

“The payments industry is changing rapidly, and TSYS continues to be one of the leading innovators,” said Allen Pettis, Executive Vice President and Chief Customer Officer, Issuer Solutions at TSYS. “Our latest study confirms that consumers are ready for change and adapting to the ever-evolving payments industry as new solutions are introduced. Because of this, retailers and payments providers can continue reimagining the digital purchase experience for consumers.”

Despite the rise of new payment methods, consumers still prefer to pay for things the traditional way with debit (44 percent), credit (33 percent) or cash (12 percent), according to the study.

Other findings from the survey include:

Security tops reasons for avoiding A.I. purchases

The top reason cited for not using a personal assistant for purchases and avoiding P2P payment options is security. Older Americans had the greatest concern with 45 percent of those 55 and older worried about security, compared to 29 percent of 18 to 24 year olds.

Banking apps and digital wallets gain in popularity

Consumers are using banking apps more regularly; usage increased from 46 percent in 2015 to 63 percent in 2017. Users are most interested in being able to stop a transaction they did not authorize (80 percent) or instantly view transactions (72 percent).

Additionally, Americans are embracing the idea of the digital wallet. The number of consumers who have made In-store purchases with smart phones increased from seven percent in 2015 to 12 percent in 2017.

Shoppers value credit card loyalty programs

Americans definitely value loyalty programs when choosing a credit card. This year’s study found that 75 percent of consumers have a credit card with a rewards program, up from 58 percent in 2015. Seventy-eight percent ranked cash rebates as their top reward feature, followed by travel (29 percent) and gift cards (27 percent).

Full findings from the study can be accessed here: tsys.com/2017usconsumerresearch

Survey Methodology:

The study was conducted by TSYS among 1,200 Qualtrics consumer panel members ages 18 and up in October 2017. All respondents were required to have at least one credit and debit card to participate in the study.

About TSYS

TSYS® (NYSE: TSS) is a leading global payments provider, offering seamless, secure and innovative solutions across the payments spectrum — from issuer processing and merchant acquiring to prepaid program management. We succeed because we put people, and their needs, at the heart of every decision. It’s an approach we call ‘People-Centered Payments®’.

Our headquarters are located in Columbus, Ga., U.S.A., with approximately 12,000 team members and local offices across 13 countries. TSYS generated revenue of $4.9 billion in 2017, while processing more than 27.8 billion transactions. We are a member of The Civic 50 and were named one of the 2018 World's Most Ethical Companies by Ethisphere magazine. TSYS is a member of the S&P 500 and routinely posts all important information on its website. For more, visit tsys.com.