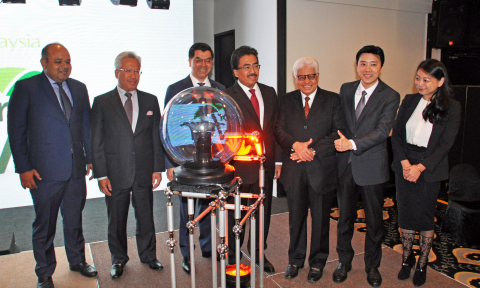

KUALA LUMPUR, Malaysia--(BUSINESS WIRE)--Fusionex, a multi-award-winning, leading data technology provider specializing in Analytics, Big Data, Machine Learning, and Artificial Intelligence (AI), has commenced a digital insurance initiative for leading Takaful insurance company STMB. Takaful Malaysia’s online sales portal “Click for Cover” was launched at a grand ceremony and signalled the digital transformation of their business processes with Fusionex technology. The launch ceremony was officiated by Datuk Seri Johari Abdul Ghani, Finance Minister II, and marked the beginning of a seamless customer experience in purchasing and renewing insurance policies online via data-centric approach.

Leveraging Fusionex technology, Takaful’s digital insurance initiative is able to help customers process their applications, issue quotations, perform underwriting, send cover notes and e-documents via a customer-focussed and seamless online platform. The platform focuses on providing the best service to its customers, with the ability to understand each customer in a more personalized way. This is in line with Takaful’s strategy of reaching out to its prospects and customers anywhere, anytime and anyhow, while having the ability to introduce newer products and targeted features that their customers will find more useful and relevant to their specific needs.

The launch also witnessed the signing of a memorandum of agreement between Fusionex and Takaful, as well as signings between Takaful and Remark, a digital marketing company. Collaboration agreements for online distribution with Lembaga Tabung Haji (LTH) and Bank Islam (BIMB) were also signed to introduce online Takaful products to depositors of LTH and customers of BIMB.

Fusionex Group CEO Dato’ Seri Ivan Teh said, “Innovation needs to be at the core of businesses, as this differentiates the leaders versus the followers. Today, we are pleased to witness Takaful Malaysia making great strides in this direction. Fusionex is delighted to be a key partner in Takaful Malaysia’s exciting digital transformation journey, and we are confident that this initial success will lead to many more success stories with Takaful Malaysia.”

Takaful Malaysia Group CEO Dato’ Sri Mohamed Hassan Kamil said, “Today’s launch of our digital strategy plan signifies our commitment towards revolutionizing the way we will grow our business by digitally transforming our sales and operations. By embracing digital tools and technology to offer up differentiated product offerings and services, we will delight our customers with a better user experience, enhanced protection products and high quality service. Our customers will benefit from an integrated multi-channel experience and this is part of our ongoing efforts to stay ahead of the curve.”

Datuk Seri Johari Abdul Ghani, Finance Minister II stated, “Today’s launch of Takaful Malaysia’s digital strategy is very much in line with the overall digital strategy outlined by the Government in growing the digital economy.”

The “Click for Cover” portal, which is powered by Fusionex technology, provides a data-centric, easy-to-use interface for customers to access the company’s products online with e-payment facilities and real-time underwriting capabilities. “Click for Cover” has the first fully integrated medical underwriting engine online in Malaysia where rating decisions will be generated online. Currently, the portal offers Motor, Personal Accident (PA) and Medical products. More products such as Term Life, Critical Illness and Travel PA Takaful will be made available later this year.

Dato’ Sri Hassan Kamil said, “Our strategic partnership with Fusionex and Remark is in line with our business goals to make our digital strategy the key driver of our innovation efforts, thereby boosting our competitiveness and powering future growth.”

Dato’ Seri Ivan Teh commented, “In this data-driven age, embracing data technology is no longer a luxury, but rather a must if one wants to remain relevant and competitive. The ultimate goal of digital transformation is great user experience; hence it’s crucial that we work with our customers to focus on the consumer and the user journey, leveraging powerful technology. We believe that it is only through this lens and a user-centric approach will businesses be able to thrive and scale to greater heights.”