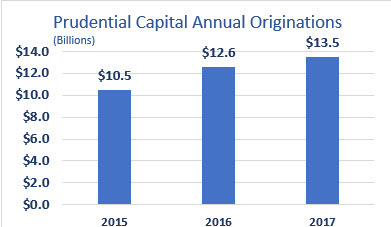

CHICAGO--(BUSINESS WIRE)--Prudential Capital Group announced today it has met the growing capital needs of middle market companies by providing $13.5 billion of senior debt and junior capital to more than 220 companies globally in 2017. Prudential Capital Group is a leading source of private capital for public and private companies and the private capital arm of PGIM, the $1.2 trillion global investment management businesses of Prudential Financial, Inc. (NYSE: PRU).

“Prudential Capital has been supporting the varied capital needs of global middle market companies for many years, and we are pleased to have provided a record level of capital this past year,” said Allen Weaver, senior managing director and head of Prudential Capital Group. “We have a long-term relationship orientation, which has proven to be very attractive to issuers in this market.”

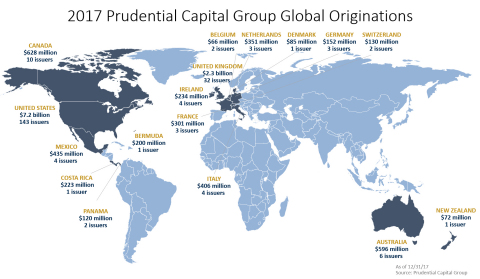

Investment grade and below investment grade purchases of $13.5 billion were record for a single year. Pricoa Capital Group, Prudential Capital’s international unit, also had a record year with a 32 percent increase in originations over 2016. Highlights include:

- $2.5 billion in UK, Ireland and the Netherlands

- $623 million in Latin America

- $593 million in Australia and New Zealand

In January 2017, Prudential Capital Partners V, a middle-market mezzanine fund focused on North America and Europe, began its investment period and completed more than $500 million in new investments. Highlights include:

- 12 new transactions

- $508 million originated in North America

- $45 million (follow-on financing)

Other teams, such as the Energy Finance Group, Infrastructure Finance and Equipment Finance also contributed $3.9 billion to the 2017 origination total. For the year, Prudential Capital’s portfolio grew to $82.2 billion, and added 100 new relationships.

“We have a lot of momentum coming out of 2017,” added Weaver. “We expect to continue to provide significant capital to support the global growth plans of our existing and new clients from our thirteen offices around the world in 2018.”

About Prudential Capital Group

Prudential Capital Group is the private capital investment arm of Prudential Financial, Inc. (NYSE: PRU). Prudential Capital Group has been a leading provider of private placements, mezzanine debt and equity, to companies for more than 75 years. Managing a portfolio of more than $82 billion as of December 31, 2017, Prudential Capital offers senior debt, mezzanine financing, leveraged leases, project financing, credit tenant leases as well as asset financing to companies, worldwide. The global regional office network has locations in Atlanta, Chicago, Dallas, Frankfurt, London, Los Angeles, Milan, Minneapolis, Newark, New York City, Paris, San Francisco and Sydney*. More information is available at prudentialcapitalgroup.com.

*The Sydney office operates through PGIM (Australia) Pty Ltd.

About PGIM and Prudential Financial, Inc.

With 15 consecutive years of positive third-party institutional net flows, PGIM, the global asset management businesses of Prudential Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset managers in the world with more than $1.2 trillion in assets under management as of December 31, 2017. PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including fundamental equity, quantitative equity, public fixed income, private fixed income, real estate and commercial mortgages. Its businesses have offices in 16 countries across five continents.

Prudential Financial’s other businesses also offer a variety of products and services, including life insurance, annuities and retirement-related services. For more information about PGIM, please visit https://www.pgim.com. For more information about Prudential, please visit news.prudential.com.