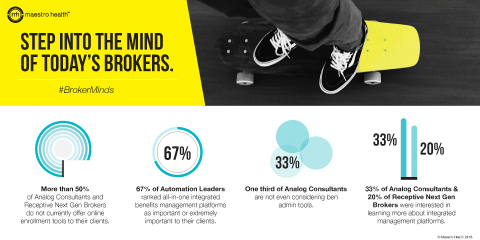

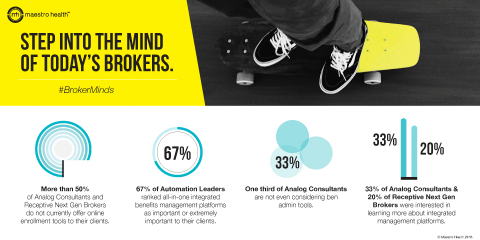

CHICAGO--(BUSINESS WIRE)--Research commissioned by Maestro Health™, a leading all-in employee health and benefits company, finds that 53 percent of brokers agreed that success for themselves and their clients is directly tied to innovation through technology solutions. The 2018 Broker Tech Trend Report brings fresh perspectives on technology adoption preferences of today’s brokers and offers guidance for employers as they seek to maximize value from their broker partners – and ultimately lower their health and benefit costs.

Through a third-party study, Maestro Health analyzed broker perceptions toward technology and benefits to begin closing the knowledge gap on technology trends. It identified three distinct broker personalities based on rates of technology adoption and attitudes toward client engagement:

- Analog Consultants

- Receptive Next Gen Brokers

- Automation Leaders

The research findings help employers understand how brokers stack up in the modern benefits landscape and see how their brokers should be personalizing solutions for them. Likewise, the data reveal important insights into the opportunities technology can offer to make employee health and benefits less burdensome.

“The research is a first-of-its-kind look into the minds of brokers and employers with respect to their technology adoption preferences and feelings toward how new solutions can help deliver smarter, more personalized benefits,” said Jeff Yaniga, Chief Channel Officer, Maestro Health. “Great technology service providers can be a bridge between brokers and employers. By collaborating, all three players become an ‘idea factory’ that can affect real change. In that way, we’re equipping brokers with the knowledge and tools they need to help their customers succeed, and we’re helping employers understand what to look for in their broker partners to help their workforce thrive in 2018 and beyond.”

Regardless of whether benefits consultants view modern technology as essential or if they prefer a more traditional approach to advising clients, it is critical to meet employers where they are and offer them solutions that can ultimately lower their health and benefit costs. As employer-sponsored health benefits rapidly evolve, so should broker behaviors toward adopting the latest tools and services to provide exceptional service. It is the responsibility of employers to understand what to look for in their broker partner and have a 360-degree view of their benefits priorities based on the needs of their workforce. Employers are increasingly seeking personalization, creative thinking and expert resources when making health benefit decisions for their organization. As such, brokers must adapt to new expectations while continuing to deliver positive engagements and guiding employers as a trusted advisor.

“Benefits in 2018 are even more complex than they were in 2017. Employees want technology to introduce simplicity, convenience, accessibility and affordability where complexity and high costs have become the status quo,” added Yaniga. “Likewise, the role of the broker is more important than ever. In the commission-based model, they face pressure to add more value and incorporate innovation to stay relevant, all while providing trusted counsel to their employer clients to maintain and grow their book of business.”

While many employers would agree that no amount of technology could ever replace the level of knowledge and service they receive from their broker, brokers can expand their opportunities by being proficient in tools that can foster higher levels of engagement and exceed client expectations. The rewards for expanding these skill sets far outweigh the risks, and both brokers and employers stand to benefit.

Download the 2018 Broker Tech Trend Report to get insight into how today’s brokers are thinking about technology and what it means for the future of benefits.

About Maestro Health™

Maestro Health makes employee health &

benefits people-friendly again by delivering an all-in platform that

meets todays needs of employers, employees, brokers and carriers.

Maestro Health owns and operates six core solutions: (me)BENEFITS ADMIN

2.0™, (me)BENEFIT ACCOUNTS™, (me)SELF-FUNDED BENEFITS™, (me)PEOPLE

MANAGEMENT™, (me)BILLING ADMIN™ and (me)ACA SERVICES™. The flexible

solutions are designed and unified on a tech-meets-service platform so

customers can customize their own HR suite based on what works best for

their organization's unique needs—all to optimize and simplify the way

employees and employers shop, enroll and live with their benefits.