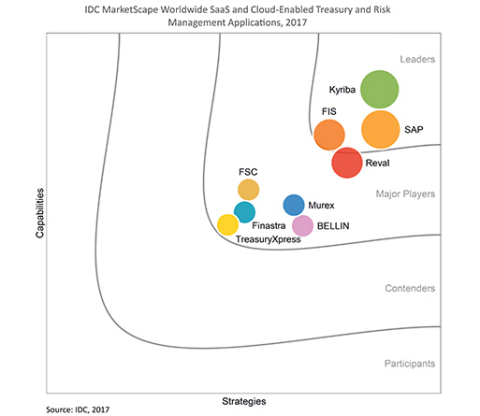

NEW YORK & PARIS & LONDON--(BUSINESS WIRE)--Kyriba, the #1 global provider of cloud treasury and financial management solutions, today announced it has been named as a “Leader” in the IDC MarketScape Worldwide SaaS and Cloud-Enabled Treasury and Risk Management Applications 2017–2018 Vendor Assessment (DOC # US43293517, December 2017). Released late last month, the IDC study provides a comprehensive assessment of the leading vendors in the market, how digital tools are driving innovation, and what to look for when selecting a world-class solution.

“The digital transformation is now taking hold within the treasury and risk application market,” said Kevin M. Permenter, senior research analyst, Enterprise Applications and Digital Commerce at IDC. “Treasury applications are starting to become more sophisticated to meet these needs. Going forward, only vendors that are able to offer solutions with extensive treasury functionality along with the new wave of digital tools like cloud, APIs, and intelligence are going to thrive in the treasury and risk applications market.”

Kyriba, which has more than 1,600 clients worldwide, was recognized by IDC for its deep customer focus, a fully virtualized multitenant SaaS application, enterprise-level data security, and advanced compliance and reporting functionality. Kyriba was positioned along with eight other global vendors, each of whom were judged by a mix of strategies and capabilities covering customer satisfaction, depth of functionality, SaaS architecture, and more.

Download a custom version of the IDC MarketScape report, including Kyriba’s vendor profile, essential advice for treasury and risk management solution buyers, and identification of emerging technology that is driving treasury innovation.

“We are honored to be recognized by one of the biggest technology analyst firms in the world, and owe this success to our many clients and strategic partners,” said Jean-Luc Robert, Chairman and CEO at Kyriba. “From the beginning, our goal has been to empower CFOs and senior financial executives to better manage the complete cash lifecycle, so they can reduce risk, optimize liquidity, and accelerate growth. We look forward to working with the entire Kyriba community to continue to push the boundaries of innovation and success.”

IDC MarketScape Criteria and Methodology

IDC researched known vendors based on their market experience and their clients’ and contacts’ request for evaluation within enterprise deals and supplemented several vendors that IDC believed to qualify as a treasury and risk system. Vendors were then surveyed and further investigated to ensure that their treasury and risk systems qualified as SaaS or cloud enabled and were already serving numerous enterprises. IDC analysts base individual vendor scores, and ultimately vendor positions on the IDC MarketScape, on detailed surveys and interviews with the vendors, publicly available information, and end-user experiences in an effort to provide an accurate and consistent assessment of each vendor's characteristics, behavior, and capability.

Market Definition

IDC defines treasury and risk management applications as applications that support corporate treasury operations (including the treasuries of financial services enterprises) with the corresponding financial institution functionality and optimize related cash management, deal management, and risk management function. For the full definition, download the custom report here.

To learn more about Kyriba, visit www.kyriba.com.

About Kyriba Corp.

Kyriba is the #1 provider of cloud treasury and financial management solutions. Kyriba empowers financial leaders and their teams with award-winning solutions for cash and risk management, payments, and supply chain finance. Kyriba delivers a highly secure, 100% SaaS platform, superior bank connectivity, and a seamlessly integrated solution set for tackling today’s most complex financial challenges. More than 1,600 companies, including many of the world’s largest organizations, rely on Kyriba to streamline key processes, protect against loss from fraud and cybercrime, and accelerate growth opportunities through improved decision support. Kyriba is headquartered in New York, with offices in San Diego, Paris, London, Tokyo, Dubai, and other major locations. For more information, visit www.kyriba.com.

About IDC MarketScape

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of ICT (information and communications technology) suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. IDC MarketScape provides a clear framework in which the product and service offerings, capabilities and strategies, and current and future market success factors of IT and telecommunications vendors can be meaningfully compared. The framework also provides technology buyers with a 360-degree assessment of the strengths and weaknesses of current and prospective vendors.

Engage with Kyriba

- Like Kyriba on Facebook at www.facebook.com/kyribacorp

- Follow Kyriba on LinkedIn at www.linkedin.com/company/kyriba-corporation

- Follow Kyriba on Twitter at www.twitter.com/kyribacorp

- Read Kyriba’s blog at www.kyriba.com/blog