NEW YORK--(BUSINESS WIRE)--Viacom Inc. (NASDAQ: VIAB, VIA) today reported financial results for the quarter and fiscal year ended September 30, 2017.

Bob Bakish, President and Chief Executive Officer, said, “In the fourth quarter and full year, we made strong progress against our plan to fundamentally stabilize and revitalize Viacom, with top line gains in both Media Networks and Filmed Entertainment segments driven by continued execution on our strategic priorities. We saw significant ratings increases across the portfolio, which drove sequential improvement in domestic advertising; our international business continues to expand, delivering double-digit revenue increases; and Paramount is demonstrating growth across multiple revenue streams as it rebuilds the theatrical slate and continues to grow its TV production business. Additionally, we have completed several multi-year renewals of major distribution contracts - including our recent agreement with Charter - which secure broad, long-term carriage of Viacom's networks for subscribers and expand our relationships with distributors through new, forward-looking advanced advertising and content production partnerships. We realized these achievements and established a stable base while reducing debt, improving free cash flow and strengthening our balance sheet.

“Viacom is stronger and our momentum continues to build. To accelerate our transition to long-term, sustainable growth, we are ramping up the evolution of Viacom's media business to better serve next generation platforms and solutions while continuing to diversify our business and strengthen our global portfolio of flagship brands. In the coming year, we will continue to focus on unleashing the full creativity and energy of Viacom to create greater value for our shareholders and audiences.”

|

FISCAL YEAR 2017 RESULTS |

|||||||||||||||||||||||||||||

| (in millions, except per share amounts) |

Quarter Ended |

B/(W) |

Year Ended September 30, |

B/(W) | |||||||||||||||||||||||||

| 2017 | 2016 |

2017 vs. |

2017 | 2016 |

2017 vs. |

||||||||||||||||||||||||

|

GAAP |

|||||||||||||||||||||||||||||

| Revenues | $ | 3,319 | $ | 3,226 | 3 | % | $ | 13,263 | $ | 12,488 | 6 | % | |||||||||||||||||

| Operating income | 705 | 332 | 112 | 2,489 | 2,526 | (1 | ) | ||||||||||||||||||||||

| Net earnings from continuing operations attributable to Viacom | 674 | 252 | 167 | 1,871 | 1,436 | 30 | |||||||||||||||||||||||

| Diluted EPS from continuing operations | 1.67 | 0.63 | 165 | 4.67 | 3.61 | 29 | |||||||||||||||||||||||

|

Non-GAAP* |

|||||||||||||||||||||||||||||

| Adjusted operating income | $ | 578 | $ | 538 | 7 | % | $ | 2,743 | $ | 2,732 | — | ||||||||||||||||||

| Adjusted net earnings from continuing operations attributable to Viacom | 310 | 273 | 14 | 1,511 | 1,465 | 3 | |||||||||||||||||||||||

| Adjusted diluted EPS from continuing operations | 0.77 | 0.69 | 12 | 3.77 | 3.68 | 2 | |||||||||||||||||||||||

|

* Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

|||||||||||||||||||||||||||||

Quarterly revenues increased 3% to $3.32 billion, reflecting gains across Media Networks and Filmed Entertainment segments. Operating income grew 112% to $705 million, reflecting growth in worldwide advertising revenue, improved Filmed Entertainment operating results, as well as a gain on an asset sale in the quarter and a restructuring charge in the prior year quarter, partially offset by a previously disclosed $59 million expense related to the termination of a third-party investment in the theatrical film slate. Adjusted operating income rose 7% to $578 million. Net earnings from continuing operations attributable to Viacom grew 167% to $674 million, principally due to the increase in operating income. Adjusted net earnings from continuing operations attributable to Viacom grew 14% to $310 million. Diluted earnings per share for the quarter increased $1.04 to $1.67, and adjusted diluted earnings per share increased $0.08 to $0.77.

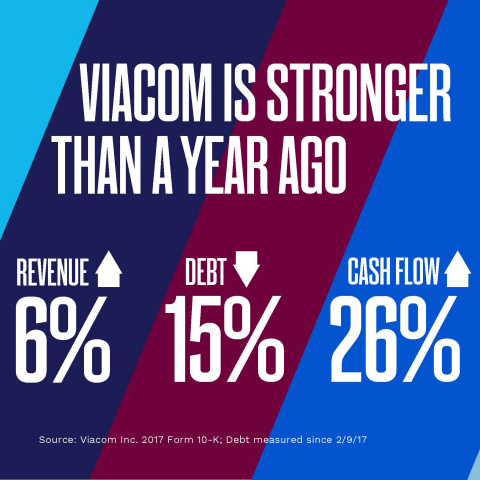

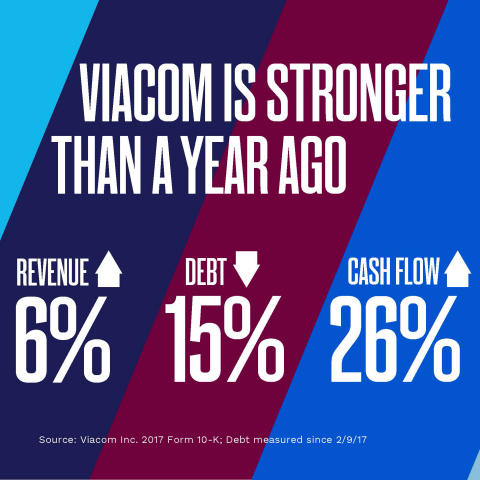

Full year revenues grew 6% to $13.3 billion, reflecting gains across Filmed Entertainment and Media Networks segments. Operating income decreased 1% to $2.49 billion, reflecting higher segment expenses partially offset by revenue growth. Adjusted operating income was flat at $2.74 billion. Net earnings from continuing operations attributable to Viacom grew 30% to $1.87 billion, principally due to gains on asset sales, and adjusted net earnings from continuing operations attributable to Viacom improved 3% to $1.51 billion, principally driven by a decrease in the adjusted effective tax rate. Diluted earnings per share for the full fiscal year increased $1.06 to $4.67, while adjusted diluted earnings per share increased $0.09 to $3.77.

MEDIA NETWORKS

Quarterly revenues increased 3% to $2.55 billion, driven by growth in advertising revenues. International revenues grew 24% to $593 million, while domestic revenues decreased 2% to $1.96 billion. Excluding a 4-percentage point favorable impact from foreign exchange, international revenues increased 20%, principally driven by a 14-percentage point favorable impact from the acquisition of Telefe.

Advertising revenues were up 6% to $1.22 billion, with domestic advertising revenues flat at $936 million, reflecting ratings growth offset by an overall decline in cable subscribers and the strategic reduction of unit loads. International advertising revenues increased 36% to $288 million, driven by the acquisition of Telefe as well as growth in Europe.

Affiliate revenues decreased 1% to $1.15 billion. Domestic affiliate revenues were down 3% to $948 million, as a decline in subscribers and lower revenue from SVOD was partially offset by rate increases. International affiliate revenues grew 12% to $200 million.

Ancillary revenues improved 5% to $181 million, driven by growth in international consumer products. International ancillary revenues grew 21% to $105 million, while domestic ancillary revenues decreased 12% to $76 million.

Adjusted operating income for Media Networks declined 8% to $693 million, primarily reflecting increases in programming expenses.

Full year revenues increased 2% to $10.10 billion, reflecting gains across all segment revenue streams. International revenues increased 12% to $2.13 billion while domestic revenues declined 1% to $7.97 billion. Excluding a 5-percentage point unfavorable impact from foreign exchange, international revenues increased 17%, primarily driven by an 11-percentage point favorable impact from the acquisition of Telefe.

Advertising revenues improved 1% to $4.86 billion, with domestic advertising revenues down 2% to $3.75 billion, as higher pricing was more than offset by lower impressions. International advertising revenues grew 14% to $1.11 billion. Excluding an 8-percentage point unfavorable impact from foreign exchange, international advertising revenues increased 22%, primarily driven by the acquisition of Telefe, as well as growth in Europe.

Affiliate revenues increased 2% to $4.64 billion. Domestic affiliate revenues improved 1% to $3.92 billion, principally reflecting rate increases and higher revenues from SVOD, partially offset by a decline in subscribers. International affiliate revenues increased 6% to $718 million.

Ancillary revenues improved 3% to $596 million. Domestic ancillary revenues declined 8% to $296 million, principally reflecting lower consumer products revenue, while international ancillary revenues increased 17% to $300 million, driven by higher consumer products revenue and the acquisition of Telefe.

Adjusted full year operating income decreased 5% to $3.30 billion, principally driven by increases in programming and other expenses.

Performance highlights:

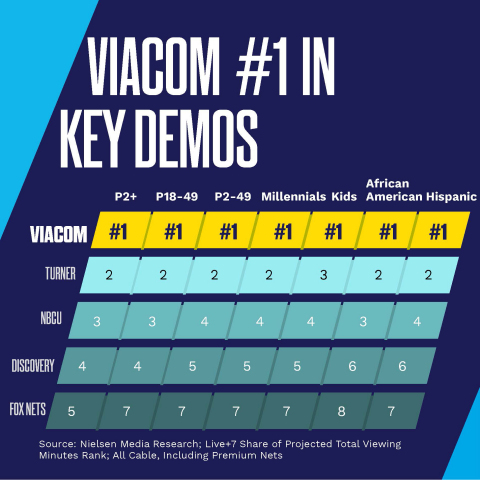

- Viacom had the #1 share of viewing on cable, with the #1 share for several diverse and coveted audiences including Kids 2-11, Millennials, African Americans, the Adults 18-49 advertising demo, as well as Adults 2-49 across all of TV.

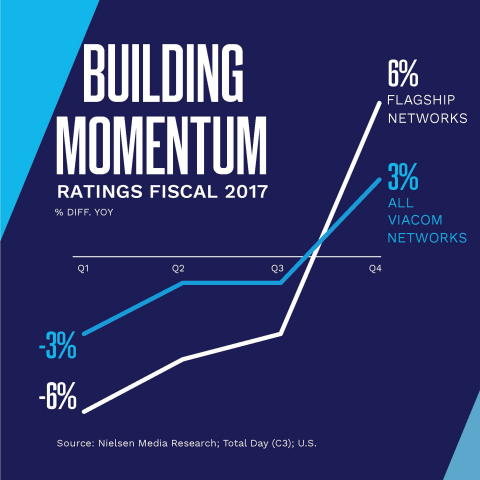

- In the quarter, domestic Media Networks grew ratings 3% year-over-year across its entire portfolio, with flagship networks up 6% year-over-year and double-digit increases at MTV and BET. This ratings improvement drove domestic advertising revenues, which stabilized in the quarter after three years of declines.

- In 2017, Viacom successfully completed multi-year contract renewals with several major distributors, including Altice USA and Charter Communications, among others. We have now renewed or extended agreements for nearly half of our subscriber base in the last year, ensuring continued carriage of our networks while unlocking opportunities to deliver greater value through partnerships that leverage our advanced advertising and data capabilities.

- MTV achieved its first double-digit ratings increase in more than six years, driven by primetime viewership of new shows including Siesta Key - the #1 original cable series in its timeslot. Moving into fiscal 2018, the multiplatform reboot of TRL drove a 21% increase in total views of MTV's digital and social content, while consistently ranking as a Top 10 Most Social Show across broadcast and cable.

- Anchored by signature scripted series including the #1 primetime cable comedy of 2017 - South Park - and a rebuilt late-night slate that now boasts TV's #1 late night talk show with millennials - The Daily Show with Trevor Noah - Comedy Central continued its turnaround, growing ratings in its key demo for the first time since fiscal 2014.

- Viacom International Media Networks continued to deliver strong top-line growth, with year-over-year revenues up 24% and 12% in the quarter and full year, respectively. Ratings across the VIMN portfolio grew 4% in the quarter, driven by the strong performances of Paramount Channel, Comedy Central, Nickelodeon and Channel 5.

FILMED ENTERTAINMENT

Quarterly revenues improved 2% to $789 million, driven by growth in licensing revenues partially offset by lower theatrical revenues. Domestic revenues fell 11% to $317 million in the quarter, while international revenues increased 13% to $472 million.

Theatrical revenues decreased 43% to $115 million, primarily due to a comparison with the strong performance of Star Trek Beyond in the prior year quarter. Domestic theatrical revenues declined 75% while international theatrical revenues declined 12%.

Licensing revenues grew 30% to $423 million, primarily driven by higher revenues from film licensing arrangements as well as Paramount Television productions. Domestic and international licensing revenues increased 26% and 31%, respectively.

Home entertainment revenues declined 5% to $190 million, principally reflecting lower international home entertainment revenues. Domestic home entertainment revenues increased 3%, while international home entertainment revenues fell 16%.

Ancillary revenues grew 33% to $61 million. Domestic and international ancillary revenues increased 11% and 110%, respectively.

Filmed Entertainment reported an adjusted operating loss of $43 million, an improvement of 69% over the prior year quarter, reflecting lower operating expenses and increased revenues. The adjusted operating loss includes the impact of a previously disclosed $59 million expense related to the termination of a slate financing agreement.

Full year revenues grew 24% to $3.29 billion, reflecting increases across all segment revenue streams.

Theatrical revenues increased 34% to $808 million, principally driven by the strong international performance of Transformers: The Last Knight. International theatrical revenues grew 86%, while domestic theatrical revenues declined 9%.

Licensing revenues grew 20% to $1.32 billion, primarily driven by Paramount Television productions, including Shooter, 13 Reasons Why and Berlin Station. Domestic and international licensing revenues increased 32% and 13%, respectively.

Home entertainment revenues improved 8% to $849 million, principally reflecting higher Teenage Mutant Ninja Turtles: Out of the Shadows carryover revenues, as well as catalog distribution revenues. Domestic and international home entertainment revenues increased 11% and 3%, respectively.

Ancillary revenues increased 82% to $317 million. Domestic ancillary revenues grew 89%, driven by the sale of a partial copyright interest in certain films released during the first half of the year in connection with a slate financing agreement, while international ancillary revenues increased 59%.

Filmed Entertainment reported an adjusted operating loss of $280 million, an improvement of 37% that reflects the increases in revenues partially offset by higher operating expenses including the impact of an expense related to the termination of a slate financing agreement.

Performance highlights:

- Paramount Television continued its significant growth, more than tripling its revenues in the fiscal year through breakout releases including Shooter, 13 Reasons Why and Berlin Station - all of which were renewed for second seasons.

- Paramount continued to execute on its strategic plan by rebuilding the slate, refining its management team and stabilizing costs.

- Notable feature film releases in the first quarter of fiscal 2018 include Daddy's Home 2, a follow-up to the successful 2015 release; and Alexander Payne's Downsizing.

BALANCE SHEET AND LIQUIDITY

In the quarter, the Company continued to implement its plan to strengthen its balance sheet, including executing on the sale of a non-core asset. At September 30, 2017, total debt outstanding was $11.12 billion. The Company has reduced debt by approximately $2 billion, or 15%, since announcing its plan to de-lever its balance sheet on February 9, 2017.

The Company’s cash balance was $1.39 billion at September 30, 2017, an increase from $379 million at September 30, 2016. During the year, net cash provided by operating activities increased $300 million, or 22%, to $1.67 billion, free cash flow increased $278 million, or 23% to $1.48 billion and operating free cash flow increased $311 million, or 26%, to $1.51 billion.

About Viacom

Viacom is home to premier global media brands that create compelling entertainment content - including television programs, motion pictures, short-form content, apps, games, consumer products, podcasts, live events and social media experiences - for audiences in more than 180 countries. Viacom's media networks, including Nickelodeon, Nick Jr., MTV, BET, Comedy Central, Spike (to be rebranded as Paramount Network in the U.S.), VH1, TV Land, CMT, Logo, Channel 5 (UK), Telefe (Argentina), Colors (India) and Paramount Channel, reach approximately 4.3 billion cumulative television subscribers worldwide. Paramount Pictures is a major global producer and distributor of filmed entertainment. Paramount Television develops, finances and produces original programming for television and digital platforms.

For more information about Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s company blog (blog.viacom.com), Twitter feed (twitter.com/viacom) and Facebook page (facebook.com/viacom).

Cautionary Statement Concerning Forward-Looking Statements

This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: the public acceptance of our brands, programs, motion pictures and other entertainment content on the various platforms on which they are distributed; technological developments, alternative content offerings and their effects in our markets and on consumer behavior; the potential for loss of carriage or other reduction in the distribution of our content; significant changes in our senior leadership and the ability of our recently-announced strategic initiatives to achieve their operating objectives; economic fluctuations in advertising and retail markets, and economic conditions generally; evolving cybersecurity and similar risks; the impact of piracy; increased costs for programming, motion pictures and other rights; the loss of key talent; competition for content, audiences, advertising and distribution; fluctuations in our results due to the timing, mix, number and availability of our motion pictures and other programming; other domestic and global economic, political, business, competitive and/or regulatory factors affecting our businesses generally; changes in the Federal communications or other laws and regulations; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2017 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at http://www.viacom.com.

|

VIACOM INC. |

|||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF EARNINGS |

|||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||

|

Quarter Ended September 30, |

Year Ended September 30, |

||||||||||||||||||||

| (in millions, except per share amounts) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| Revenues | $ | 3,319 | $ | 3,226 | $ | 13,263 | $ | 12,488 | |||||||||||||

| Expenses: | |||||||||||||||||||||

| Operating | 1,885 | 1,862 | 7,436 | 6,684 | |||||||||||||||||

| Selling, general and administrative | 800 | 771 | 3,005 | 2,851 | |||||||||||||||||

| Depreciation and amortization | 56 | 55 | 223 | 221 | |||||||||||||||||

| Restructuring | — | 206 | 237 | 206 | |||||||||||||||||

| Total expenses | 2,741 | 2,894 | 10,901 | 9,962 | |||||||||||||||||

| Gain on asset sale | 127 | — | 127 | — | |||||||||||||||||

| Operating income | 705 | 332 | 2,489 | 2,526 | |||||||||||||||||

| Interest expense, net | (149 | ) | (150 | ) | (618 | ) | (616 | ) | |||||||||||||

| Equity in net earnings of investee companies | 3 | 2 | 81 | 87 | |||||||||||||||||

| Gain on sale of EPIX | — | — | 285 | — | |||||||||||||||||

| Other items, net | 12 | (6 | ) | (25 | ) | (7 | ) | ||||||||||||||

| Earnings from continuing operations before provision for income taxes | 571 | 178 | 2,212 | 1,990 | |||||||||||||||||

| Provision for income taxes | 124 | 83 | (293 | ) | (519 | ) | |||||||||||||||

| Net earnings from continuing operations | 695 | 261 | 1,919 | 1,471 | |||||||||||||||||

| Discontinued operations, net of tax | — | 2 | 3 | 2 | |||||||||||||||||

| Net earnings (Viacom and noncontrolling interests) | 695 | 263 | 1,922 | 1,473 | |||||||||||||||||

| Net earnings attributable to noncontrolling interests | (21 | ) | (9 | ) | (48 | ) | (35 | ) | |||||||||||||

| Net earnings attributable to Viacom | $ | 674 | $ | 254 | $ | 1,874 | $ | 1,438 | |||||||||||||

| Amounts attributable to Viacom: | |||||||||||||||||||||

| Net earnings from continuing operations | $ | 674 | $ | 252 | $ | 1,871 | $ | 1,436 | |||||||||||||

| Discontinued operations, net of tax | — | 2 | 3 | 2 | |||||||||||||||||

| Net earnings attributable to Viacom | $ | 674 | $ | 254 | $ | 1,874 | $ | 1,438 | |||||||||||||

| Basic earnings per share attributable to Viacom: | |||||||||||||||||||||

| Continuing operations | $ | 1.67 | $ | 0.63 | $ | 4.68 | $ | 3.62 | |||||||||||||

| Discontinued operations | — | 0.01 | 0.01 | 0.01 | |||||||||||||||||

| Net earnings | $ | 1.67 | $ | 0.64 | $ | 4.69 | $ | 3.63 | |||||||||||||

| Diluted earnings per share attributable to Viacom: | |||||||||||||||||||||

| Continuing operations | $ | 1.67 | $ | 0.63 | $ | 4.67 | $ | 3.61 | |||||||||||||

| Discontinued operations | — | 0.01 | 0.01 | — | |||||||||||||||||

| Net earnings | $ | 1.67 | $ | 0.64 | $ | 4.68 | $ | 3.61 | |||||||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||||||

| Basic | 402.4 | 396.9 | 399.9 | 396.5 | |||||||||||||||||

| Diluted | 402.4 | 398.3 | 400.6 | 398.0 | |||||||||||||||||

| Dividends declared per share of Class A and Class B common stock | $ | 0.20 | $ | 0.20 | $ | 0.80 | $ | 1.40 | |||||||||||||

|

VIACOM INC. |

|||||||||||

|

CONSOLIDATED BALANCE SHEETS |

|||||||||||

|

(Unaudited) |

|||||||||||

| (in millions, except par value) |

September 30, 2017 |

September 30, 2016 |

|||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 1,389 | $ | 379 | |||||||

| Receivables, net | 2,970 | 2,712 | |||||||||

| Inventory, net | 919 | 844 | |||||||||

| Prepaid and other assets | 523 | 587 | |||||||||

| Total current assets | 5,801 | 4,522 | |||||||||

| Property and equipment, net | 978 | 932 | |||||||||

| Inventory, net | 3,982 | 4,032 | |||||||||

| Goodwill | 11,665 | 11,400 | |||||||||

| Intangibles, net | 313 | 315 | |||||||||

| Other assets | 959 | 1,307 | |||||||||

| Total assets | $ | 23,698 | $ | 22,508 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 431 | $ | 453 | |||||||

| Accrued expenses | 869 | 773 | |||||||||

| Participants' share and residuals | 825 | 801 | |||||||||

| Program obligations | 712 | 692 | |||||||||

| Deferred revenue | 463 | 419 | |||||||||

| Current portion of debt | 19 | 17 | |||||||||

| Other liabilities | 434 | 517 | |||||||||

| Total current liabilities | 3,753 | 3,672 | |||||||||

| Noncurrent portion of debt | 11,100 | 11,896 | |||||||||

| Participants' share and residuals | 384 | 358 | |||||||||

| Program obligations | 477 | 311 | |||||||||

| Deferred tax liabilities, net | 294 | 381 | |||||||||

| Other liabilities | 1,323 | 1,349 | |||||||||

| Redeemable noncontrolling interest | 248 | 211 | |||||||||

| Commitments and contingencies | |||||||||||

| Viacom stockholders' equity: | |||||||||||

|

Class A common stock, par value $0.001, 375.0 authorized; 49.4 and

49.4 |

— | — | |||||||||

|

Class B common stock, par value $0.001, 5,000.0 authorized; 353.0

and 347.6 |

— | — | |||||||||

| Additional paid-in capital | 10,119 | 10,139 | |||||||||

| Treasury stock, 393.8 and 399.4 common shares held in treasury, respectively | (20,590 | ) | (20,798 | ) | |||||||

| Retained earnings | 17,124 | 15,628 | |||||||||

| Accumulated other comprehensive loss | (618 | ) | (692 | ) | |||||||

| Total Viacom stockholders' equity | 6,035 | 4,277 | |||||||||

| Noncontrolling interests | 84 | 53 | |||||||||

| Total equity | 6,119 | 4,330 | |||||||||

| Total liabilities and equity | $ | 23,698 | $ | 22,508 | |||||||

|

VIACOM INC. |

|||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||||

|

(Unaudited) |

|||||||||||

|

Year Ended |

|||||||||||

| (in millions) | 2017 | 2016 | |||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net earnings (Viacom and noncontrolling interests) | $ | 1,922 | $ | 1,473 | |||||||

| Discontinued operations, net of tax | (3 | ) | (2 | ) | |||||||

| Net earnings from continuing operations | 1,919 | 1,471 | |||||||||

| Reconciling items: | |||||||||||

| Depreciation and amortization | 223 | 221 | |||||||||

| Feature film and program amortization | 4,739 | 4,568 | |||||||||

| Equity-based compensation | 68 | 163 | |||||||||

| Equity in net earnings and distributions from investee companies | (14 | ) | (83 | ) | |||||||

| Gain on asset sales | (412 | ) | — | ||||||||

| Deferred income taxes | (174 | ) | 254 | ||||||||

| Operating assets and liabilities, net of acquisitions: | |||||||||||

| Receivables | (132 | ) | 149 | ||||||||

| Production and programming | (4,412 | ) | (5,102 | ) | |||||||

| Accounts payable and other current liabilities | (207 | ) | (229 | ) | |||||||

| Other, net | 73 | (41 | ) | ||||||||

| Net cash provided by operating activities | 1,671 | 1,371 | |||||||||

| INVESTING ACTIVITIES | |||||||||||

| Acquisitions and investments, net | (378 | ) | (58 | ) | |||||||

| Capital expenditures | (195 | ) | (172 | ) | |||||||

| Proceeds received from asset sales | 848 | — | |||||||||

| Grantor trust proceeds/(contributions) | 54 | (69 | ) | ||||||||

| Net cash provided by/(used in) investing activities | 329 | (299 | ) | ||||||||

| FINANCING ACTIVITIES | |||||||||||

| Borrowings | 2,569 | — | |||||||||

| Debt repayments | (3,352 | ) | (368 | ) | |||||||

| Purchase of treasury stock | — | (100 | ) | ||||||||

| Dividends paid | (319 | ) | (635 | ) | |||||||

| Excess tax benefits on equity-based compensation awards | 1 | — | |||||||||

| Exercise of stock options | 172 | 11 | |||||||||

| Other, net | (81 | ) | (81 | ) | |||||||

| Net cash used in financing activities | (1,010 | ) | (1,173 | ) | |||||||

| Effect of exchange rate changes on cash and cash equivalents | 20 | (26 | ) | ||||||||

| Net change in cash and cash equivalents | 1,010 | (127 | ) | ||||||||

| Cash and cash equivalents at beginning of period | 379 | 506 | |||||||||

| Cash and cash equivalents at end of period | $ | 1,389 | $ | 379 | |||||||

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION

The following tables reconcile our results for the quarter and year ended September 30, 2017 and the quarter and year ended September 30, 2016 to adjusted results that exclude the impact of certain items identified as affecting comparability. We use consolidated adjusted operating income, adjusted earnings from continuing operations before provision for income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to Viacom and adjusted diluted earnings per share ("EPS") from continuing operations, as applicable, among other measures, to evaluate our actual operating performance and for planning and forecasting of future periods. We believe that the adjusted results provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare Viacom’s results with those of other companies and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with accounting principles generally accepted in the United States of America, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before provision for income taxes, provision for income taxes, net earnings from continuing operations attributable to Viacom and diluted EPS from continuing operations as indicators of operating performance, and they may not be comparable to similarly titled measures employed by other companies.

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Quarter Ended |

||||||||||||||||||||||||||

| Operating Income |

Earnings from |

Provision for |

Net Earnings

Attributable to |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 705 | $ | 571 | $ | (124 | ) | $ | 674 | $ | 1.67 | |||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Gain on asset sale (3) | (127 | ) | (127 | ) | (20 | ) | (96 | ) | (0.24 | ) | ||||||||||||||||

| Discrete tax benefit (6) | — | — | 268 | (268 | ) | (0.66 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 578 | $ | 444 | $ | 124 | $ | 310 | $ | 0.77 | ||||||||||||||||

|

Year Ended |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 2,489 | $ | 2,212 | $ | 293 | $ | 1,871 | $ | 4.67 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring and programming charges (2) | 381 | 381 | 135 | 246 | 0.61 | |||||||||||||||||||||

| Gain on asset sales (3) | (127 | ) | (412 | ) | (116 | ) | (285 | ) | (0.71 | ) | ||||||||||||||||

| Loss on extinguishment of debt (4) | — | 20 | 7 | 13 | 0.03 | |||||||||||||||||||||

| Investment impairment (5) | — | 10 | 4 | 6 | 0.01 | |||||||||||||||||||||

| Discrete tax benefit (6) | — | — | 340 | (340 | ) | (0.84 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 2,743 | $ | 2,211 | $ | 663 | $ | 1,511 | $ | 3.77 | ||||||||||||||||

|

Quarter Ended |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 332 | $ | 178 | $ | (83 | ) | $ | 252 | $ | 0.63 | |||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring (7) | 206 | 206 | 75 | 131 | 0.33 | |||||||||||||||||||||

| Discrete tax benefit (8) | — | — | 110 | (110 | ) | (0.27 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 538 | $ | 384 | $ | 102 | $ | 273 | $ | 0.69 | ||||||||||||||||

|

Year Ended September 30, 2016 |

||||||||||||||||||||||||||

|

Operating |

Earnings from |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 2,526 | $ | 1,990 | $ | 519 | $ | 1,436 | $ | 3.61 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring (7) | 206 | 206 | 75 | 131 | 0.33 | |||||||||||||||||||||

| Discrete tax benefit (8) | — | — | 102 | (102 | ) | (0.26 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 2,732 | $ | 2,196 | $ | 696 | $ | 1,465 | $ | 3.68 | ||||||||||||||||

(1) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented.

(2) We recognized pre-tax restructuring and programming charges of $381 million in the year ended September 30, 2017, resulting from the execution of our flagship brand strategy and strategic initiatives at Paramount. The charges include a severance charge of $212 million, a non-cash intangible asset impairment charge of $18 million resulting from the decision to abandon an international trade name, a programming charge of $144 million associated with management’s decision to cease use of certain original and acquired programming and $7 million of other exit activities.

(3) In the quarter and year ended September 30, 2017, a consolidated entity completed the sale of broadcast spectrum in connection with the FCC’s broadcast spectrum auction. The sale resulted in a pre-tax gain of $127 million, with $11 million attributable to the noncontrolling interest. We also completed the sale of our 49.76% interest in EPIX in the year ended September 30, 2017, resulting in a pre-tax gain of $285 million.

(4) We redeemed senior notes and debentures totaling $3.3 billion in the year ended September 30, 2017, resulting in the recognition of a net pre-tax extinguishment loss of $20 million.

(5) During the year ended September 30, 2017, we recognized an impairment loss to write-down a cost method investment.

(6) The net discrete tax benefit in the quarter ended September 30, 2017 was principally related to the recognition of foreign tax credits realized on the distribution to Viacom’s U.S. group of certain securities. In addition to the items in the quarter, the net discrete tax benefit in the year ended September 30, 2017 includes the reversal of a valuation allowance on capital loss carryforwards in connection with the sale of our investment in EPIX and the release of tax reserves with respect to certain effectively settled tax positions.

(7) We recognized a pre-tax charge restructuring charge of $206 million in the quarter and year ended September 30, 2016, reflecting costs in connection with the separation of certain senior executives. The restructuring charge includes the cost of separation payments of $138 million and the acceleration of equity-based compensation expense of $68 million.

(8) The net discrete tax benefit in the quarter and year ended September 30, 2016 was principally related to a tax accounting method change granted by the Internal Revenue Service, the release of tax reserves with respect to certain effectively settled tax positions and the recognition of capital loss carryforwards. The net discrete tax benefit for the year was partially offset by a reduction in qualified production activity tax benefits as a result of retroactively reenacted legislation.

The following table includes a reconciliation of net cash provided by operating activities (GAAP) to free cash flow and operating free cash flow (non-GAAP). We define free cash flow as net cash provided by operating activities minus capital expenditures, plus excess tax benefits from equity-based compensation awards (actual tax deductions in excess of amounts previously recognized, which is included within financing activities in the statement of cash flows), as applicable. We define operating free cash flow as free cash flow, excluding the impact of the cash premium on the extinguishment of debt, as applicable. Free cash flow and operating free cash flow are non-GAAP measures. Management believes the use of these measures provides investors with an important perspective on, in the case of free cash flow, our liquidity, including our ability to service debt and make investments in our businesses, and, in the case of operating free cash flow, our liquidity from ongoing activities.

|

Reconciliation of net cash provided by operating activities

to free cash flow and operating free cash flow (in millions) |

Quarter Ended |

Better/ (Worse) |

Year Ended |

Better/ (Worse) |

|||||||||||||||||||||||||||

| 2017 | 2016 | $ | 2017 | 2016 | $ | ||||||||||||||||||||||||||

| Net cash provided by operating activities (GAAP) | $ | 1,018 | $ | 971 | $ | 47 | $ | 1,671 | $ | 1,371 | $ | 300 | |||||||||||||||||||

| Capital expenditures | (56 | ) | (92 | ) | 36 | (195 | ) | (172 | ) | (23 | ) | ||||||||||||||||||||

| Excess tax benefits | — | — | — | 1 | — | 1 | |||||||||||||||||||||||||

| Free cash flow (Non-GAAP) | 962 | 879 | 83 | 1,477 | 1,199 | 278 | |||||||||||||||||||||||||

| Debt retirement premium | — | — | — | 33 | — | 33 | |||||||||||||||||||||||||

| Operating free cash flow (Non-GAAP) | $ | 962 | $ | 879 | $ | 83 | $ | 1,510 | $ | 1,199 | $ | 311 | |||||||||||||||||||