SAN FRANCISCO--(BUSINESS WIRE)--Wells Fargo & Company (NYSE:WFC) today announced Greenhouse℠ by Wells Fargo, a new mobile banking experience with tools to help consumers manage their money and know where they stand financially.

Combining personal finance management tools with Wells Fargo banking, the Greenhouse experience will help consumers pay bills on time, spend confidently, and start to build a savings cushion — all while providing personalized insights through artificial intelligence to help them stay on track. Greenhouse, a standalone mobile app, will be available in a limited, national pilot in the first quarter of 2018 and will launch for Apple iPhone® users during the first half of 2018.

Avid Modjtabai, head of Payments, Virtual Solutions and Innovation at Wells Fargo, made the announcement onstage at The BancAnalysts Association of Boston Conference in Boston.

“We believe the Greenhouse experience will appeal to a broad base of consumers, many of whom have several income sources or are paid infrequently, which can make budgeting a challenge,” said Modjtabai. “Whether you are new to banking, don’t have regular paychecks, or typically manage money with cash, we believe the Greenhouse experience can help you manage day-to-day spending while planning for the future.”

Within minutes of downloading the Greenhouse app, consumers can be up and running safely and securely from wherever they are.

Greenhouse customers will have:

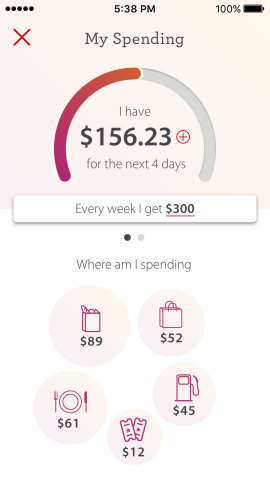

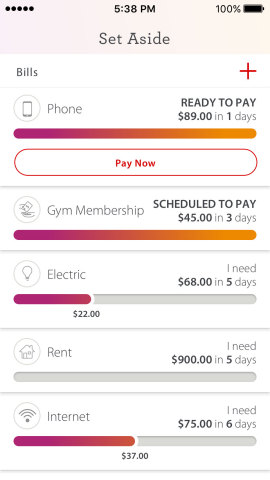

- Intuitive money management with two accounts that work together: one account for weekly spending tied to their debit card, and one account dedicated to savings and bills. In this account, customers can set aside money to build a savings cushion as well as for specific expenses, such as rent or a phone bill. The app ties the two bank accounts together and provides spending trend visualizations, personalized insights based on an artificial intelligence engine, and key reminders to help customers stay on track and reach their financial goals.

- Immediate access to their Greenhouse accounts: real-time debit card use with a mobile wallet tied to the weekly spending account, access to both accounts at more than 13,000 Wells Fargo ATMs, and the convenience of approximately 5,900 retail bank branches.

- The ability to send and receive payments: access to the Zelle℠ peer-to-peer payments network to receive and send payments to almost anyone with a U.S. bank account.

In addition, Greenhouse customers will never incur bank overdraft fees when using the new experience, and purchases and payments that would overdraw the accounts will generally not be processed.

“Many people manage money with a rear-view mirror approach, only looking backwards at the end of each month,” said Steve Ellis, head of the Innovation Group at Wells Fargo. “The Greenhouse experience helps consumers take control of their financial health by enabling them to become more hands-on with their finances. From creating a weekly spending budget, to working toward financial goals, the customer is in control — all on a mobile phone.”

Financial health is a challenge for many. Research shows that 57 percent of Americans are struggling financially1, and 44 percent say they would not be able to cover a $400 emergency expense without selling something or borrowing money2.

To help more Americans feel more stable and prepared for life’s opportunities and challenges, Wells Fargo is providing a growing set of services that make it easier for all customers to know where they stand. The services also help customers make more informed financial decisions based on their specific needs and goals, including a conversation about financial health that currently is available through the Wells Fargo phone bank and will be offered by bankers in Wells Fargo branches next year.

The launch of the Greenhouse experience in 2018 will be the initial version, with additional enhancements and tools planned based on customer feedback.

How Wells Fargo supports financial health

Wells Fargo seeks to provide its customers the personalized support, proactive guidance and convenient financial resources they need to take action to improve their financial health. These include providing 68 million customers free access to their FICO® Credit Score, and a Financial Health Conversations program that has provided personalized plans for more than 23,000 customers since the start of 2015. For Wells Fargo’s easy-to-follow financial health guidelines and online tools, see One Little ThingSM, a financial health resource.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.9 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 8,400 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 42 countries and territories to support customers who conduct business in the global economy. With approximately 268,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 25 on Fortune’s 2017 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

1Center for Financial Services Innovation, Understanding and Improving Consumer Financial Health in America, March 2015

2Board of Governors of the Federal Reserve System, Report on the Economic Well-Being of U.S. Households in 2016, May 2017