NEW YORK--(BUSINESS WIRE)--Pershing Square Capital Management, L.P. (“Pershing Square”) today demanded that ADP (NASDAQ:ADP) provide detailed support or immediately retract its misleading claim that its plan released to shareholders on September 12th will result in increased net operational margins of “500 basis points” in three years.

Pershing Square’s extensive research has highlighted ADP’s significant underperformance relative to its competitors and its potential. We have called for an operational transformation to meaningfully increase ADP’s efficiency and margins, as well as a commitment to build a best-in-class technology organization to increase growth.

Upon presenting our detailed research publicly, ADP initially claimed Pershing Square’s analysis “betrays a fundamental lack of understanding of the current state of ADP's business.”1 The Company has since refused to answer our questions about its underperformance and its lack of plans for improvement. Meanwhile, ADP has continued to use an inaccurate total shareholder return calculation and make misleading claims about its performance relative to its competitors.

In recent weeks, as ADP has gained an appreciation for the significant shareholder support for our views, the Company has attempted to pivot its message to suggest that the existing board and management are already making the significant progress shareholders are demanding. In doing so, the Company has now focused almost exclusively on its purported claim that its current plan will deliver “500 basis points” of margin expansion over the next three years.

“So we, obviously, have margin improvement initiatives underway…And we have a plan that we’ve publicly put out there to increase the margins by another 500 basis points over the next three years. So I think we’ve focused on margin, as Bill [Ackman] is.”

- CEO Carlos Rodriguez, Bloomberg Radio Interview, 10/18/2017

“[W]e just guided to another 500 basis point improvement over the next three years.”

- CEO Carlos Rodriguez, Bloomberg TV Interview, 10/18/2017

“And we’ve also made an enormous amount of progress on our margins, so as we’ve been rebuilding our technology and going through the transformation that we’re going through…and we have plans to continue to drive margin improvement another 500 basis points over the next three years.”

- CEO Carlos Rodriguez, Yahoo Finance Interview, 10/21/2017

“ADP’s management team and Board have a tangible plan to drive an additional 500 basis points in net operational margin improvement by FY 2020.”

- ADP Press Release, ADP Comments on Glass Lewis Recommendation, 10/23/2017

“Carlos has a plan for another 500 basis points of margin improvement.”

- Former ADP Director Greg Brenneman, Bloomberg TV Interview, 10/26/2017

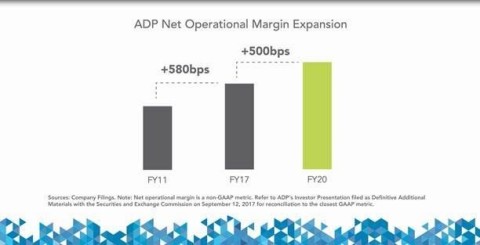

ADP’s CEO Carlos Rodriguez and its Chairman John Paul Jones even produced a video for shareholders with the attached graphic, which purports to show meaningful projected progress.

None of these communications – media appearances by CEO Carlos Rodriguez, a video for shareholders featuring Chairman John P. Jones and CEO Carlos Rodriguez, press releases publicly stating ADP’s case, and appearances by former board members serving as advocates for ADP’s position – includes a mention of ADP’s actual published plan to increase margins by just 100-200 basis points. The fact that ADP discusses its purported net operational margins without distinguishing the difference between this figure and reported margins also causes shareholders to draw the wrong conclusions.

ADP and its leadership are now almost exclusively discussing a purported “500 basis points” of “net operational margin expansion” to obfuscate their lack of progress to their shareholders. This “500 basis points” figure is both inaccurate and misleading.

Pershing Square addressed this misleading “500 basis points” claim on pages 21 and 22 of our September 27th presentation (further included as pages 62 and 63 in the detailed supplement of our October 11th presentation, ADP Ascending).

Net operational margin is a concept Pershing Square introduced as part of our analysis of ADP, and it is intended to show profitability net of non-economic (PEO pass-through revenue) and non-operational (interest on client funds) drivers. Net operational margin is calculated as (EBIT – client funds interest – corporate extended income net) / (total revenue – PEO pass-through revenue – client funds interest).2 Thus, it is a derivation of the total profit margins, but excludes the impact of items largely outside of management’s control. This calculation requires just five figures, which are all reasonably estimable from ADP’s September 12th plan.

ADP’s current net operational margins are 21.6%. The Company’s current plan provides revenue guidance of $15-$16bn by FY 2020 ($15.5bn at the midpoint) and margin guidance of 21-22% (implying ~$3.3bn of EBIT at the midpoint). Given other known variables, including the Company’s guidance for its HRBPO business (including its “PEO”) to compound at a 12 – 14% growth rate, it is a near mathematical impossibility for the Company’s current plan to produce 500 basis points of net operational margins but only deliver an actual margin increase of 100-200 basis points. By our calculation, ADP’s plan delivers net operational margins of ~24.5% or just ~300 basis points of net operational margin expansion. Our detailed deconstruction of ADP’s announced September 12th plan shows this ~300 basis points of operational margin expansion (of which ~2/3rd is from Employer Services) and can be found on page 63 in the detailed supplement of our October 11th presentation, ADP Ascending. Additionally, we have released a simple Excel spreadsheet to further support our calculation.

ADP’s “500 basis points” claim is simply inaccurate and misleading.

Pershing Square asked ADP to provide support for this figure in our Question of the Week on October 19th. ADP has not done so. We are aware of numerous shareholders and sell-side analysts who have attempted to contact ADP’s Investor Relations department to clarify this figure. It is Pershing Square’s understanding that ADP’s Investor Relations department has been unwilling to explain this to shareholders.

Even though ADP will not answer questions from shareholders about how the “500 basis points” is calculated, ADP has continued to prominently feature this misleading claim to attempt to win support from shareholders and to help persuade influential observers such as the proxy advisory firms.

While Glass Lewis correctly saw through ADP’s misleading claim, Institutional Shareholder Services (“ISS”) unfortunately did not.

“Upon closer scrutiny, ADP's three-year plan calls for only approximately 300 basis points in net operating margin expansion, and only 220 basis points of margin expansion in Employer Services, which is consistent with ADP's historical performance and long-term plan of delivering 50 to 100 basis points per year. Upon review, we find the Company's plan to be underwhelming in this regard, as does Pershing Square, other ADP shareholders we spoke with and certain analysts who follow the Company.”

- Glass Lewis, 10/23/17

“The company expects its operational EBIT margin to improve by 500 to 600 basis points by FY 2020…These plans suggest that the board and management may not be content with the current situation.”

- Institutional Shareholder Services, 10/25/17

ADP’s current operational inefficiency and its stated plan to make essentially no progress in expanding its operating margins, beyond its historical cadence driven by the inherent operating leverage of its business, is a critical point of differentiation in this proxy contest. ADP’s board and management are content with the current situation and their plan is a continuation of the status quo. The Company is attempting to obfuscate this lack of progress with this new baseless “500 basis points” talking point.

ADP’s shareholders and those who advise ADP shareholders on whether to support the current board and management’s plan to address ADP’s underperformance deserve an accurate representation of the Company’s commitments. Unfortunately, ADP’s attempts to mislead ISS caused ISS’s report to cite ADP’s “plan” as evidence that its “board and management may not be content with the current situation.”

Pershing Square is formally demanding that ADP provide support, consistent with the reconciliation to GAAP on page 60 of its September 12th presentation, to show investors the basis for its “500 basis points” improvement claim. We demand that ADP provide this calculation in detail no later than its upcoming November 2nd earnings presentation.

Absent proper support, we are demanding that ADP issue an immediate press release to formally retract its misleading statements and clarify for shareholders that its actual plan calls for just 100-200 basis points of actual margin expansion or just ~300 basis points of net operational margin expansion.

For additional information, visit our website: www.ADPascending.com. Follow ADPascending on Facebook, Twitter and YouTube.

To vote for Pershing Square’s Nominees for ADP’s Transformation and ensure that Bill Ackman is elected to the board, shareholders should vote the GOLD Proxy Card or GOLD Voting Instruction Form.

THE ONLY WAY TO VOTE FOR BILL ACKMAN AND THE NOMINEES FOR ADP’S TRANSFORMATION IS TO VOTE ON THE GOLD PROXY CARD OR VOTING INSTRUCTION FORM.

You can vote by Internet, telephone or by signing and dating the GOLD Proxy Card or Voting Instruction Form and mailing it in the postage paid envelope provided. We urge you NOT to vote using any white proxy card or voting instruction form you receive from ADP. Please discard the white proxy card.

If you have any questions about how to vote your shares, please contact our proxy solicitor, D.F. King & Co., Inc., at (866) 342-1635.

About Pershing Square Capital Management, L.P.

Pershing Square Capital Management, L.P., based in New York City, is a SEC-registered investment advisor to investment funds.

This press release relates to Pershing Square’s solicitation of proxies in connection with the 2017 annual meeting of stockholders of ADP.

The information contained in this press release (the “Information”) is based on publicly available information about Automatic Data Processing, Inc. (“ADP” or the “Company”), which has not been independently verified by Pershing Square Capital Management, L.P. (“Pershing Square”). Pershing Square recognizes that there may be confidential or otherwise non-public information in the possession of ADP or others that could lead ADP or others to disagree with Pershing Square’s conclusions. This press release and the Information is not a recommendation or solicitation to buy or sell any securities.

The analyses provided may include certain forward-looking statements, estimates and projections prepared with respect to, among other things, general economic and market conditions, changes in management, changes in board composition, actions of ADP and its subsidiaries or competitors, the ability to implement business strategies and plans and pursue business opportunities in the human capital management industry. Such forward-looking statements, estimates, and projections reflect various assumptions by Pershing Square concerning anticipated results that are inherently subject to significant uncertainties and contingencies and have been included solely for illustrative purposes, including those risks and uncertainties detailed in the continuous disclosure and other filings of ADP with the Securities and Exchange Commission at www.sec.gov. No representations, express or implied, are made as to the accuracy or completeness of such forward-looking statements, estimates or projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results contained herein.

_________________________

1 ADP Press Release, August

17th, 2017

2 Consistent with ADP’s financial reporting, both client funds interest and corporate extended investment income are deducted from EBIT in the numerator, while the interest on client funds deducted from revenue in the denominator does not include the effects of the extended investment strategy.