NEW YORK--(BUSINESS WIRE)--Pershing Square Capital Management, L.P. (“Pershing Square”) today released two new questions for ADP (NASDAQ: ADP).

ADP has yet to answer any of the first four questions we have asked. Today, Pershing Square released the following questions:

Questions:

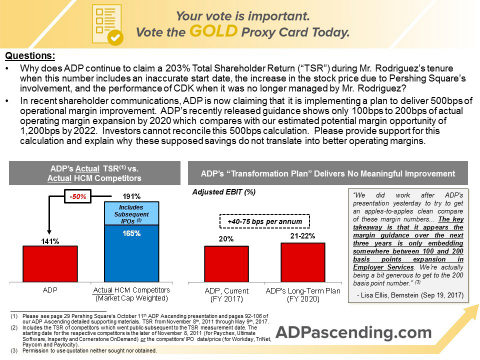

Why does ADP continue to claim a 203% Total Shareholder Return (“TSR”) during Mr. Rodriguez’s tenure when this number includes an inaccurate start date, the increase in the stock price due to Pershing Square’s involvement, and the performance of CDK when it was no longer managed by Mr. Rodriguez?

In recent shareholder communications, ADP is now claiming that it is implementing a plan to deliver 500bps of operational margin improvement. ADP’s recently released guidance shows only 100bps to 200bps of actual operating margin expansion by 2020 which compares with our estimated potential margin opportunity of 1,200bps by 2022. Investors cannot reconcile this 500bps calculation. Please provide support for this calculation and explain why these supposed savings do not translate into better operating margins.

Pershing Square’s previous four questions are:

Question 1 – September 20, 2017:

What are ADP’s margins in Employer Services by sub-segment (Small-Business (“SMB”), Mid-market, Enterprise, and International), excluding float and allocating corporate expenses?

- Is ADP earning comparable margins to Paychex (~41%) in its SMB business? If so, that would imply 12% margins for the rest of Employer Services.

Question 2 – September 28, 2017:

When ADP owned Dealer Services, it aimed to produce just ~50bps of annual margin improvement. When Dealer Services was spun-off as CDK Global (NASDAQ: CDK) (“CDK”), it promptly identified an opportunity to double margins without negative consequence to CDK’s customers, shareholders or other stakeholders. Why was ADP not able to realize this opportunity when it owned CDK?

- CDK achieved this improvement by engaging constructively with shareholders, hiring an outside consultant to evaluate its potential, and announcing a transformation plan – why won’t ADP do the same?

Question 3 – October 5, 2017:

Why is ADP’s labor productivity ~28% below its competitors’, particularly in light of its enormous scale advantage?

Question 4 – October 10, 2017:

Competitors like Workday, Ultimate Software and Ceridian’s Dayforce have taken substantial market share at the expense of ADP, despite ADP spending significantly more on R&D. Why doesn’t ADP have a best-in-class product for the Enterprise market?

We ask that ADP respond to all of these questions so shareholders can better understand ADP’s potential.

Review all of Pershing Square’s weekly questions to shareholders here: https://adpascending.com/questions/

Pershing Square published its most recent ADP presentation on October 11, 2017. Shareholders can access that presentation here and additional supporting materials here.

For additional information, visit our website: www.ADPascending.com. Follow ADPascending on Facebook, Twitter and YouTube.

To vote for Pershing Square’s Nominees for ADP’s Transformation, please vote the GOLD Proxy Card or GOLD Voting Instruction Form.

You can vote by Internet, telephone or by signing and dating the GOLD Proxy Card or Voting Instruction Form and mailing it in the postage paid envelope provided. We urge you NOT to vote using any white proxy card or voting instruction form you receive from ADP. Please discard the white proxy card.

If you have any questions about how to vote your shares, please contact our proxy solicitor, D.F. King & Co., Inc., at (866) 342-1635.

About Pershing Square Capital Management, L.P.

Pershing Square Capital Management, L.P., based in New York City, is a SEC-registered investment advisor to investment funds.

This press release relates to Pershing Square’s solicitation of proxies in connection with the 2017 annual meeting of stockholders of ADP.

The information contained in this press release (the “Information”) is based on publicly available information about Automatic Data Processing, Inc. (“ADP” or the “Company”), which has not been independently verified by Pershing Square Capital Management, L.P. (“Pershing Square”). Pershing Square recognizes that there may be confidential or otherwise non-public information in the possession of ADP or others that could lead ADP or others to disagree with Pershing Square’s conclusions. This press release and the Information is not a recommendation or solicitation to buy or sell any securities.

The analyses provided may include certain forward-looking statements, estimates and projections prepared with respect to, among other things, general economic and market conditions, changes in management, changes in board composition, actions of ADP and its subsidiaries or competitors, the ability to implement business strategies and plans and pursue business opportunities in the human capital management industry. Such forward-looking statements, estimates, and projections reflect various assumptions by Pershing Square concerning anticipated results that are inherently subject to significant uncertainties and contingencies and have been included solely for illustrative purposes, including those risks and uncertainties detailed in the continuous disclosure and other filings of ADP with the Securities and Exchange Commission at www.sec.gov. No representations, express or implied, are made as to the accuracy or completeness of such forward-looking statements, estimates or projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results contained herein.