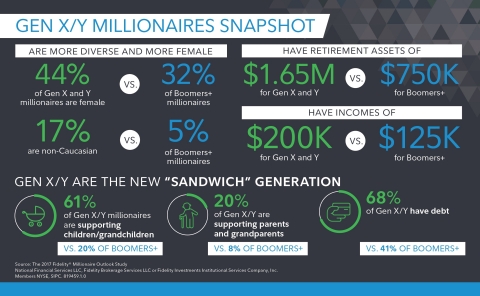

BOSTON--(BUSINESS WIRE)--Fidelity Investments® released the results of its 9th Millionaire Outlook study today, which shows that the face of wealth is changing and is beginning to “tip” to Gen X and Millennials (Gen Y).2 Gen X/Y millionaires are at an inflection point due to their age and the complexity of their financial situations, and they look much different than older generations of millionaires do (see graphic).

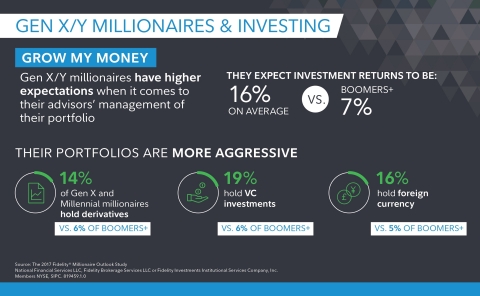

And the differences don’t end there: the Fidelity Millionaire Outlook study found that Gen X/Y millionaires take a much different approach to money than Boomers (see graphic).

With the ranks of Gen X/Y millionaires growing fast (they were 8 percent of millionaires in 2012 and are now 18 percent3) and the fact that only 58 percent of them are currently working with a financial advisor (down from 72 percent five years ago), they represent both an opportunity and a risk for the wealth management industry. By 2030, Gen X/Y will surpass Baby Boomers in terms of holding the most wealth in the country.4

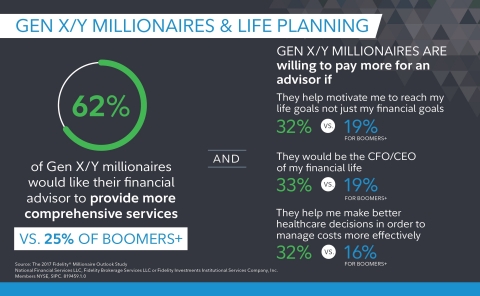

“With the percentage of Gen X/Y millionaires using an advisor on the decline, the industry needs to take a step back and ask: What can we be doing to ‘tip’ these investors toward valuing advice?” said David Canter, head of the registered investment advisor segment at Fidelity Clearing & Custody Solutions. “Gen X and Millennials don’t manage their finances in the same way that their parents did – they want an advisor who will be their own personal CFO and organize and simplify their financial lives.”

Key Takeaways for Advisors:

1. Sixty-nine percent of Gen X/Y

millionaires have referred at least one person to their advisor in the

past year (vs. 48 percent of Boomers), so consider gathering feedback on

your approach via client satisfaction surveys and advisory boards so

that you can tailor your services to this market.

2. Examine your

book of business to see if you’ve established relationships with your

current clients’ children in the Gen X/Y population. Forty-nine percent

are likely or very likely to meet with their parents’ advisor if

recommended, but only 16 percent of financial advisors are actively

targeting younger investors.5

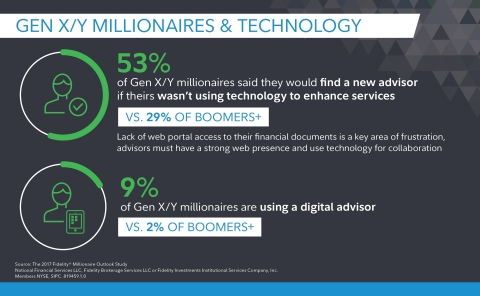

3. Make sure you’re

providing online access to statements, reports and, financial records

via your website, an online portal, and/or an app, and staying on top of

the latest ways to enhance the client experience through technology.

4.

Given that Gen X/Y millionaires are looking for more than just

investment advice, consider taking steps to go beyond money management

and offer comprehensive services, for example, outlining how you can

help them stick to a financial plan and reach their goals.

5. Gen

X/Y prefers to consolidate assets with one advisor. Use data aggregation

tools to find outside assets, and bring up the ease of one-stop shopping

in conversations.

For more details on the study and to access Fidelity’s new report, The Tipping Point: Will the Coming Wave of Wealth Value Advice, visit go.fidelity.com/millionaireoutlook2017.

About the Fidelity Millionaire Outlook Study

The

2017 Fidelity® Millionaire Outlook Study was an online, blind

study conducted during the period January 18 through February 13, 2017.

The sample was provided by TNS, a third-party research firm not

affiliated with Fidelity. The study focused on understanding affluent

investors’ attitudes, goals, behaviors and preferences related to

investing, wealth management, and advice. Six hundred and one

participants were defined as “Millionaires” with $1 million or more in

total investable assets, excluding 401(k) and real estate investments.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$6.4 trillion, including managed assets of $2.3 trillion as of August

31, 2017, we focus on meeting the unique needs of a diverse set of

customers: helping more than 26 million people invest their own life

savings, 23,000 businesses manage employee benefit programs, as well as

providing more than 12,500 financial advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for 70 years, Fidelity employs more than 40,000 associates who are

focused on the long-term success of our customers. For more information

about Fidelity Investments, visit https://www.fidelity.com/about.

The content provided herein is general in nature and is for

informational purposes only. This information is not individualized and

is not intended to serve as the primary or sole basis for your decisions

as there may be other factors you should consider.

Third party

marks are the property of their respective owners; all other marks are

the property of FMR LLC.

Fidelity Clearing & Custody Solutions®

provides clearing, custody, or other brokerage services through National

Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE,

SIPC. 200 Seaport Blvd, Boston, MA 02210

Products and services

provided through Fidelity Institutional Asset Management®

(FIAM®) to investment professionals, plan sponsors and

institutional investors by Fidelity Investments Institutional Services

Company, Inc., 500 Salem Street, Smithfield, RI 02917.

Fidelity

Brokerage Services LLC, Member NYSE, SIPC 900 Salem Street, Smithfield,

RI 02917

819459.1.0

© 2017 FMR LLC. All rights reserved.

1 Sources: Deloitte Center for Financial Services; Pew

Research Center; Age in the year 2017.

2 For the

purposes of this study, Gen Y (Millennials) is 21 to 35 years of age,

Gen X is 36 to 51 years of age and Boomers+ are 52 and older. The number

of Gen Y millionaires is 20, the number of Gen X millionaires is 49 and

the number of Boomers+ is 532.

3 According to the 2017

Fidelity Millionaire Outlook study, the number of Gen X and Millennial

millionaires has more than doubled in the past five years. For

comparison purposes, the Federal Reserve’s 2016 Survey of Consumer

Finances (SCF) indicates Gen X/Y Millionaire households comprise an

estimated 13.4% of Millionaire households, which is relatively flat

compared to 13.9% in its 2013 study, but indicates growth compared to

same proportion of Gen X/Y Millionaire households in 2010 which is

estimated at 10%. Different sampling and survey methodologies will

produce different results, but the general trend of growth over a

five-year period is consistent.2016 Federal Reserve Survey of Consumer

Finances.

4 Sources: Deloitte Center for Financial

Services; Pew Research Center; Age in the year 2017.

5

The 2017 Fidelity RIA Benchmarking Study was conducted between April 19

and June 6, 2017. 408 firms participated.