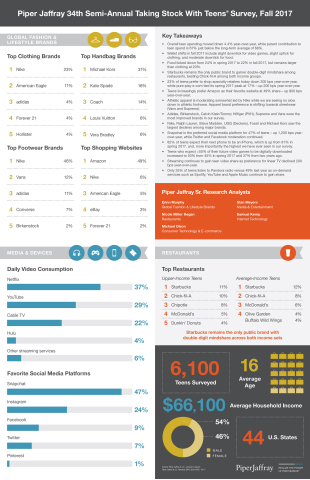

MINNEAPOLIS--(BUSINESS WIRE)--Piper Jaffray Companies (NYSE: PJC), a leading investment bank and asset management firm, completed its 34rd semi-annual Taking Stock With Teens research survey, which highlights spending trends and brand preferences amongst 6,100 teens across 44 U.S. states.

For an infographic and more information regarding the most recent survey, visit piperjaffray.com/teens.

Since the project began in 2001, Piper Jaffray has surveyed more than 155,000 teens and collected nearly 40 million data points on teen spending in fashion, beauty and personal care, digital media, food, gaming and entertainment.

“For the first time in years, we’ve seen Nike share moderate as a preferred brand. Offsetting this weakness, we’ve seen an unexpected rise in trends like streetwear with Vans and Supreme gaining momentum. In addition, other brands such as adidas, Puma and New Balance has been capturing more mindshare as teens gravitate towards that 1990s retro look,” said Erinn Murphy, Piper Jaffray senior research analyst.

Fall 2017 Key Findings

Overall Spending Behavior

- Overall teen spending moved down 4.4% year-over-year, while parent contribution to teen spend is 67% just below the long-term average of 68%.

- Wallet shifts in fall 2017 include slight downtick for video games, slight uptick for clothing, and moderate downtick for food.

- Food ticked down from 24% in spring 2017 to 22% in fall 2017, but remains larger than clothing at 20%.

Apparel

- Athletic apparel is moderating somewhat led by Nike, but there is no slowdown in athletic footwear. Apparel brand preference is shifting towards streetwear with brands like Vans and Supreme.

- Nike, Ralph Lauren, Steve Madden, UGG (Deckers), Fossil and Michael Kors saw the largest declines among major brands.

Technology Spending & Behavior

- Snapchat is the preferred social media platform for 47% of teens using the platform – up 12% year-over-year.

- 82% of teens expect their next phone to be an iPhone, which is up from 81% in spring 2017, and more importantly, the highest we have ever seen in our survey.

- Teens who expect >50% of their future video games to be digitally downloaded increased to 50% from 45% in spring 2017 and 37% from two years ago.

- Streaming continues to gain teen video share as preference for linear TV declined 2% since last fall.

- Only 35% of teens listen to Pandora radio versus 49% last year as on-demand services such as Spotify, YouTube and Apple Music continue to gain share.

- 23% of teens prefer to shop specialty retailers, which is down 3% year-over-year, while pure-play e-com tied its spring 2017 peak at 17% – up 2% year-over-year.

- Teens increasingly prefer Amazon as their favorite website at 49% share – up 9% year-over-year.

About the Survey

The Taking Stock With Teens survey is a

semi-annual research project comprised of gathering input from

approximately 6,100 teens with an average age of 16.0 years. Teen

spending patterns, fashion trends, and brand and media preferences were

assessed through surveying a geographically diverse subset of high

schools across the U.S.

About Piper Jaffray

Piper

Jaffray Companies (NYSE: PJC) is a leading investment bank and asset

management firm. Securities brokerage and investment banking services

are offered in the U.S. through Piper Jaffray & Co., member SIPC and FINRA;

in Europe through Piper Jaffray Ltd., authorized and regulated by the

U.K. Financial Conduct Authority; and in Hong Kong through Piper Jaffray

Hong Kong Limited, authorized and regulated by the Securities and

Futures Commission. Asset management products and services are offered

through five separate investment advisory affiliates―U.S. Securities and

Exchange Commission (SEC) registered Advisory Research, Inc., Piper

Jaffray Investment Management LLC, PJC Capital Partners LLC and Piper

Jaffray & Co., and Guernsey-based Parallel General Partners Limited,

authorized and regulated by the Guernsey Financial Services Commission.

Follow Piper Jaffray: LinkedIn | Facebook | Twitter

© 2017 Piper Jaffray Companies, 800 Nicollet Mall, Suite 1000, Minneapolis, Minnesota 55402-7036