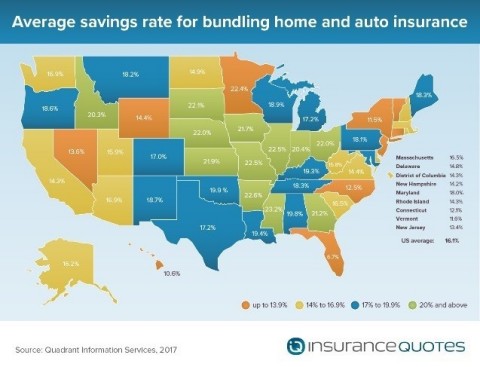

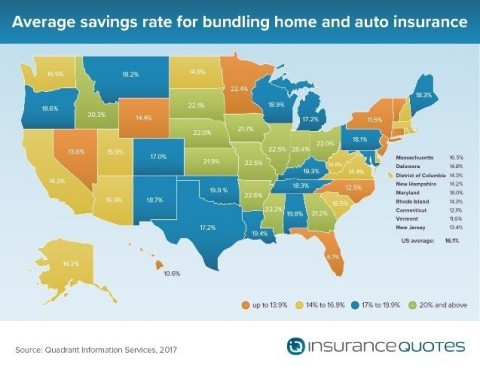

AUSTIN, Texas--(BUSINESS WIRE)--According to new data from insuranceQuotes, consumers across the country save an average of $322 (16.1%) per year by bundling their auto and homeowners insurance policies with the same insurer.

“Bundling is a great strategy to save money on your insurance,” said Laura Adams, senior insurance analyst at insuranceQuotes. “However, the amount you save depends on the state where you live and the types of policies you have. For instance, bundling auto and homeowners saves an average of $322 (16.1%), while auto and renters saves $84 (7.9%).”

Below are the states with the highest savings for bundling auto and homeowners policies:

1. Louisiana – $590 (19.4% discount)

2. Mississippi – $520

(23.2%)

3. Oklahoma – $513 (19.9%)

4. Texas – $491

(17.2%)

5. Kansas – $463 (21.9%)

Meanwhile, these states show the lowest savings:

1. Vermont – $175 (11.6% discount)

2. Hawaii – $188

(10.6%)

3. North Carolina – $212 (12.5%)

4. Florida

– $214 (6.7%)

5. Utah – $222 (15.9%)

“Not only does bundling an auto policy with your home, condo or renters insurance save money, but it also makes it easier to manage your insurance when you only have one provider,” Adams said. “However, it’s still smart to compare both bundled and unbundled quotes to make sure you’re getting the best deal for your situation.”

The full report—including rankings and savings for all 50 states, plus previous years’ findings—is available at https://www.insurancequotes.com/home/bundling-home-auto-insurance-savings-10032017.

Methodology:

insuranceQuotes commissioned Quadrant Information Services to calculate rates using data from the largest carriers (representing 60-70% of market share) in each U.S. state and the District of Columbia.

About insuranceQuotes:

insuranceQuotes gives consumers a free, easy way to shop and compare insurance quotes online for auto, home, health, life and business. Follow on Facebook and Twitter.