NEW YORK--(BUSINESS WIRE)--Pershing Square Capital Management, L.P. (“Pershing Square”) today published a letter to shareholders highlighting the significant opportunity for improvement at ADP (NASDAQ: ADP).

The full letter can be viewed here: https://adpascending.com/shareholder-materials/

Since our first presentation on August 17, 2017, ADP has yet to respond to the substance of our arguments and it has effectively stated that it can’t do any better. Today, Pershing Square published the first in a series of weekly public questions to ADP to help investors understand whether ADP is achieving its full potential. Pershing Square asks that ADP answer these questions publicly and in a timely manner so that all investors may better evaluate the company’s performance and future prospects.

Question 1:

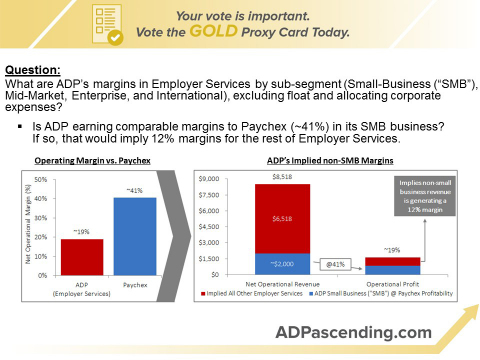

What are ADP’s margins in Employer Services by sub-segment (Small-Business (“SMB”), Mid-market, Enterprise, and International), excluding float and allocating corporate expenses?

- Is ADP earning comparable margins to Paychex (~41%) in its SMB business? If so, that would imply 12% margins for the rest of Employer Services.

Before shareholders cast their votes in the upcoming election, they deserve to know the margins of each sub-segment of Employer Services as these are critical data points for investors to use to evaluate the company’s performance.

Pershing Square also released the first in a series of videos for shareholders who are interested in learning about the tremendous opportunity for improvement at ADP. The video can be viewed at: www.ADPascending.com and on ADPascending’s newly launched Facebook, Twitter and YouTube pages.

For additional information, visit our website: www.ADPascending.com.

About Pershing Square Capital Management, L.P.

Pershing Square Capital Management, L.P., based in New York City, is a SEC-registered investment advisor to investment funds.

Pershing Square Capital Management, L.P. (“Pershing Square”) and certain of its affiliated funds have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying GOLD proxy card to be used to solicit proxies in connection with the upcoming annual meeting of stockholders (the “Annual Meeting”) of Automatic Data Processing, Inc. (the “Company”) and the election of a slate of director nominees at the Annual Meeting (the “Solicitation”). Stockholders are advised to read the proxy statement and any other documents related to the Solicitation because they contain important information, including information relating to the participants in the Solicitation. These materials and other materials filed by Pershing Square with the SEC in connection with the Solicitation are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Pershing Square with the SEC are also available, without charge, by directing a request to Pershing Square’s proxy solicitor, D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 (Call Collect: (212) 269-5550; Call Toll Free: (866) 342-1635) or email: ADP@dfking.com.

William A. Ackman, Veronica M. Hagen, V. Paul Unruh, Pershing Square, PS Management GP, LLC (“PS Management”), Pershing Square, L.P., Pershing Square II, L.P., Pershing Square International, Ltd., Pershing Square Holdings, Ltd. and Pershing Square VI Master, L.P. may be deemed “participants” under SEC rules in the Solicitation. William A. Ackman, Pershing Square and PS Management may be deemed to beneficially own the equity securities of the Company described in Pershing Square’s statement on Schedule 13D initially filed with the SEC on August 7, 2017 (the “Schedule 13D”), as it may be amended from time to time. Except as described in the Schedule 13D, none of the individuals listed above has a direct or indirect interest, by security holdings or otherwise, in the Company or the matters to be acted upon, if any, in connection with the Annual Meeting.