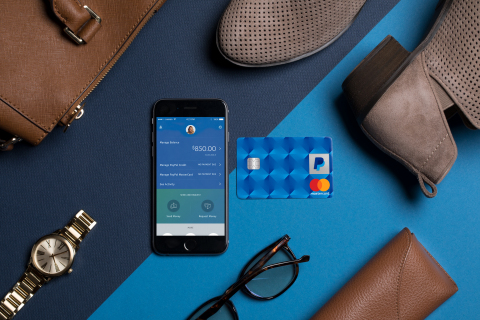

SAN JOSE, Calif.--(BUSINESS WIRE)--PayPal (NASDAQ: PYPL) customers in the U.S. can now earn cash back on every purchase online and in stores with today’s launch of the new PayPal Cashback Mastercard issued by Synchrony Bank. The PayPal Cashback Mastercard, designed exclusively for PayPal members, offers cardholders 2% cash back every day, on every purchase – everywhere Mastercard is accepted.

Unlike other rewards credit cards, there is no annual cash back limit, no minimum redemption amount, no restriction on how to spend cash rewards and no expiration. The PayPal Cashback Mastercard offers all the security and convenience expected from PayPal, plus all the traditional benefits of a Mastercard. All accounts are automatically added to the member’s PayPal wallet to simplify checkout and provide peace of mind.

Key benefits of the new PayPal Cashback Mastercard:

- 2% cash back on every purchase – everywhere Mastercard is accepted

- No annual fee

- No limit or expiration on cash rewards earned

- No rotating rewards categories and no restrictions on purchase types

- Cash rewards redeemed directly to PayPal balance – no redemption minimums or limits on how to use rewards

- Zero fraud liability

- Automatically added to PayPal wallet upon approval, allowing immediate use before physical card arrives in most cases

- When used to pay for merchandise through PayPal, eligible transactions receive PayPal Purchase Protection at no additional cost

- Mastercard benefits including extended warranty coverage, purchase protection, and identity theft resolution assistance

“The introduction of the PayPal Cashback Mastercard with Synchrony Bank continues PayPal’s commitment to provide customers with rewarding product experiences and a range of innovative credit options,” said Mark Britto, senior vice president, Global Credit, PayPal. “By providing a simple way for people to earn cash rewards for the shopping they’re already doing, the PayPal Cashback Mastercard will give consumers yet another reason to shop with PayPal.”

PayPal has partnered with Synchrony Bank since 2004 to offer credit card options that enable cardholders to shop online and in stores.

“We are excited to continue deepening our relationship with PayPal, a digital payments leader who shares the same vision of providing simple and convenient payment solutions for customers,” said Curtis Howse, senior vice president and general manager, Diversified Client Group, Synchrony Financial. “We look forward to advancing our partnership to provide even greater value for cardholders.”

To learn more about the PayPal Cashback Mastercard, visit http://www.paypal.com/cashback.

The PayPal Cashback Mastercard is issued by Synchrony Bank pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

About PayPal

Fueled by a fundamental belief that having

access to financial services creates opportunity, PayPal (NASDAQ: PYPL)

is committed to democratizing financial services and empowering people

and businesses to join and thrive in the global economy. Our open

digital payments platform gives PayPal's 210 million active account

holders the confidence to connect and transact in new and powerful ways,

whether they are online, on a mobile device, in an app, or in person.

Through a combination of technological innovation and strategic

partnerships, PayPal creates better ways to manage and move money, and

offers choice and flexibility when sending payments, paying or getting

paid. Available in more than 200 markets around the world,

the PayPal platform, including Braintree, Venmo and Xoom, enables

consumers and merchants to receive money in more than 100 currencies,

withdraw funds in 56 currencies and hold balances in

their PayPal accounts in 25 currencies.

About Synchrony Financial

Synchrony Financial (NYSE: SYF) is

one of the nation’s premier consumer financial services companies. Our

roots in consumer finance trace back to 1932, and today we are the

largest provider of private label credit cards in the United States

based on purchase volume and receivables.* We provide a range of credit

products through programs we have established with a diverse group of

national and regional retailers, local merchants, manufacturers, buying

groups, industry associations and healthcare service providers to help

generate growth for our partners and offer financial flexibility to our

customers. Through our partners’ over 365,000 locations across the

United States and Canada, and their websites and mobile applications, we

offer our customers a variety of credit products to finance the purchase

of goods and services. Synchrony Financial offers private label credit

cards, Dual Card™, and general purpose co-branded credit cards,

promotional financing and installment lending, loyalty programs and

FDIC-insured savings products through Synchrony Bank. More information

can be found at www.synchronyfinancial.com,

facebook.com/SynchronyFinancial,

www.linkedin.com/company/synchrony-financial

and twitter.com/SYFNews.