TORONTO & BOSTON--(BUSINESS WIRE)--Canada fell one place to No. 11 in retirement security among 43 countries, according to the 2017 Global Retirement Index published today by Natixis Global Asset Management. That outcome was driven in part because prosperity has lagged behind for lower-income Canadians, but Canada’s strong health system helped stabilize its position from further decline.

Now in its fifth year, the Natixis Global Retirement Index seeks to provide a measure of how well retirees are set up to succeed across the developed world. It creates an overall retirement security score based on an analysis of 18 key drivers of retiree welfare across four broad categories: Finances, Health, Material Wellbeing and Quality of Life.

According to data compiled by Natixis, several factors affected the overall score for Canada (76%) in this year’s index:

- Decline in prosperity: Canada’s position in the Material Wellbeing category declined because of rising levels of income inequality. In the income inequality indicator, Canada ranks 21st, which is considerably better than the U.S. ranking (38th), but indicates that many Canadians are missing out on economic growth and may be struggling to save for a secure retirement as a result. Canada also registered a decline in indicator scores for employment and income per capita compared to last year.

- Robust finances: Canada finishes among the top 10 countries for financial stability. Its tax pressure indicator score (15th) was improved compared to other countries and there was an increase in the five-year average of real interest rates, which tends to grow the level of wealth of retirees. Canada’s governance score is strong, and it ranks ninth among all GRI countries. But its old-age dependency ratio, which measures the proportion of people age 65 and older to those of working age, has increased, which stresses the government programs that support retirees.

- Strong grades in health: Canada finishes 10th for both health expenditure per capita and insured health expenditure, which measures the proportion of healthcare expenses covered by insurance, while its score for the life expectancy indicator improved from last year.

“This year’s Global Retirement Index is an important reminder that retirement security is a complex, multi-dimensional issue that is vastly influenced by a nation’s policies, politics and economics,” said Ed Farrington, Executive Vice President of Retirement for Natixis Global Asset Management. “The population is getting older, making retirement security one of the most pressing social issues facing the world. Factors such as increasing longevity, income inequality and the impact of monetary policy on personal savings and pension liabilities, are challenging the long-standing assumptions about how individuals plan for and live in retirement.”

The best performers

The top 10 countries in the 2017 index include eight from Western Europe, including Norway at No. 1, followed by Switzerland, Iceland, Sweden, Germany (No. 7), Denmark (No. 8), the Netherlands (No. 9), and Luxembourg (No. 10), plus New Zealand (No. 5) and Australia (No. 6). These countries benefit from a combination of strong social programs, widely accessible healthcare, low levels of income inequality and excellent work-based retirement savings plans.

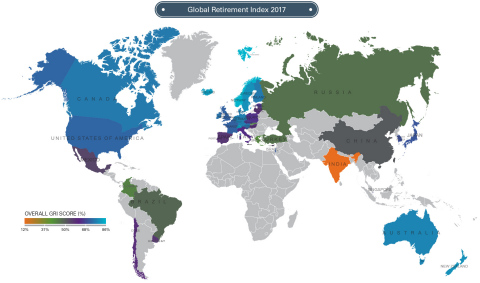

On a regional basis, even though Western Europe dominates the top 10 rankings, Western Europe collectively ranks lower than North America (Canada and the U.S.). This reflects the challenges of other countries in Western Europe – mainly, Italy, Portugal, and Spain – as they continue to struggle with financial setbacks. The index also illustrates the “Great Divergence,” as some economists call it, between Western Europe and North America, on the one hand, and the rest of the world on the other. North America’s overall score was 73%, and Western Europe’s was 70%. The next highest regions were Eastern Europe and Central Asia, with scores of 50%; and Asia Pacific at 34%.

Longer lifespans. Larger liabilities.

The rapid growth of seniors is forcing many countries to rethink their public pension systems. Pension managers are under pressure as increased lifespans of members and a long period of historically low interest rates have increased liabilities and created a funding shortfall. The world’s six largest pension saving systems, which includes Canada, are expected to reach a $224 trillion gap by 2050, a study by the World Economic Forum shows.1

The threat of unfunded liabilities has led to a significant change in employer retirement plan offerings, with many organizations freezing pension plans and transitioning to defined contribution plans, a switch that off-loads the liabilities for retirement funding from the employer to the employee.

Individuals in Canada are well aware of the challenge ahead of them. In a survey of investors conducted by Natixis earlier this year, 78% feel that funding retirement will fall increasingly to them rather than to the government.2

The economics of retirement security: a global view

The country comparison provided in the Global Retirement Index is intended to spur a larger discussion about what is needed to improve retirement security globally. In the first of three supplemental reports to the Index, Dave Lafferty, Chief Market Strategist for Natixis Global Asset Management in Boston, and Philippe Waechter, Head of Economic Research for Natixis Asset Management in Paris, discuss the long-term prospects for economic growth and the challenges of monetary policy, longevity, pension fund shortfalls, inflation, old-age dependency and related pressure on government resources.

“It may be obvious that a higher economic growth rate means higher earnings on assets deferred to the future,” according to Lafferty. “What’s not so obvious is that when economic growth is higher, the incentive to save is better. Yet higher long-term real and nominal growth rates can’t be generated in a secular low-growth period. It’s very hard for people who are just getting by to even justify saving in the first place, never mind how much they’re going to save, or how fast it’s going to grow.”

Commenting on the growing ratio of retirees to employment-age adults, Waechter said, “In the past, life in retirement was 10 to 15 years; now it’s 25 to 35 years. It will be increasingly challenging for countries to balance retirement schemes where the young generations are paying for their elders, because there are too few workers contributing, current productivity growth is too low to generate sufficient income to pay pensions for the number of people living longer, and macroeconomic conditions have changed. Growth, wage inflation and interest rates could remain low for an extended period of time. To create the surplus needed for the transfer of wealth from the present to the future, productivity growth must come back, and we have to think differently about the arbitrage between pension levels, retirement age and worker contributions.”

To download a copy of the Global Retirement Index report, visit ngam.natixis.com/us/research/global-retirement-index-2017.

The top 20 nations, along with their standing in last year’s Global Retirement Index, are:

| 1. Norway (No. 1 in 2016) | 6. Australia (6) | 11. Canada (10) | 16. Czech Republic (18) | ||||||

| 2. Switzerland (2) | 7. Germany (7) | 12. Finland (11) | 17. United States (14) | ||||||

| 3. Iceland (3) | 8. Denmark (12) | 13. Austria (9) | 18. United Kingdom (17) | ||||||

| 4. Sweden (5) | 9. Netherlands (8) | 14. Ireland (16) | 19. France (20) | ||||||

| 5. New Zealand (4) | 10. Luxembourg (13) | 15. Belgium (15) | 20. Israel (19) | ||||||

Methodology

The Global Retirement Index assesses factors that drive retirement security across 43 mainly developed economies where retirement is a pressing social and economic issue. It was compiled by Natixis Global Asset Management with support from CoreData Research, a U.K.-based financial research firm. The index includes International Monetary Fund (IMF) advanced economies, members of the Organization for Economic Co-operation and Development (OECD), and the BRIC countries (Brazil, Russia, India and China). The report captured data from a variety of sources, including the World Bank. The researchers calculated a mean score in each category and combined the category scores for a final overall ranking of the 43 nations studied.

The Natixis Individual Investor Retirement Survey surveyed 300 individual investors across Canada with a minimum of $134,894 CAD (US$100,000) in investable assets. The online survey was conducted in February/March 2017 and is part of a larger global study of 8,300 investors in 26 countries from Asia, Europe, the Americas and the Middle East. The findings are published in a new whitepaper, “Retirement, Death, and Taxes.” For more information, visit durableportfolios.com/global/understanding-investors/individual-investor-retirement-survey-2017.

About Natixis Global Asset Management

Natixis Global Asset Management serves thoughtful investment professionals worldwide with more insightful ways to invest. Through our Durable Portfolio Construction® approach, we focus on risk to help them construct more strategic portfolios that seek to endure today’s unpredictable markets. We draw from deep investor and industry insights and partner closely with our clients to put objective data behind the discussion.

Natixis Global Asset Management is ranked among the world’s largest asset management firms.3 Uniting over 20 specialized investment managers globally ($895.6 billion AUM4), we bring a diverse range of solutions to every strategic opportunity. From insight to action, Natixis Global Asset Management helps our clients better serve their own with more durable portfolios.

Headquartered in Paris and Boston, Natixis Global Asset Management, S.A. is part of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Global Asset Management, S.A.’s affiliated investment management firms and distribution and service groups include Active Index Advisors®;5 AEW Capital Management; AEW Europe; AlphaSimplex Group; Axeltis; Darius Capital Partners; DNCA Investments;6 Dorval Asset Management;7 Emerise;8 Gateway Investment Advisers; H2O Asset Management;7 Harris Associates; Loomis, Sayles & Company; Managed Portfolio Advisors®;5 McDonnell Investment Management; Mirova;9 Natixis Asset Management; Ossiam; Seeyond;9 Vaughan Nelson Investment Management; Vega Investment Managers; and Natixis Global Asset Management Private Equity, which includes Seventure Partners, Naxicap Partners, Alliance Entreprendre, Euro Private Equity, Caspian Private Equity and Eagle Asia Partners. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at ngam.natixis.com | LinkedIn: linkedin.com/company/natixis-global-asset-management.

In Canada: This material is provided by NGAM Canada LP/Natixis Global Asset Management Canada.

1 https://www.weforum.org/press/2017/05/global-pension-timebomb-funding-gap-set-to-dwarf-world-gdp/

2 2017 Global Individual Investor Survey

3

Cerulli Quantitative Update: Global Markets 2016 ranked

Natixis Global Asset Management, S.A. as the 16th

largest asset manager in the world based on assets under management

($870.3 billion) as of December 31, 2015.

4

Net asset value as of March 31, 2017. Assets under management (AUM) may

include assets for which non-regulatory AUM services are provided.

Non-regulatory AUM includes assets which do not fall within the SEC’s

definition of ‘regulatory AUM’ in Form ADV, Part 1.

5 A

division of NGAM Advisors, L.P.

6 A brand

of DNCA Finance.

7 A subsidiary of Natixis

Asset Management.

8 A brand of Natixis

Asset Management and Natixis Asset Management Asia Limited, based in

Singapore and Paris.

9 Operated in the

U.S. through Natixis Asset Management U.S., LLC.