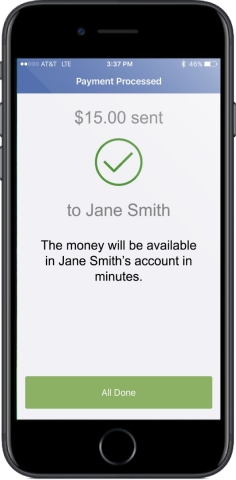

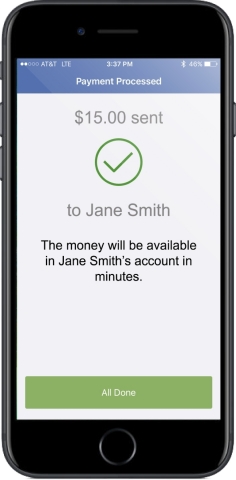

CINCINNATI--(BUSINESS WIRE)--Fifth Third Bank (Nasdaq: FITB) launches safe, fast and simple person-to-person (P2P) payments this month, incorporating the benefits and features of Zelle℠, a revolutionary new P2P service from Early Warning. Beginning June 23, customers using the Fifth Third Mobile Banking app can send and receive real-time payments for free using the recipient’s registered mobile number or email address.

“Fifth Third is excited to be one of the first banks to extend its digital P2P capabilities with Zelle,” said Greg Carmichael, president and CEO of Fifth Third Bancorp. “Adding the Zelle fast and secure features to our award-winning mobile app gives our customers new freedom to bank when they want and how they want.”

The P2P payment marketplace experienced dramatic growth in 2016, reaching one-third of Americans and totaling nearly $500 billion in transactions. Beginning this month, and continuing on a rolling basis over the next 12 months, Zelle will become available in the mobile banking apps of more than 30 participating financial institutions.

“Customers want their payments to be fast and simple,” said Melissa Stevens, Fifth Third’s chief digital officer and head of omnichannel banking. “We aim to meet customers where they are and integrate seamless and meaningful features for our customers. Zelle offers great P2P service by giving our customers the features they want without requiring them to leave the security of Fifth Third’s app or internet banking site.”

“They don’t want to use a different app or have to remember a separate set of passwords. Zelle offers the solution by giving customers the features they want without requiring them to leave the security of Fifth Third’s app.”

Accessing Zelle through Fifth Third is free and makes it easy to pay others – whether dividing the cost of dinner or paying rent on an apartment. When sending money, users can add a short message (including emojis) and set alerts to keep track of their transactions. Fifth Third also will offer the ability to use voice-enabled functions to make Zelle payments.

“The addition of Fifth Third represents a significant milestone as Early Warning continues to expand the Zelle Network, making fast, safe payments accessible to almost anyone nationwide,” said Lou Anne Alexander, group president, Payments at Early Warning. “Fifth Third is a leader in innovation, and Earning Warning is pleased to work together to provide Fifth Third customers with access to fast P2P payments through Zelle.”

*Mobile Internet data charges may apply as well as text messaging charges. Contact your mobile service provider for details.

About Fifth Third

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. As of March 31, 2017, the Company had $140 billion in assets and operated 1,155 full-service Banking Centers and 2,471 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Wealth & Asset Management. As of March 31, 2017, Fifth Third also had a 17.8 percent interest in Vantiv Holding, LLC. Fifth Third is among the largest money managers in the Midwest and, as of March 31, 2017, had $323 billion in assets under care, of which it managed $33 billion for individuals, corporations and not-for-profit organizations through its Trust, Brokerage and Insurance businesses. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the Nasdaq® Global Select Market under the symbol “FITB.” Fifth Third Bank was established in 1858. Member FDIC, Equal Housing Lender.