OMAHA, Neb.--(BUSINESS WIRE)--As vacationers hit the beaches this summer, America’s teenagers and college students will be punching time cards, pressing shirts and beginning seasonal jobs and internships. Seven in 10 (71 percent) young millennials age 20 to 26 and half of teens are currently in the paid workforce. And many teens will be swapping paychecks for bullet points on their resumes this year, with half expecting to take unpaid internships during their college years, according to a recent survey from TD Ameritrade.

“Teens and college students have many things to consider when planning for summer break,” said Christine Russell, senior manager, retirement and long-term investing at TD Ameritrade. “Whether they are utilizing the summer months to earn extra cash for college or sacrificing potential income in exchange for gaining valuable professional experience, it’s important for parents and teens to plan ahead in case they encounter a summer without a paycheck. For parents this can be a valuable teaching opportunity.”

Teens Expect to Work More, For Less During College Than Young

Millennials Did

TD

Ameritrade’s Summer Jobs and Internships survey of 2,001 teens (ages

13 to 19) and young millennials (ages 20 to 26) found:

- Part-time work: 86 percent of teens surveyed expect to work part-time during college compared with the 72 percent of young millennials who actually have/had part-time jobs in college.

- Unpaid internships: 56 percent of teens surveyed say they’d prefer an unpaid internship for the experience instead of a paid job outside of their field of study vs. 38 percent of millennials.

- Paid internships: Seven in 10 (73 percent) teens surveyed expect to have a paid internship during their college years compared with the 47 percent of young millennials who have/had paid internships.

- Starting early: Teens surveyed had their first paid job, on average, at age fourteen while young millennials started working two years later on average, at sixteen.

Beginning to Save

More than half (56 percent) of teens

surveyed have started saving for future expenses; putting away an

average of $290 a month. When it comes time to tap into their savings,

how do they anticipate spending their cash? Four in 10 (41 percent) say

education. A third (33 percent) will spend savings on clothes, 31

percent on new technology and 30 percent on a car. One-quarter (26

percent) plan on keeping their savings for an emergency fund.

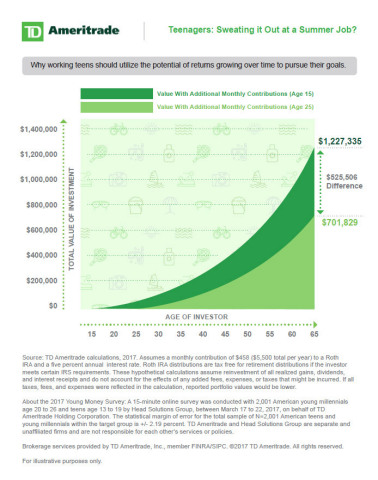

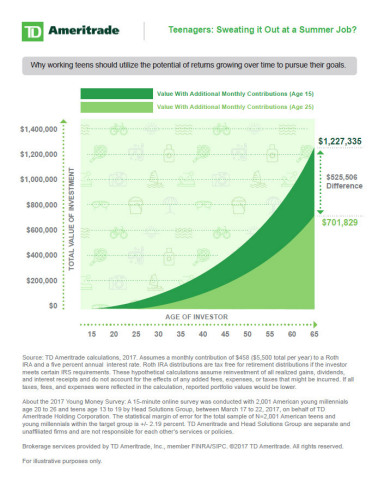

“Though it’s important for parents to encourage their teen to save, they should also encourage them to consider what, specifically, they are saving for,” Russell continued. “The earlier you can develop sound financial planning, investing and saving habits, the better. Retirement may seem far away, but for teens, time is actually on their side. Next to staying out of high-interest debt, opening a retirement account like a Roth IRA is a smart consideration for teenage savers.”

Roth IRAs allow savers to pay the income tax at their current rate, which can be beneficial for teen savers, who are traditionally in a lower tax bracket. Even better, the earnings from Roth IRA accounts are tax-free at age 59 1/2, subject to IRS rules. While it may be unlikely that teens will be able to make the maximum contribution of $5,500 per year to their account, even the smallest contributions may add up over time. Investor education services, like Investools, can help teens and their parents increase their investor IQ on topics such as compounding, which can help them make more confident, informed financial decisions.

Encouraging Saving

Russell offers the following tips to help

teens manage their summer earnings:

- Ask your teen to identify expenses they will have down the road, from big ticket items like tuition and mobile phones, to things like clothes and entertainment. Discuss the tradeoffs of spending now versus waiting.

- Openly discuss the costs associated with attending college or other post-secondary education.

- Develop a budget.

- Set realistic savings goals tied to specific objectives like school, a car or retirement.

- Discuss foundational financial concepts such as compounding, tax-free vs. tax-deferred, and taxable growth, or take the time to learn about them together.

- Encourage your teen to open a Roth IRA and deposit money into it each month. Let compounding and tax-free growth (subject to IRS rules) work for your teen.

About TD Ameritrade Holding Corporation

Millions of

investors and independent registered investment advisors (RIAs) have

turned to TD Ameritrade’s (Nasdaq: AMTD) technology, people and education to

help make investing and trading easier to understand and do. Online or

over the phone. In a branch or with an independent RIA. First-timer or

sophisticated trader. Our clients want to take control, and we help them

decide how - bringing Wall Street to Main Street for more than 40 years.

TD Ameritrade has time and again been recognized

as a leader in investment services. Please visit TD Ameritrade’s newsroom

or www.amtd.com for

more information, or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

Investools Inc. is an education subsidiary of TD Ameritrade Holding Corporation.

Survey conducted by Head Solutions Group

Head Solutions

Group (U.S.) Inc., is a leading market research partner for Financial

Services companies in North America. With offices in New

York, Toronto and Montreal, Head delivers the deep customer insights

that increase institutional knowledge and propel business action. TD

Ameritrade and Head Solutions Group are separate and unaffiliated firms

and are not responsible for each other’s services or policies.

About the Summer Jobs and Internships Survey

A 15-minute

online survey was conducted with 2,001 American young millennials age 20

to 26 and teens age 13 to 19 by Head Solutions Group, between March 17

to 22, 2017, on behalf of TD Ameritrade Holding Corporation. The

statistical margin of error for the total sample of N=2,001 American

teens and young millennials within the target group is +/- 2.19 percent.

This means that in 19 out of 20 cases, survey results will differ by no

more than 2.19 percentage points in either direction from what would

have been obtained by the opinions of all target group members in the

United States. Sample was drawn from major regions in proportion to the

U.S. Census.

Source: TD Ameritrade Holding Corporation