BOSTON--(BUSINESS WIRE)--For the past three years, Fidelity has explored issues that are top-of-mind for advisors through its quarterly Fidelity® Advisor Investment Pulse survey. It found that topics like the government and economy, portfolio management, market volatility, and interest rates consistently rank at the top of advisors’ list of concerns. This quarter, the survey explored the topic that has consistently ranked last: inflation. On a list of 14 potential topics, inflation ranked joint last with alternative investments. Against the backdrop of discussions on the Federal Reserve nearing its dual mandate of maximum employment and price stability, there are increasing concerns about inflation, even though they are still muted. In Q1 2017, a little over 3 percent of advisors cited inflation as an area of focus. While this is a small percentage, it is the highest since the start of 2014, signaling an opportunity to focus on this topic.

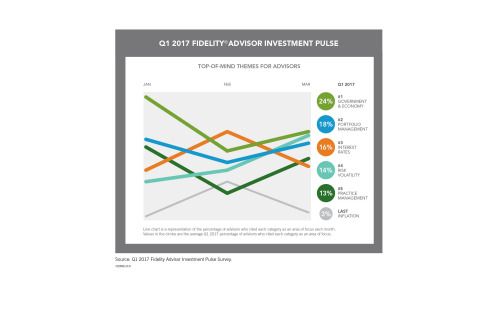

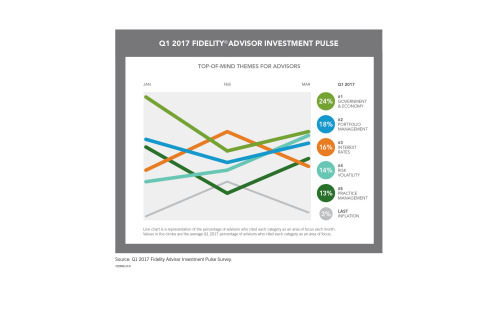

The latest results of the quarterly survey were released today by Fidelity Institutional Asset Management, a distribution and client service organization dedicated to meeting the investment needs of financial advisors, institutional investors and consultants. As with the previous two quarters, the findings showed that regulatory and political developments continued to be the top concern for advisors in Q1. In fact, 24 percent of the advisors surveyed cited topics relating to government and the economy, with many focused on developments with the Department of Labor’s (DOL) fiduciary investment advice rule and statements from the new administration on its potential fiscal policy direction.

“Against this backdrop, inflation fears continue to be pushed into the background, especially with U.S. inflation slowing structurally since the early 1980s,” said Robert Litle, head of Intermediary Sales, Fidelity Institutional Asset Management. “Looking at the survey findings, we wanted to draw attention to what advisors are not concerned about, but perhaps should be. Given current expectations, any increase in the pace of long-term inflation could catch advisors off-guard.”

Although sustained low inflation is a reasonable scenario, two factors could contribute to ending the long-standing disinflationary trend in the U.S.:

1. Peak globalization: Any move toward protectionism could put upward pressure on import costs and goods prices.

2. Aging demographics: This may mean decreased consumption as older people have historically spent less.1 However, an aging population could also mean decreased productivity and a decline in domestic production, which could reduce supply. Coupled with the potential of higher import costs, the net effect could be an increase in inflation.

Managing Inflation Risk

Even periods of modestly rising inflation can pose challenges for advisors and investors. Historically, rising inflation has meant a drag on returns from equities and bonds.2

“Inflation risks matter for everyone, but some may be more exposed to it than others, so it’s important for advisors to consider their clients’ unique circumstances,” explained Litle. “Managing inflation risk is especially important for investors who have retired or are approaching retirement. Unlike younger investors, many of them have portfolios that are more conservatively positioned and income-oriented. In addition, older investors tend to have shorter time horizons to recoup losses in purchasing power and greater expenses in health care, an area with rapidly rising costs.”

Before long-term inflation risks materialize, advisors should take advantage of the opportunity to:

1. Reassess their point of view on inflation

2. Examine their book of business to identify clients who may be more conservatively positioned

3. Revisit these clients’ objectives and risk profiles, and make inflation a part of the client conversation. Some key considerations include an investor’s time horizon, relevant inflation rate, starting allocation, and the nature of the required income stream

4. Make a plan for these clients’ portfolios in the event of an increase in the long-term pace of inflation and an erosion of purchasing power

While no single asset class has consistently outperformed in every inflationary environment, advisors should be prepared help their clients diversify beyond mainstream asset classes to manage inflation risk, including by considering a mix of inflation-resistant asset classes as part of a strategic allocation.

Other Findings this Quarter

As the DOL rule continues to dominate headlines, advisors are taking the opportunity presented by regulatory change to examine their business models, so practice management continues to be a hot topic for advisors (rising two spots to No. 5). In addition to growing their business, advisors are spending more time on value-added activities such as wealth planning, and they are looking to better articulate their value to potential and existing clients.

For advisors, juggling wealth planning, running their practices, and investment management responsibilities such as managing inflation risk can be challenging. To focus on areas where they can add value to their clients and their businesses, advisors should consider ways to become more efficient at investment management, including by leveraging the power of a process, considering model portfolios, reviewing their manager selection process, and documenting and communicating investment decisions to goals. This allows them to spend more time on planning-oriented activities like comprehensive goals-based planning, getting to know their clients, and broadening their offerings to include planning for social security, healthcare and retirement income. These tactics could help them distinguish their services from lower-cost options and build deeper relationships with clients.

Resources for Advisors

Fidelity Institutional Asset Management offers advisors original insights aimed at addressing their top concerns. The resources may be used to support client discussions on managing inflation risk. To access these insights, visit: institutional.fidelity.com/investmentpulse (for financial advisors only3). Resources include:

- Long-Term Inflation Risks May Be on the Rise: Investors expect inflation to remain subdued, but peak globalization and aging demographics are risks to that outlook.

- Managing Inflation Risk Is Important, Even if Inflation Remains Subdued: Inflation warrants prudent risk management, and may be particularly concerning for conservatively positioned, income-oriented retirees.

The Fidelity Advisor Investment Pulse is a survey that captures the investment topics on the minds of advisors in order to identify common concerns and deliver resources to help them navigate changing market conditions. Fidelity has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About the Fidelity Advisor Investment Pulse

The

Advisor Investment Pulse is an ongoing primary research effort that

captures the views of Fidelity Institutional Asset Management advisor

clients. All Fidelity Institutional Asset Management advisor clients in

the broker-dealer and registered investment advisor communities are

asked to participate in the online survey. In Q1 2017, 210 advisors

participated in the survey. These advisors serve a range of clients,

including individual investors, businesses, plan sponsors and

institutions. Respondents are asked an open-ended question: “Thinking

about the investing environment and outlook, and the potential impact on

your client portfolios, what investment challenge or opportunity would

you say is top-of-mind for you right now?”

The survey reports top-of-mind themes of most concern to financial advisors in both their practices and in the financial markets. These themes are distilled from individual financial advisor comments. The chart reflects the most current five themes that represent the most widely held views. Given the variability of the number of responses over time, and the ongoing nature of this effort, confidence levels will also be variable.

About Fidelity Institutional Asset ManagementSM

Fidelity Institutional Asset ManagementSM (FIAMSM) is one of the largest organizations serving the U.S. institutional marketplace. It works with financial advisors and advisory firms, offering them resources to help investors plan and achieve their goals; it also works with institutions and consultants to meet their varying and custom investment needs. Fidelity Institutional Asset Management provides actionable strategies, enabling its clients to stand out in the marketplace, and is a gateway to Fidelity’s original insight and diverse investment capabilities across equity, fixed income, high-income and global asset allocation.

Fidelity Institutional Asset Management is a division of Fidelity Investments.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$6.1 trillion, including managed assets of $2.2 trillion as of April 30,

2017, we focus on meeting the unique needs of a diverse set of

customers: helping more than 26 million people invest their own life

savings, 23,000 businesses manage employee benefit programs, as well as

providing more than 12,500 financial advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for 70 years, Fidelity employs 45,000 associates who are focused on the

long-term success of our customers. For more information about Fidelity

Investments, visit https://www.fidelity.com/about.

Not FDIC insured. May lose value. No bank guarantee.

Not NCUA or NCUSIF insured. May lose value. No credit union guarantee.

Diversification does not ensure a profit or guarantee against a loss. Investing involves risk, including risk of loss. Past performance is no guarantee of future returns.

In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation, credit, and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities. Income exempt from federal income tax may be subject to state or local tax. All or a portion of a municipal fund’s income may be subject to the federal alternative minimum tax. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic and political risks.

Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. Because of their narrow focus, sector securities tend to be more volatile than funds that diversify across many sectors and companies. Each sector security is also subject to the additional risks associated with its particular industry.

Asset allocation does not ensure a profit or guarantee against a loss. The ability of each fund to meet its investment objective is directly related to its target asset allocation among the underlying funds and the ability of those funds to meet their investment objectives.

The third-party trademarks and service marks are the property of their respective owners. All other trademarks and service marks are the property of FMR LLC or an affiliated company.

Fidelity Clearing & Custody SolutionsSM provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 200 Seaport Boulevard, Boston, MA 02210.

Products and services provided through Fidelity Institutional Asset Management® (FIAM®) to investment professionals, plan sponsors and institutional investors by Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield, RI 02917.

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact your investment professional or visit institutional.fidelity.com for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

802973.1.0

© 2017 FMR LLC. All rights reserved.

1 Source: U.S. Census Bureau, Bureau of Labor Statistics,

Haver Analytics, Fidelity Investments (AART), as of Dec. 31, 2015.

2

During such inflationary periods of at least six months since the

mid-1930s, the magnitude of equity outperformance on a real or

inflation-adjusted basis has fallen and the real return of intermediate

Treasuries has, on average, been slightly negative. Even if the highly

inflationary 1970s are excluded, the real annualized returns for U.S.

equities and 10-year Treasuries have been just 1% and 0.4%,

respectively, during periods of rising inflation—well below their

long-term averages of roughly 7% and 2%. Stocks – top 3,000 U.S. stocks

by market capitalization. 10-Year Treasury – Bloomberg Barclays U.S.

10-Year Treasury Bond Index. Source: Bureau of Labor Statistics, Global

Financial Data, Haver Analytics, Fidelity Investments (AART), as of Dec.

31, 2015.

3 These resources are for Fidelity

Institutional Asset Management advisor clients only.