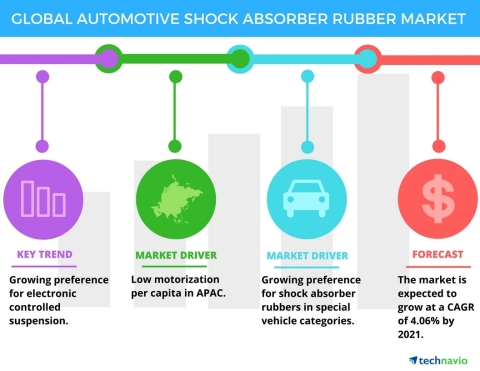

LONDON--(BUSINESS WIRE)--Technavio market research analysts forecast the global automotive shock absorber rubber market to grow at a CAGR of more than 4% during the forecast period, according to their latest report.

The market study covers the present scenario and growth prospects of the global automotive shock absorber rubber market for 2017-2021. The report also lists mount and boot as the two major application segments, of which the mount segment accounted for 68% of the market share in 2016.

According to Praveen Kumar, a lead analyst at Technavio for automotive components research, “The use of advanced optimization techniques for light weighting of suspension components, growing preference for shock absorbers in special vehicle categories, and price margin factors are driving the growth of this market.”

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio analysts highlight the following three market drivers that are contributing to the growth of the global automotive shock absorber rubber market:

- Growing preference for shock absorber rubbers in special vehicle categories

- Use of advanced optimization techniques for reducing the weight of suspension components

- Low motorization per capita in APAC

Growing preference for shock absorber rubbers in special vehicle categories

There is a growing popularity of the use of shock absorbers and stiffening of dampers to be used for off-road vehicles such as ATVs and UTVs. The growing demand for shock absorber rubbers in specialty vehicles will drive the market for the automotive shock absorber rubber market.

There is a growing penetration of shock absorbers, especially in mid-segment UTVs and ATVs. Shock absorber rubbers cost approximately USD 580 for one unit (containing two shock absorbers), and due to higher pricing, they were only fitted in the premium versions of utility and all-terrain vehicles.

Use of advanced optimization techniques for reducing the weight of suspension components

The fuel emission regulations in Europe and North America have put enormous pressure on the OEMs to lower fuel consumption, improve the existing fuel economy of vehicles, and develop efficient new designs. The CAFE regulation has set the standards up to 54.5 mpg to be achieved by 2025, which means OEMs have lesser time on their hands to reach the optimum standards. The OEMs are trying to optimize their suspension products to decrease weight or create new spring and strut designs. It is a continuous process to improve suspension systems to meet the ever-increasing demands of the customers.

For instance, Hutchens Industries, a major player in spring suspensions and sliding subframes in trailers, is using higher strength steel to provide lighter suspension. It also offers lightweight dampers that support the concept of small cars that offer low total weight, reduced CO2 emissions, higher fuel efficiency, better comfort, and reduced noise.

Low motorization per capita in APAC

Asia contributes to more than 50% of the world's total population along with the two most populated countries in the world, i.e., China and India. However, these emerging economies are the least urbanized, and none of the other regions in the world surpass Asia in terms of the urban population. Hence, there is an increasing potential for the growth of motorization with an increase in the size of the urban population in China and India. For instance, China had a market size of approximately 23 million units of passenger cars in 2016, which is expected to increase up to approximately 29 million units by 2020.

“The global automotive shock absorber rubber market is directly related to the sales of passenger cars and light commercial vehicles. Therefore, with increasing growth of the middle-class income, and resultant increase in urbanization, there is high potential for the growth of market in the emerging countries of APAC,” says Praveen.

Browse Related Reports:

- Global Commercial Vehicle Propeller Shaft Market 2017-2021

- Global Automotive Wheel Bearings Market 2017-2021

- Global Agricultural Tractor Tires Market 2017-2021

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like powertrain, wheels and tires, and automotive electronics. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.