NEW YORK--(BUSINESS WIRE)--Tourbillon Capital Partners, L.P. (“Tourbillon”), a substantial shareholder of Spectrum Brands Holdings, Inc. (NYSE:SPB) (“Spectrum” or the “Company”), today sent a letter to Spectrum’s Board of Directors urging the Board to consider the interests of unaffiliated shareholders and the Company as a whole in evaluating the unique opportunity to enter into a potential downstream merger with HRG Group, Inc. (NYSE:HRG), Spectrum’s majority shareholder.

Jason Karp, CEO and CIO at Tourbillon Capital Partners, stated: “As a long-time shareholder of Spectrum Brands, we support the Company’s standalone business strategy, but also believe the right transaction with HRG could yield 70-90% upside to SPB shares. Given HRG is Spectrum’s majority shareholder, our support is predicated on Spectrum’s Board negotiating a deal at arm’s length, ensuring all shareholders’ interests are considered, not just HRG’s, to mitigate any potential conflicts of interest and maximize value.

“To protect the interests of SPB shareholders and maximize shareholder value, we expect Spectrum’s Board to form a special committee, retain independent advisors, and seek approval by a majority of Spectrum’s minority shareholders. In our view, not doing so would constitute a severe breach of the Board’s fiduciary duty and a disregard for proper corporate governance.”

The full text of the letter follows:

May 18, 2017

David M. Maura

Kenneth C. Ambrecht

Norman S. Matthews

Terry

L. Polistina

Andreas Rouvé

Hugh R. Rovit

The Chairman and

the Independent Members

of the Board of Directors

Spectrum

Brands Holdings, Inc.

3001 Deming Way

Middleton, Wisconsin

53562

Gentlemen,

Tourbillon Capital Partners, L.P. (together with its affiliates, “Tourbillon” or “we”) is a substantial long-term shareholder of Spectrum Brands Holdings, Inc. (“Spectrum” or the “Company”) and a former substantial multi-year shareholder of HRG Group, Inc. (“HRG”). We wanted to share our thoughts with respect to the potential downstream merger of HRG into Spectrum (or a similar transaction) following HRG’s sale of Fidelity & Guaranty Life (“FGL”)1 which, based on public statements by Spectrum, we believe is anticipated by the market.

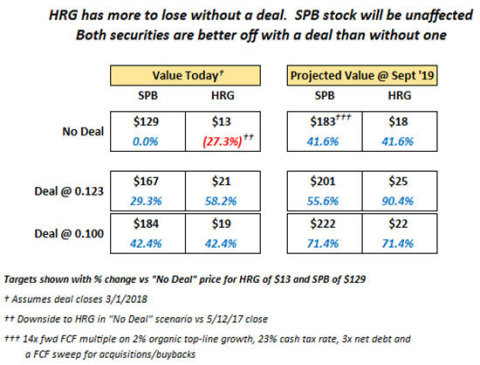

As a significant unaffiliated Spectrum shareholder, we have spent considerable time evaluating the merits of a transaction with HRG and the terms that would make it worthy of the support of Spectrum shareholders. We believe a transaction with HRG offers Spectrum a once-in-a-corporate-lifetime opportunity to retire 15-25%2 of its shares outstanding, and we are supportive of such a transaction at the right exchange ratio. According to our conservative estimates, Spectrum is worth $1833 per share as a stand-alone company. Based on our analysis, the right transaction could yield $220-$2504 per share, or 70%-90% upside5 to Spectrum shares over the next 18-24 months, while also delivering substantial value to HRG shareholders; value they could not realize absent a transaction.

Given that HRG is Spectrum’s majority shareholder and several members of the Spectrum Board are affiliated with or hold stock of HRG, any potential transaction with HRG would be considered an affiliate and controlled transaction. We assume that Spectrum’s Board has been given the mandate to negotiate the terms of this highly conflicted transaction between Spectrum and its controlling shareholder, and that you have established a special committee of the Board and retained an independent investment bank to advise you. In addition, in compliance with corporate best practices and in the proper discharge of your fiduciary duties in the context of a conflicted transaction of this type, we believe you must also condition this transaction on approval by a majority of the unaffiliated minority shareholders of Spectrum.

Recent sell-side analyst commentary suggests that Spectrum may offer between 0.145 and 0.170 of Spectrum shares per HRG share. We believe any offer in this range is unacceptable and that any reasonable unaffiliated shareholder would concur, for the reasons we explain below. Our analysis indicates a substantially lower exchange ratio in the range of 0.100 to 0.123 is more appropriate. With the information we have today, we would not vote in favor of a transaction where the exchange ratio is above this range, and we would expect our fellow unaffiliated Spectrum shareholders to share our views.

- HRG needs this transaction much more than Spectrum does. We believe HRG’s share price is artificially high as the market is anticipating a transaction – if there were no transaction contemplated, HRG shares would fall to a modest discount to their tax-effected net asset value of $13/share, nearly 30% lower than the stock price today6. Accordingly, this is the value Spectrum should be required to deliver to consummate a transaction as HRG has no alternative to this outcome. This translates to a 0.100 exchange ratio. Further, Spectrum has a robust stand-alone growth plan that is not reliant on this transaction for its future success. Finally, Spectrum can pursue a transaction of this sort at any time in the future; the urgency to consummate a transaction is HRG’s alone.

- Spectrum should be compensated for the complexity involved with collapsing the HRG structure. There is opportunity cost associated with assuming $400 million in HRG liabilities7 and deviating from Spectrum’s stand-alone strategy. Accordingly, Spectrum must evaluate this transaction as it would evaluate any arm’s length acquisition. In keeping with Spectrum’s track record, we expect that any transaction that does not increase Spectrum’s stand-alone value ($183/share target) by at least 10% (i.e., >$200/share) would be unacceptable.

- In considering the appropriate exchange ratio, Spectrum should not feel compelled to pay for potential multiple expansion, index addition, NOL value, etc. This is value that HRG can only realize in a transaction with Spectrum and would otherwise be worthless.

- HRG’s shareholders would be receiving consideration in a significantly more attractive and liquid security than their own and will share in future Spectrum upside, which we believe is substantial post deal. We illustrate a more generous exchange ratio of 0.123 in the chart above, which delivers Spectrum shareholders a 10% increase to its stand-alone prospects, and which we believe is the minimum acceptable offer. To be clear, we do not endorse delivering a 90% return to HRG shareholders over their unaffected taxed value. However, we do believe that this is a fair and balanced range of potential outcomes that should reasonably be acceptable to HRG shareholders.

Both entities are worth considerably more with a deal on the terms we propose. As reflected in the chart above, any transaction in the range we have recommended offers HRG significantly more value than it can otherwise achieve stand-alone. In fact, absent a transaction, HRG shareholders will most likely face an immediate 30% loss. Conversely, Spectrum’s projected value increases in any scenario. While we have used conservative multiples in the chart above, we believe there could be further upside to Spectrum shares considering peers and the market trade considerably higher even though Spectrum has a superior historical, and likely future, growth profile.

We have been proud shareholders and staunch supporters of Spectrum since 2013. Therefore, it is with a very long-term ownership mentality that we express these opinions. We intend to vigilantly monitor the discharge of your fiduciary duties to unaffiliated shareholders of Spectrum. We are confident that when Spectrum shareholders evaluate this transaction they will agree with our conclusions. We are eager and open to discussing our thoughts with you in greater detail.

We trust that you will make the best decision for all shareholders with regard to this matter, and that Spectrum will continue to grow and prosper under your stewardship.

Best regards,

Jason H. Karp

Chief Executive Officer and Chief Investment Officer

Tourbillon

Capital Partners, L.P.

Tourbillon Capital Partners, L.P. (“Tourbillon”), based in New York City, is an SEC-registered investment adviser to privately-offered investment funds. Tourbillon may increase, decrease, dispose of, or change the size or form of its investment in, or change its views about, Spectrum Brands, Inc. for any or no reason, at any time. Tourbillon disclaims any obligation to notify the market of any such changes. This announcement includes statements that are, or may be deemed to be, “forward‐looking statements”, which may be identified by the use of forward‐looking terminology, including terms such as “intends”, “will”, “believe”, “view” or similar terminology. Although Tourbillon believes that the expectations and views reflected in any such forward–looking statements or projections are reasonable, such statements are subject to a number of assumptions, risks and uncertainties which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

| 1 | For the purpose of this communication, we have assumed a sale of FGL for $32/share in cash. | |

| 2 | We estimate HRG owns 0.155 shares of SPB net of liabilities post sale of FGL. Any exchange ratio below 0.155 results in a net retirement of SPB shares. | |

| 3 | Stand-alone target assumes a conservative 14x fwd free cash flow (FCF) multiple on 2% organic top-line growth, a 23% exit cash tax-rate, exit net leverage at 3x, and a FCF sweep into acquisitions and share repurchases. | |

| 4 | Assuming a 0.100 exchange ratio and a 14-16x fwd FCF multiple range (in addition to the operating assumptions above). | |

| 5 | For the purpose of this communication, last-sale stock prices are as of close 5/12/17. | |

| 6 | Assumes a 35% corporate tax rate and a 10% discount to the after tax net asset value of $14.45 for HRG. We assume all remaining NOLs are exhausted against this tax liability. | |

| 7 | Net liabilities after de-levering post FGL sale at $32/share. Incorporates FGL/SPB dividends through 3/1/18, coupon payments, debt call costs, corporate costs, taxes and advisor fees. | |