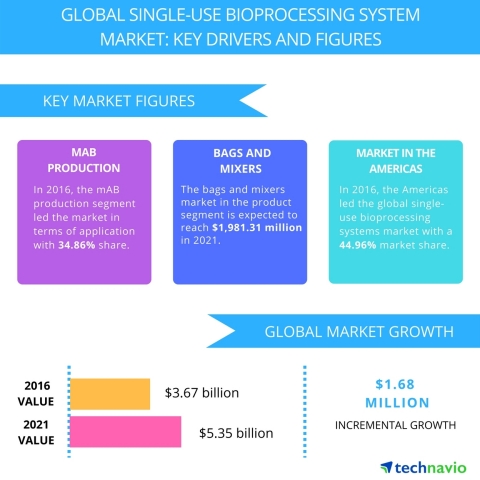

LONDON--(BUSINESS WIRE)--Technavio analysts forecast the global single-use bioprocessing systems market to grow at a CAGR of almost 8% during the forecast period, according to their latest report.

The research study covers the present scenario and growth prospects of the global single-use bioprocessing systems market for 2017-2021. The market is segmented based on application (mAB production, vaccine production, plant cell cultivation, PSCTs, others), product type (bags and mixers, bioreactors and fermenters, filtration devices and sampling systems, bioprocess containers, and tubing), and end-user (pharmaceutical companies, CROs and CMOs, biotechnology companies, academic and research institutions). The market is further segmented based on geography (Americas, EMEA, and APAC).

The global market for single-use bioprocessing systems was estimated at USD 3.67 billion in 2016 and is expected to grow moderately during the forecast period. The competition in the market is very high as the five key vendors, namely Sartorius, Thermo Fisher Scientific, Merck, Danaher, and GE Healthcare, occupy the major share of the market. Some of the reasons for the high adoption rates of single-use systems in biopharma manufacturing are reduced cost (manufacturing and set-up), increased flexibility (multiple productions), and quicker time to market. The emergence of disposable products such as the tangential flow filtration (TFF) devices in downstream applications and the importance of single-use technology in aiding continuous bioprocessing will boost the market demand for the global single-use bioprocessing system.

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio analysts highlight the following three factors that are contributing to the growth of the global single-use bioprocessing systems market:

- SUT combats global drug shortage problem

- Increasing M&As

- Rise in production of affordable biologics

SUT combats global drug shortage problem

The biopharmaceutical industry is shifting toward single-use technology (SUTs) to combat the global drug shortage. The increasing evidence of sterility, along with regulatory organizations encouraging pharma companies to switch to single-use technologies, hints toward a transition. Companies that have integrated and shifted toward a single-use system have expressed their satisfaction regarding lower costs, reduced overall contamination rates, and enhanced production throughput efficiency. Companies spend lesser time with disassembly and clean-up of the system while using SUTs, which results in quicker turnaround time for new batches of medications.

Amber Chourasia, a lead lab equipment research analyst at Technavio, says, “Single-use technology is gaining popularity as it is the most cost-efficient solution to increase rapidity in drug development, support larger batches of production, and achieve a quicker time to market the solutions.”

Increasing M&As

The market has witnessed intense activities in the single-use bioprocessing systems in terms of M&As. Small companies are acquired by the vendors with greater market share to boost their production and increase their product offerings or simply set up shop in the emerging markets and tap into the ever-increasing demand.

“M&As support the strong financial growth of the key vendors, and this will continue to drive demand in the market as M&As would be a prevalent theme for key vendors looking to increase their market and develop their revenue generating assets,” asserts Amber.

Rise in production of affordable biologics

Increasing competition in new therapy areas and the launch of biosimilars have increased the demand and put pressure on manufacturers to produce at a lower cost and in lesser time. According to estimates, the global market for biologics is over USD 180 billion and represents a share of 15%-20% of the overall pharmaceuticals market.

The technological advances in single-use process and facilities will aid in the reduction of drug substance manufacturing costs. Downstream processing improvements and chromatography resins make up a large portion of the costs. Therefore, changing a polishing step from resin chromatography to an SU membrane column can significantly reduce expenses. Several research studies have indicated that after using SUTs, unit operation cost is reduced by 20%-30% compared with traditional manufacturing practices.

Top vendors:

- Danaher

- GE Healthcare

- Merck

- Sartorius

- Thermo Fisher Scientific

Browse Related Reports:

- Global Liquid Handling Market 2017-2021

- Global Biochemistry Analyzer Market 2017-2021

- Global Lab Consumables Market 2017-2021

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like engineering tools, tools and components, and unit operations. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.