CHICAGO--(BUSINESS WIRE)--With the likes of Amazon Prime, Jet.com and the recent free shipping offensive at WalMart and Target, most retail observers have been commenting about brick and mortar survival. “Not true,” according to a recent study by Market Track, LLC, the leader in advertising, eCommerce, brand protection, and promotional intelligence solutions. The shopper study reveals despite declines in foot traffic and same-store sales numbers, most consumers still prefer to buy most categories in-store, but do research online before doing so.

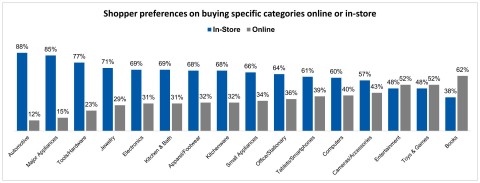

In a nationwide survey of over 1,200 primary household shoppers, the majority of respondents indicated that they prefer making most purchases at a physical location. However, for all sixteen categories for which the study surveyed, 80% of respondents also said they would do online price comparisons, signaling a true shift to the age of the “channel-less shopper.”

According to the study, consumers noted the bigger the ticket on the item, the more likely they were to research prices online. For example, respondents indicated for items like computers, tablets, electronics and major appliances they were more likely to compare prices online before going in-store to ultimately make a purchase.

“Even with consumers indicating their preference to purchase items in-store, the highly competitive online environment is impacting brick and mortar results. Decreases in profit margins can be attributed to shoppers being armed with more pricing and comparison information,” said Traci Gregorski, Senior Vice President of Marketing at Market Track. “With real-time price data and other online information such as ratings and reviews at their disposal, it is much easier to decide which retailer to visit and which brand to buy. With prices fluctuating more frequently due to competitive pressures, it behooves shoppers to do their homework no matter where they decide to make their purchase.”

Adding yet another dimension is the rising consumer adoption of mobile. This is especially true in the “digital native” groups where they have never known a world without the internet and online shopping. The study indicated that for those in the 18-20 age group, 40% prefer to do most of their shopping for non-grocery items on mobile, 38% prefer shopping online and 22% would rather go in store. For the 21-29 age group mobile is even more pronounced, with 47% saying they primarily use their mobile device to shop, 31% indicated they prefer online and only 22% want to make a trip to the store.

Then there’s Amazon. 87% of shoppers surveyed said they shop on Amazon, with more than one in three saying they shop on Amazon at least once a week. Why? The majority indicated "selection of products" as the main driver for shopping on Amazon. The 30-39 age group has the most Prime members at 63%, however, every age group except those 50 and above had over half as Prime members.

“The increase in dollars being spent online is significant, however, the influence of eCommerce is much broader. The transactional data is only one dimension. What is most meaningful about eCommerce in our survey is that it shows it is the great equalizer, placing additional advantage on the consumer side and necessitating a more strategic approach from retailers and brands participating in the online space. Increased competition, marketplaces and emerging specialty e-retailers require both retailers and brands to be vigilant in monitoring, analyzing, and changing course quickly in order to remain profitable,” continued Gregorski.

To view the complete results of the study, please visit, https://blog.markettrack.com/shopper-survey.

About Market Track

Headquartered in Chicago, Illinois, Market Track is the leading provider of subscription-based advertising, promotion and eCommerce intelligence solutions in North America. Through monitoring trade and promotional advertising, pricing and e-commerce activity, brand protection and competitive advertising activity, Market Track provides the most comprehensive coverage of key media channels available. Market Track’s solutions enable advertisers, agencies, retailers, and manufacturers of consumer goods to efficiently monitor and analyze causal data, creative execution, and ad spending to maximize the value of their marketing campaigns. Clients use Market Track’s capabilities to determine how competing retailers, products and brands are being advertised, priced and promoted both in-store and online. The company’s granular creative assets and data cover nearly every retail trade class, product category and media channel. For more information, please visit, www.markettrack.com.