SAN FRANCISCO--(BUSINESS WIRE)--Today, Wells Fargo Bank, N.A. (NYSE:WFC) announces that customers now have card-free access to all of its 13,000 ATMs(1), coast-to-coast. The company’s One-Time Access Code technology allows customers to authenticate at an ATM using an 8-digit token and their debit or ATM card Personal Identification Number (PIN), instead of a physical card.

“At Wells Fargo, we believe the future is cardless, and the launch of One-Time Access Code provides our 20 million mobile banking customers another convenient way to manage money,” said Brett Pitts, head of digital for Virtual Channels. “This new ATM feature exemplifies Wells Fargo’s commitment to innovation.”

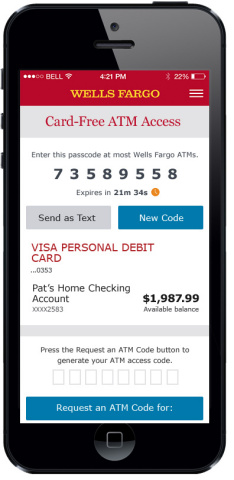

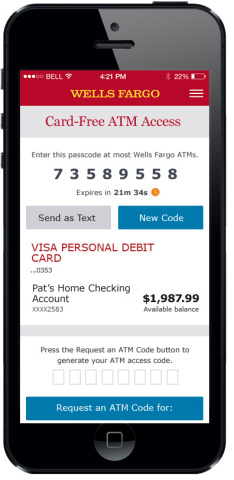

Customers first log into the Wells Fargo mobile app, select Card-Free ATM access under Account Services, and request a one-time-use, 8-digit access code. Upon arriving at the ATM, he or she simply enters the code and their debit or ATM card PIN, then proceeds to the main menu to perform their transaction (visit Wells Fargo Stories to see this technology in action).

“Mobile continues to be the channel of choice for millions of our customers, so it only makes sense to leverage it for new, convenient ATM experiences,” said Adam Vancini, head of operations for Virtual Channels. “Whether a customer happens to have a card on them or not, One-Time Access Code provides another simple and secure way to withdraw cash at any of our ATMs.”

Wells Fargo’s mobile banking is the company’s fastest growing channel, reaching a milestone of more than 20 million active customers in March. Recently, Keynote awarded Wells Fargo first place on its biannual Mobile Banking Scorecard, citing the bank’s leadership in digital functionality, quality and availability, ease of use and mobile app experiences.

“Every time a customer walks up to an ATM or into a branch, chances are they’re carrying a phone, and we believe the real power of mobile is the ability to enhance the customer experience at our ATMs and branches,” said Jonathan Velline, head of branch and ATM banking. “We’re excited to provide our customers with more ways to conveniently and securely make ATM transactions.”

In addition to One-Time Access Code, later this year customers will be able to initiate a cardless ATM transaction with the “tap and pay” technology in an NFC-enabled smartphone. When this feature is live, a customer will be able to initiate a transaction by signing into a leading mobile wallet (Wells Fargo Wallet, Apple Pay, Android Pay or Samsung Pay), and holding the phone near an NFC-enabled ATM terminal. Once authenticated, the customer will input their debit or ATM card PIN and complete their transaction. More than 40 percent (more than 5,000) of Wells Fargo ATMs are currently NFC-enabled.

For more information, visit www.wellsfargo.com.

(1) The entire fleet of Wells Fargo ATMs has One-Time Access Code technology; however, some ATMs, located inside select branches, will only feature card-free access during non-business hours when team members are not present to assist customers. Additionally, some ATMs are located within secure locations that may require customers to swipe their cards for entry.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.9 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 8,600 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 42 countries and territories to support customers who conduct business in the global economy. With approximately 269,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 27 on Fortune’s 2016 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.