SAN FRANCISCO--(BUSINESS WIRE)--Digital natives expect buying a home to be a seamless online experience like everything else they do in work and life. Yet, obtaining a mortgage is still by and large an inefficient, outdated, and offline process. To fill this gap, LendingHome, the largest, fastest-growing mortgage marketplace lender, today launched the next-generation one-stop online mortgage designed for the needs of first-time homebuyers.

LendingHome’s online mortgage is the first to prioritize the customer experience by putting control over the process into the hands of the homebuyer. While the first wave of digital lenders brought the old-school paper mortgage application online, retrofitting it to be accessed via the Internet, much of the process is still controlled by the lender offline and is opaque and confusing for the homebuyer. In contrast, LendingHome has created the next-generation digital mortgage that gives homebuyers confidence and control over the process with a dynamic, interactive online experience. It also offers a faster, simpler, and more transparent mortgage process than the outdated paper-laden methods still used by many lenders.

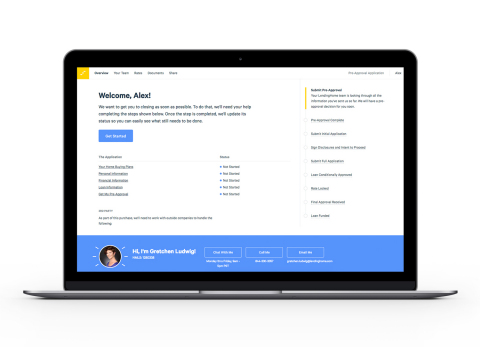

With LendingHome, homebuyers can confidently choose and lock down the right mortgage for their needs online without picking up the phone. They can apply via an interactive application that gives tips and feedback as they go, keep real-time track of their progress with a personalized milestone timeline, trade points and lock their rate online before the market changes, and easily share their loan status with their real estate agent with the click of a button. Additionally, first-time homebuyers can get everything they need -- educational articles, advice, and tools -- in one spot online to successfully buy their first home with step-by-step guidance through the mortgage process.

LendingHome has built deep expertise in originating mortgages online. It started by funding short-term bridge and rental loans to property investors and has funded over $1B in loans. It now brings its online mortgage platform to consumers with the launch of its home financing solution, available at www.lendinghome.com/home-loans in nine states with more coming soon.

“The home financing process is daunting for just about anyone,” said Matt Humphrey, LendingHome’s co-founder and CEO, who was recently named to the Forbes 30 Under 30 in Finance in 2017. “But it can be particularly frustrating for this next wave of first-time homebuyers who expect everything to be done seamlessly online and often don’t know what to expect or prepare for in the process. What’s more, even other online mortgage processes often quickly lead to endless back-and-forth emails and phone calls with lenders, and confusion over if and when they’ll be able to get their loan. Getting a mortgage shouldn’t be this way. With the power of our technology, we designed the next-generation digital mortgage specifically for the needs of digital natives so that they feel confident and in control when financing their first home.”

As a digital native himself and a serial tech entrepreneur, Humphrey knew that there had to be a better way to get a mortgage than the inefficient processes still used today. After selling his sixth startup, an e-commerce platform called HomeRun for north of $100 million, Matt saw an opportunity to disrupt the $8.2 trillion mortgage industry with a technology-first entrepreneurial approach to offer a vastly better mortgage experience to the next generation of homebuyers.

To transform the industry, Matt and his team have built a deep end-to-end online technology platform and infrastructure that creates a smooth customer experience on the front-end and operational efficiencies on the back-end. These back-end efficiencies will ultimately enable more accurate, faster, and cheaper loan processing to homebuyers across the country.

Putting Control Into the Hands of the Homebuyer

LendingHome’s online mortgage makes the process fast, simple, and transparent. Borrowers get their rates within seconds -- not days -- complete their application in minutes -- not weeks -- and move confidently toward an on-time close. It gives homebuyers confidence and control over the process with a range of loan options, innovative features, and trustworthy resources to choose from. It includes the ability to:

- Select the right loan for your needs anywhere, anytime: Borrowers can select from a range of loan products at competitive rates. Using LendingHome’s Trade Points tool, they can configure the loan that’s best for their needs without wasting time going back and forth with a loan officer.

- Lock your rate with the click of a button: Online rate lock allows borrowers to capture available rates in real time without the worry of missing out because the market moved.

- Get guidance right when you need it: An educational hub offers advice on complex topics like debt-to-income and loan types. Extensive in-product tips and education are available exactly at the time they’re needed to help throughout the application process. While it’s easy to complete the mortgage process online, LendingHome has personalized loan specialists available to talk to borrowers via phone or chat when needed.

- Know what to expect and do at every step: A personalized dashboard lets borrowers know exactly what documentation they’ll need to provide, without the headache of fielding last-minute piecemeal requests via email and phone. A Milestone Tracker lets them know exactly where they stand in the mortgage process and what comes next.

- Stay on the same page with your real estate agent: A Loan Tracker tool enables borrowers to seamlessly share the progress of their loan with their real estate agent or partner.

Availability

LendingHome’s home financing solution is available at www.lendinghome.com/home-loans to homebuyers in Arizona, California, Colorado, Florida, Georgia, Nevada, Oregon, Texas, and Washington, with more states to be added in the coming months.

The Rise in First-Time Homebuyers

There are 15.8 million homebuyers -- many of whom are tech savvy -- expected to enter the market from 2015 to 2025, according to research from the book, Big Shifts Ahead: Demographic Clarity for Businesses from John Burns Real Estate Consulting. Today, forty-seven percent of homebuyers are first-time buyers, and half (50 percent) are under the age of 36. They have a median age of 33 and nearly six in 10 are Millennials (56 percent) per a recent survey by Zillow Group. Per the same survey, the majority of homebuyers, 87 percent, use online resources to search, shop and purchase their home. However, many first-time homebuyers have a low level of knowledge of the mortgage criteria with 50 percent saying that they “don’t know” the minimum down payment percentage required, their credit score or their debt-to-income ratio per a survey conducted by Fannie Mae.

About LendingHome:

LendingHome reimagines the traditional mortgage process to transform it into a fast, transparent, and reliable marketplace for borrowers and investors. It does this through its proprietary technology platform and team of seasoned real estate investment experts. LendingHome serves borrowers looking for financing to purchase or refinance residential real estate properties. At the same time, it serves institutional and individual investors looking for access to attractive, high-yield real estate assets. Since it started lending in mid-2014, LendingHome now funds over $1 billion in mortgage loans. Based in San Francisco, California, LendingHome has over 250 employees and has raised over $100 million in equity financing from Renren, Ribbit Capital, Foundation Capital, First Round Capital, and more. To learn more, go to www.lendinghome.com.