OMAHA, Neb.--(BUSINESS WIRE)--TD Ameritrade, Inc. (“TD Ameritrade”), a broker-dealer subsidiary of TD Ameritrade Holding Corporation (Nasdaq:AMTD), is today releasing the Investor Movement Index® reading for February 2017. The Investor Movement Index, or the IMXSM, is a proprietary, behavior-based index created by TD Ameritrade that aggregates Main Street investor positions and activity to measure what investors are actually doing and how they are positioned in the markets.

The February 2017 Investor Movement Index for the four weeks ending February 24, 2017, reveals:

- Reading: 6.15 (compared to 5.71 in January)

- Trend direction: Positive

- Trend length: 1 month

- Score relative to historic ranges: High

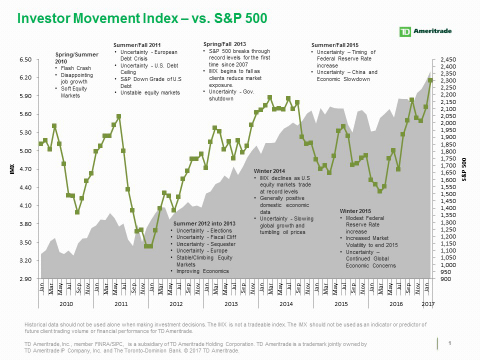

February’s IMX rose to 6.15, breaking above 6.0 for the first time, and surpassing the previous record high of 5.87 set in March 2014. Equity markets were on the rise during the February IMX period with the Dow Jones Industrial Average posting their 11th record high for the year. TD Ameritrade clients increased their exposure to equity markets by rotating into diversified instruments and buying popular stocks, like Amazon.com, Inc. (AMZN) and Nvidia Corp. (NVDA).

“A year ago, retail clients were dialing back their equity exposure and the February 2016 IMX was at 4.44,” said JJ Kinahan, chief market strategist for TD Ameritrade. “Indices are now at an all-time high as retail clients continued to increase their exposure to equity markets. Investor confidence was further fueled by February’s market highs, earnings and other macroeconomic influences.”

In February, TD Ameritrade clients continued to be net buyers of banks. JP Morgan Chase & Company (JPM) and Bank of America Corp. (BAC) were both net buys. Nvidia Corp. (NVDA), which saw its share price reach an all-time high early in the period, then large decreases late in the period following downgrades by Wall Street, was a net buy as well. Amazon.com Inc. (AMZN), which reported better-than-expected earnings, was another net buy. Chesapeake Energy Corp. (CHK), which has been under pressure following natural gas prices trending lower, was another net buy. Teva Pharmaceutical (TEVA) and Macy’s, Inc. (M), both of which reported upbeat earnings, were also bought up. Additional popular names bought included Dry Ships Inc. (DRYS) and Ford Motor (F).

Apple Inc. (AAPL) was once again net sold during the February IMX period as the company’s market cap topped $700 billion and the stock reached a new all-time high. Alcoa Corp. (AA) and Arconic Inc. (ARNC), which previously comprised former Dow component Alcoa, both trended upward during the period and were net sold. Energy names ConocoPhillips Corp. (COP) and Kinder Morgan Inc. (KMI), which each posted decreases during the period, were net sold. Walt Disney Co. (DIS) and Yahoo! Inc. (YHOO) both saw new 12-month highs and were also sold. Tesla Motors, Inc. (TSLA) was net sold after reaching a new all-time high in the middle of the period. Additional popular names sold include Chipotle Mexican Grill, Inc. (CMG) and Alibaba Group Holding (BABA).

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of 6 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to December 2010; to view the full report from February 2017; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or TD Ameritrade Mobile Trader platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

For the latest TD Ameritrade news and information, follow the company on Twitter, @TDAmeritradePR.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

Millions of investors and independent registered investment advisors (RIAs) have turned to TD Ameritrade’s (Nasdaq:AMTD) technology, people and education to help make investing and trading easier to understand and do. Online or over the phone. In a branch or with an independent RIA. First-timer or sophisticated trader. Our clients want to take control, and we help them decide how — bringing Wall Street to Main Street for more than 40 years. TD Ameritrade has time and again been recognized as a leader in investment services. Please visit TD Ameritrade’s newsroom or www.amtd.com for more information.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).