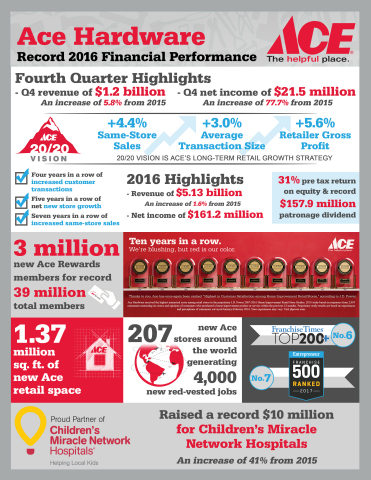

OAK BROOK, Ill.--(BUSINESS WIRE)--Ace Hardware Corporation (“Ace” or the “Company”), the largest retailer-owned hardware cooperative in the world, today reported fourth quarter 2016 revenues of $1.2 billion, an increase of $67.6 million or 5.8 percent from the fourth quarter of 2015. Net income was $21.5 million for the fourth quarter 2016, an increase of $9.4 million or 77.7 percent from the fourth quarter of 2015. Consolidated fiscal 2016 revenues were $5.1 billion, an increase of $80.5 million or 1.6 percent compared to the prior year. Fiscal 2016 net income was $161.2 million, an increase of $5.0 million or 3.2 percent compared to the prior year.

“I am proud to report that 2016 was the fourth consecutive year of record financial performance for the Company,” said John Venhuizen, President and CEO. “I feel privileged and grateful to report the best ever sales, net income and shareholder return in what was admittedly a challenging year.”

The 4.4 percent increase in retail same-store-sales during the fourth quarter of 2016 reported by the approximately 3,000 Ace retailers who share daily retail sales data was the result of increased customer count and average transaction size. Same-store-sales at these stores were up 2.5 percent for the full year.

“We are pleased to announce a record $157.9 million in patronage dividends resulting from the 2.5 percent growth in same-store-sales, 152 new domestic stores and hard work by the entire Ace team,” said Venhuizen. “To give you an idea of the success of our retail strategy, we have seen increases in same-store-sales for seven consecutive years, increases in new store growth for five consecutive years and increases in customer transactions for four consecutive years.”

Revenues

Fourth Quarter

Consolidated revenues for the quarter ended December 31, 2016 totaled $1.2 billion. Total wholesale revenues were $1.17 billion, an increase of $63.0 million, or 5.7 percent, as compared to the prior year fourth quarter. Increases were noted across many departments with lawn and garden and outdoor living showing the largest increases.

Wholesale merchandise revenues to comparable stores increased $41.9 million in the fourth quarter of 2016. Wholesale merchandise revenues to new domestic stores activated in the 2015 and 2016 fiscal year periods contributed $26.2 million in incremental revenues during the quarter, while wholesale merchandise revenues decreased $10.1 million due to stores that cancelled their membership in 2015 and 2016. The Company’s Ace Wholesale Holdings LLC (“AWH”) subsidiary contributed $3.0 million of incremental revenue in the fourth quarter of 2016, which is an increase of 3.5 percent from the prior year fourth quarter.

Retail revenues from Ace Retail Holdings (“ARH”) were $64.4 million in the fourth quarter of 2016. This is an increase of $4.6 million, or 7.7 percent, from the fourth quarter of 2015. Same-store-sales were up 3.0 percent versus the prior year with outdoor living and lawn and garden showing the largest increases.

Fiscal Year

Consolidated revenues for fiscal 2016 totaled $5.1 billion, an increase of $80.5 million, or 1.6 percent, as compared to the prior year. Total wholesale revenues were $4.9 billion, an increase of $69.9 million, or 1.5 percent, as compared to the prior year. Increases were noted across many departments with outdoor living, lawn and garden and tools showing the largest gains.

Wholesale merchandise revenues from new domestic stores were $107.2 million in fiscal 2016. This increase was partially offset by a decrease in wholesale merchandise revenues of $51.4 million due to domestic store cancellations. Wholesale merchandise revenues to comparable domestic stores increased $19.5 million in fiscal 2016 compared to fiscal 2015. The Company’s AWH subsidiary contributed $19.0 million of incremental revenue in fiscal 2016, which was an increase of 5.5 percent from the prior year.

Retail revenues from ARH were $262.3 million during fiscal 2016, an increase of $10.6 million or 4.2 percent. Same-store-sales increased 1.2 percent due to a 2.9 percent increase in average ticket. The largest increases were in outdoor living, lawn and garden and electrical.

Ace added 152 new domestic stores in fiscal 2016 and cancelled 100 stores. This brought the Company’s total domestic store count to 4,363 at the end of fiscal 2016, an increase of 52 stores from the end of fiscal 2015. On a worldwide basis, Ace added 207 stores in fiscal 2016 and cancelled 103, bringing the worldwide store count to 4,994 at the end of fiscal 2016.

Gross Profit

Fourth Quarter

Wholesale gross profit for the three months ended December 31, 2016 was $134.0 million, an increase of $12.1 million from the fourth quarter of 2015. The wholesale gross margin percentage was 11.5 percent of wholesale revenues in the fourth quarter of 2016, an increase from the fourth quarter of 2015 gross margin percentage of 11.0 percent. The increase in the wholesale gross margin percentage was primarily driven by the timing of receipt of vendor funds.

Retail gross profit for the three months ended December 31, 2016 was $28.9 million, an increase of $2.7 million from the fourth quarter of 2015. The retail gross margin percentage was 44.9 percent of retail revenues in the fourth quarter of 2016, up from 43.8 percent in the fourth quarter of 2015. The increase in the retail gross margin percentage was primarily the result of higher margin rates at new retail stores added in 2016. Retail gross profit is determined based on the Company’s wholesale acquisition cost of product, not ARH’s acquisition cost which includes a markup from the Company.

Fiscal Year

Wholesale gross profit for fiscal 2016 was $595.0 million, an increase of $5.9 million from fiscal 2015. The wholesale gross margin percentage was 12.2 percent of wholesale revenues in fiscal 2016, a slight decrease from the fiscal 2015 gross margin percentage of 12.3 percent.

Retail gross profit for fiscal 2016 was $117.8 million, an increase of $5.2 million from fiscal 2015. The retail gross margin percentage was 44.9 percent of retail revenues in fiscal 2016, up slightly from 44.7 percent in fiscal 2015.

Expenses

Fourth Quarter

Wholesale operating expenses for the fourth quarter of 2016 were essentially unchanged from the fourth quarter of 2015. As a result, wholesale operating expenses decreased to 9.7 percent of wholesale revenues in the fourth quarter of 2016 from 10.2 percent of wholesale revenues in the fourth quarter of 2015.

Retail operating expenses of $24.6 million increased $0.8 million from the fourth quarter of 2015. The increase was primarily driven by expenses from new retail stores added in 2016. Retail operating expenses as a percent of retail revenues decreased to 38.2 percent in the fourth quarter of 2016 from 39.8 percent in the fourth quarter of 2015.

During the fourth quarter of 2016, the Company recorded additional warehouse facility closure costs of $2.5 million related to the previous closure of ARH’s leased distribution center in Lenexa, Kansas. There were no warehouse facility closure costs recorded in the fourth quarter of 2015.

Fiscal Year

Wholesale operating expenses increased $7.4 million, or 1.7 percent, for fiscal 2016 as compared to fiscal 2015. The increase in 2016 was primarily due to additional expense associated with the increase in wholesale merchandise revenue. As a percentage of wholesale revenues, wholesale operating expenses remained consistent at 9.0 percent in both fiscal 2016 and 2015.

Retail operating expenses of $99.0 million increased $3.3 million, or 3.4 percent, in fiscal 2016 as compared to fiscal 2015. The increase was primarily driven by expenses from new retail stores added in 2016. Retail operating expenses as a percent of retail revenues decreased to 37.7 percent in fiscal 2016 from 38.0 percent in fiscal 2015.

During fiscal 2016, the Company recorded additional warehouse facility closure costs of $3.3 million related to the previous closure of ARH’s leased distribution center in Lenexa, Kansas. Fiscal 2015 warehouse facility closure costs were $3.7 million related to the closure of this same ARH distribution center and the settlement of a withdrawal liability for the multi-employer pension fund that covered former union employees at the closed Retail Support Center in Toledo, Ohio.

Balance Sheet

Receivables increased $25.6 million from the prior year end primarily as a result of higher trade receivables driven by an increase in fourth quarter wholesale revenues.

Inventories increased $26.3 million from the prior year end primarily due to a planned increase in outdoor living merchandise as well as the increase in the number of ARH stores.

Debt decreased $54.6 million versus the prior year end as a result of cash provided by the Company’s operating activities during the past twelve months.

About Ace Hardware

For more than 90 years, Ace Hardware has been known as the place with the helpful hardware folks in thousands of neighborhoods across America, providing customers with a more personal kind of helpful. In 2016, Ace ranked “Highest in Customer Satisfaction with Home Improvement Retail Stores, Ten years in a Row,” according to J.D. Power. With more than 4,900 hardware stores locally owned and operated across the globe, Ace is the largest retailer-owned hardware cooperative in the world. Headquartered in Oak Brook, Ill., Ace and its subsidiaries currently operate 17 distribution centers in the U.S. and also have distribution capabilities in Ningbo, China; Colon, Panama; and Dubai, United Arab Emirates. Its retailers' stores are located in all 50 states, the District of Columbia and approximately 60 countries. For more information on Ace, visit www.acehardware.com or visit our newsroom at newsroom.acehardware.com.

| ACE HARDWARE CORPORATION | ||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||

| (In millions) | ||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| December 31, | January 2, | December 31, | January 2, | |||||||||||||

| 2016 | 2016 | 2016 | 2016 | |||||||||||||

| (13 Weeks) | (13 Weeks) | (52 Weeks) | (52 Weeks) | |||||||||||||

| Revenues: | ||||||||||||||||

| Wholesale revenues | $ | 1,167.2 | $ | 1,104.2 | $ | 4,863.2 | $ | 4,793.3 | ||||||||

| Retail revenues | 64.4 | 59.8 | 262.3 | 251.7 | ||||||||||||

| Total revenues | 1,231.6 | 1,164.0 | 5,125.5 | 5,045.0 | ||||||||||||

| Cost of revenues: | ||||||||||||||||

| Wholesale cost of revenues | 1,033.2 | 982.3 | 4,268.2 | 4,204.2 | ||||||||||||

| Retail cost of revenues | 35.5 | 33.6 | 144.5 | 139.1 | ||||||||||||

| Total cost of revenues | 1,068.7 | 1,015.9 | 4,412.7 | 4,343.3 | ||||||||||||

| Gross profit: | ||||||||||||||||

| Wholesale gross profit | 134.0 | 121.9 | 595.0 | 589.1 | ||||||||||||

| Retail gross profit | 28.9 | 26.2 | 117.8 | 112.6 | ||||||||||||

| Total gross profit | 162.9 | 148.1 | 712.8 | 701.7 | ||||||||||||

| Distribution operations expenses | 31.8 | 33.6 | 134.7 | 131.7 | ||||||||||||

| Selling, general and administrative expenses | 43.2 | 45.5 | 167.1 | 166.1 | ||||||||||||

| Retailer success and development expenses | 38.3 | 33.7 | 138.4 | 135.0 | ||||||||||||

| Retail operating expenses | 24.6 | 23.8 | 99.0 | 95.7 | ||||||||||||

| Warehouse facility closure costs | 2.5 | - | 3.3 | 3.7 | ||||||||||||

| Total operating expenses | 140.4 | 136.6 | 542.5 | 532.2 | ||||||||||||

| Operating income | 22.5 | 11.5 | 170.3 | 169.5 | ||||||||||||

| Interest expense | (3.2 | ) | (3.2 | ) | (12.8 | ) | (15.8 | ) | ||||||||

| Interest income | 0.9 | 1.0 | 3.4 | 3.4 | ||||||||||||

| Other income, net | 1.4 | 1.3 | 5.7 | 6.6 | ||||||||||||

| Income tax (expense) benefit | (0.1 | ) | 1.5 | (5.4 | ) | (7.5 | ) | |||||||||

| Net income | 21.5 | 12.1 | 161.2 | 156.2 | ||||||||||||

| Less: net (loss) income attributable to noncontrolling interests | - | (0.5 | ) | 0.3 | 2.0 | |||||||||||

| Net income attributable to Ace Hardware Corporation | $ | 21.5 | $ | 12.6 | $ | 160.9 | $ | 154.2 | ||||||||

| Patronage distributions accrued | $ | 21.3 | $ | 13.2 | $ | 157.9 | $ | 145.9 | ||||||||

| Patronage distributions accrued for third party retailers | $ | 19.1 | $ | 11.1 | $ | 152.8 | $ | 141.3 | ||||||||

| ACE HARDWARE CORPORATION | |||||||

| CONSOLIDATED BALANCE SHEETS | |||||||

| (In millions, except share data) | |||||||

| December 31, | January 2, | ||||||

| 2016 | 2016 | ||||||

| Assets | |||||||

| Cash and cash equivalents | $ | 16.8 | $ | 11.3 | |||

| Marketable securities | 49.1 | 47.1 | |||||

| Receivables, net of allowance for doubtful accounts of $6.9 and $8.3, respectively | 400.9 | 375.3 | |||||

| Inventories | 740.8 | 714.5 | |||||

| Prepaid expenses and other current assets | 42.4 | 45.1 | |||||

| Total current assets | 1,250.0 | 1,193.3 | |||||

| Property and equipment, net | 340.0 | 318.1 | |||||

| Notes receivable, net of allowance for doubtful accounts of $7.7 and $8.7, respectively | 9.4 | 11.8 | |||||

| Goodwill and other intangible assets | 35.8 | 35.3 | |||||

| Other assets | 93.5 | 98.7 | |||||

| Total assets | $ | 1,728.7 | $ | 1,657.2 | |||

| Liabilities and Equity | |||||||

| Current maturities of long-term debt | $ | 36.4 | $ | 27.2 | |||

| Accounts payable | 629.7 | 552.5 | |||||

| Patronage distributions payable in cash | 62.2 | 57.5 | |||||

| Patronage refund certificates payable | 6.9 | 8.6 | |||||

| Accrued expenses | 157.6 | 172.9 | |||||

| Total current liabilities | 892.8 | 818.7 | |||||

| Long-term debt | 178.4 | 242.2 | |||||

| Patronage refund certificates payable | 60.9 | 41.3 | |||||

| Other long-term liabilities | 63.3 | 58.9 | |||||

| Total liabilities | 1,195.4 | 1,161.1 | |||||

| Member Retailers’ Equity: | |||||||

| Class A voting common stock, $1,000 par value, 10,000 shares authorized, 2,726 and 2,734 issued and outstanding, respectively | 2.7 | 2.7 | |||||

| Class C nonvoting common stock, $100 par value, 6,000,000 shares authorized, 4,132,170 and 3,756,627 issued and outstanding, respectively | 413.2 | 375.7 | |||||

| Class C nonvoting common stock, $100 par value, issuable to retailers for patronage distributions, 523,158 and 564,155 shares issuable, respectively | 52.3 | 56.4 | |||||

| Contributed capital | 18.2 | 20.7 | |||||

| Retained earnings | 37.2 | 28.4 | |||||

| Accumulated other comprehensive income | 0.5 | 0.2 | |||||

| Equity attributable to Ace member retailers | 524.1 | 484.1 | |||||

| Equity attributable to noncontrolling interests | 9.2 | 12.0 | |||||

| Total equity | 533.3 | 496.1 | |||||

| Total liabilities and equity | $ | 1,728.7 | $ | 1,657.2 | |||

| ACE HARDWARE CORPORATION | ||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

| (In millions) | ||||||||

| Twelve Months Ended | ||||||||

| December 31, | January 2, | |||||||

| 2016 | 2016 | |||||||

| (52 Weeks) | (52 Weeks) | |||||||

| Operating Activities | ||||||||

| Net income | $ | 161.2 | $ | 156.2 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 51.1 | 50.2 | ||||||

| Amortization of deferred financing costs | 0.5 | 0.7 | ||||||

| Loss on early extinguishment of debt | - | 2.2 | ||||||

| (Gain) loss on the disposal of assets, net | (0.1 | ) | 0.1 | |||||

| (Credit) provision for doubtful accounts | (0.8 | ) | 0.1 | |||||

| Warehouse facility closure costs | 0.1 | 0.8 | ||||||

| Other, net | (0.3 | ) | 0.1 | |||||

| Changes in operating assets and liabilities, exclusive of effect of acquisitions: | ||||||||

| Receivables | (43.7 | ) | (18.3 | ) | ||||

| Inventories | (23.8 | ) | (17.8 | ) | ||||

| Other current assets | 2.7 | (3.2 | ) | |||||

| Other long-term assets | 2.4 | (10.8 | ) | |||||

| Accounts payable and accrued expenses | 61.8 | (40.4 | ) | |||||

| Other long-term liabilities | 4.9 | (9.5 | ) | |||||

| Deferred taxes | 1.2 | 8.6 | ||||||

| Net cash provided by operating activities | 217.2 | 119.0 | ||||||

| Investing Activities | ||||||||

| Purchases of marketable securities | (6.5 | ) | (11.5 | ) | ||||

| Proceeds from sale of marketable securities | 5.1 | 5.6 | ||||||

| Purchases of property and equipment | (70.8 | ) | (41.9 | ) | ||||

| Cash paid for acquired businesses, net of cash acquired | (4.2 | ) | (5.6 | ) | ||||

| (Increase) decrease in notes receivable, net | (1.3 | ) | 2.2 | |||||

| Other, net | 0.1 | 0.1 | ||||||

| Net cash used in investing activities | (77.6 | ) | (51.1 | ) | ||||

| Financing Activities | ||||||||

| Net (payments) borrowings under revolving lines of credit | (56.4 | ) | 150.2 | |||||

| Principal payments on long-term debt | (8.1 | ) | (177.0 | ) | ||||

| Payments of deferred financing costs | - | (1.1 | ) | |||||

| Payments of cash portion of patronage distribution | (53.7 | ) | (48.9 | ) | ||||

| Payments of patronage refund certificates | (9.9 | ) | (6.7 | ) | ||||

| Purchase of noncontrolling interests | (5.2 | ) | - | |||||

| Repurchase of stock | (1.7 | ) | (3.9 | ) | ||||

| Other, net | 0.9 | 1.0 | ||||||

| Net cash used in financing activities | (134.1 | ) | (86.4 | ) | ||||

| Increase (decrease) in cash and cash equivalents | 5.5 | (18.5 | ) | |||||

| Cash and cash equivalents at beginning of period | 11.3 | 29.8 | ||||||

| Cash and cash equivalents at end of period | $ | 16.8 | $ | 11.3 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid | $ | 10.5 | $ | 9.8 | ||||

| Income taxes paid | $ | 3.7 | $ | 5.4 | ||||