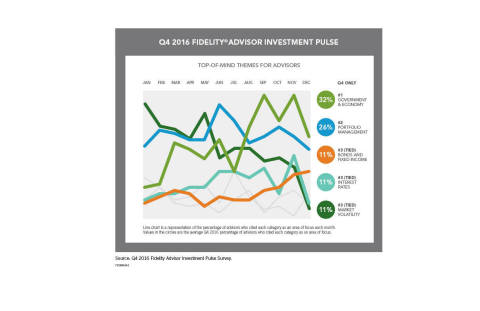

BOSTON--(BUSINESS WIRE)--Regulatory and political developments remained top-of-mind for financial advisors in Q4 2016, according to the latest Fidelity® Advisor Investment Pulse survey.1 Advisors continued to keep their eye on the Department of Labor’s (DOL) fiduciary rule on investment advice as well as the election results, with more than 32 percent surveyed citing topics relating to government and economy as areas of focus. The latest results of the Fidelity Advisor Investment Pulse survey were released today by Fidelity Institutional Asset Management, a distribution and client service organization dedicated to meeting the investment needs of financial advisors, institutions, and consultants.

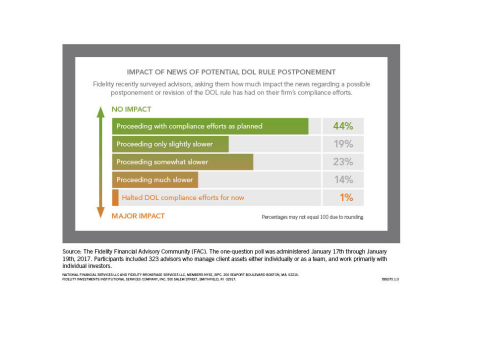

With growing discussions on the DOL fiduciary rule toward the end of the year and into early 2017, Fidelity conducted a separate poll of advisors2 in January to see how a potential postponement would impact their plans to comply. According to the poll, 44 percent did not slow down their plans, while another 19 percent were proceeding only slightly slower with their plans.

“Advisors continued to focus on implementation and have firmly shifted their focus from the ‘what’ to the ‘how,’” said Scott E. Couto, president, Fidelity Institutional Asset Management. “While they have invested time, energy and resources to understanding the rule and its implications, they have now directed their attention to what it means for their practices, including how to implement the necessary changes, regardless of any potential regulatory developments.”

Implementing the DOL Fiduciary Rule as an Opportunity

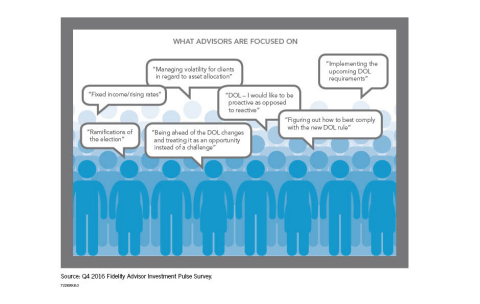

Many

advisors who took part in the Q4 Fidelity Advisor Investment Pulse

survey were focused on strategic and tactical changes related to how

they run their practices and work with their clients, including

identifying potential new clients as they move toward more fee-based

business, as well as balancing face-time with clients and the time

needed to complete compliance requirements.

As advisors evaluate their businesses and how they can continue to work toward managing the regulatory changes under discussion, they may find it useful to identify opportunities where they can better serve their clients and commit to a client-centric practice:

1. Discuss the regulatory changes and their implications with clients: Advisors can consider establishing a framework to discuss the effects of regulatory changes with clients. Quarterly meetings or client reviews may be an appropriate time to explain the changes and what they may mean to clients.

2. Have a disciplined process: A deliberate, defensible and documented process on how investment options are evaluated may increase client confidence in recommendations. It is important that advisors look across the different product features and benefits and a structured process for documenting client interactions, including any recommendations or guidance the advisor provides, can help frame discussions around fees and services.

3. Optimize productivity: By being efficient at investment management, advisors can turn their attention toward areas where they can deliver more value. For example, they can gain scale and efficiency in managing investments by considering model portfolios and reviewing their manager selection process. This will free up time to provide goals-based planning.

4. Use the opportunity to get to know clients better: With more time to demonstrate their value, advisors may find it useful to leverage the best interest standard, under the DOL rule, to strengthen client relationships. By documenting and formalizing discussions about goals, risk tolerance, investment time frame, return objectives, tax restrictions, and other life circumstances, advisors can get to know their clients better.

“While there may be further developments which may impact the DOL fiduciary rule, the reality is that the rule is only accelerating – not causing – some of the fundamental trends that had already been taking hold across the retirement industry: the shift toward greater transparency, fee-based compensation, lower-cost products and digital advice solutions,” added Couto. “These will likely remain with or without the DOL rule being applicable, in part due to changing consumer preferences and new technologies. Regardless of the fate of the DOL rule, advisors may find that proactively taking action now will better prepare them for the future.”

Other Findings from the Q4 Advisor Investment Pulse Survey

Government

and economy was in the top three areas of focus for advisors throughout

2016, with a steady increase throughout the year from 28 percent in Q3,

21 percent in Q2 and 16 percent in Q1.

In addition to government and economy, there were other top-of-mind themes for advisors in Q4 2016:

- No. 2: Portfolio management (26 percent of respondents citing it as an area of focus, vs. 25 percent in Q3)

- No. 3 (tied): Bonds and fixed income (11 percent vs. 14 percent in Q3)

- No. 3 (tied): Interest rates (11 percent vs. 13 percent in Q3)

- No. 3 (tied): Market volatility ( 11 percent vs. 18 percent in Q3)

Alongside government and economy, portfolio management remained a top theme across 2016. Given constant changes in terms of regulatory reforms, political and macroeconomic shifts, and market volatility, many advisors directed their attention toward portfolio management to help clients navigate the uncertainty. As it became clear that the Federal Reserve would hike interest rates in December, attention on rates began to shift toward the role of bonds and fixed income in clients’ portfolios and how these asset classes can help clients meet their long-term financial objectives.

The Fidelity Advisor Investment Pulse is a survey that captures the investment topics on the minds of around 250 advisors in order to identify common concerns and deliver resources to help them navigate changing market conditions. Fidelity has been tracking advisor sentiment about investing concerns and opportunities since April 2012. This proprietary research enables Fidelity to provide advisors with timely perspectives from their peers, and offer tools to take advantage of the investment opportunities that exist today.

About the Fidelity Advisor Investment Pulse

The

Advisor Investment Pulse is an ongoing primary research effort that

captures the views of more than 1,000 Fidelity Institutional Asset

Management advisor clients annually. All Fidelity Institutional Asset

Management advisor clients in the broker-dealer and registered

investment advisor communities are asked to participate in the online

survey. These advisors serve a range of clients, including individual

investors, businesses, plan sponsors and institutions. Respondents are

asked an open-ended question: “Thinking about the investing environment

and outlook, and the potential impact on your client portfolios, what

investment challenge or opportunity would you say is top-of-mind for you

right now?”

The survey reports top-of-mind themes of most concern to financial advisors in both their practices and in the financial markets. These themes are distilled from individual financial advisor comments. The chart reflects the most current five themes that represent the most widely held views. Given the variability of the number of responses over time, and the ongoing nature of this effort, confidence levels will also be variable.

About Fidelity Institutional Asset ManagementSM

Fidelity

Institutional Asset ManagementSM (FIAMSM) is one

of the largest organizations serving the U.S. institutional marketplace.

It works with financial advisors and advisory firms, offering them

resources to help investors plan and achieve their goals; it also works

with institutions and consultants to meet their varying and custom

investment needs. Fidelity Institutional Asset Management provides

useful strategies, enabling its clients to stand out in the marketplace,

and is a gateway to Fidelity’s original insight and diverse investment

capabilities across equity, fixed income, high-income and global asset

allocation.

Fidelity Institutional Asset Management is a division of Fidelity Investments.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$5.7 trillion, including managed assets of $2.1 trillion as of December

31, 2016, we focus on meeting the unique needs of a diverse set of

customers: helping more than 25 million people invest their own life

savings, nearly 20,000 businesses manage employee benefit programs, as

well as providing more than 12,500 financial advisory firms with

investment and technology solutions to invest their own clients’ money.

Privately held for 70 years, Fidelity employs 45,000 associates who are

focused on the long-term success of our customers. For more information

about Fidelity Investments, visit https://www.fidelity.com/about.

Not NCUA or NCUSIF insured. May lose value. No credit union guarantee.

Diversification does not ensure a profit or guarantee against a loss. Investing involves risk, including risk of loss. Past performance is no guarantee of future returns.

In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation, credit, and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities. Income exempt from federal income tax may be subject to state or local tax. All or a portion of a municipal fund’s income may be subject to the federal alternative minimum tax. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic and political risks.

Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. Because of their narrow focus, sector securities tend to be more volatile than funds that diversify across many sectors and companies. Each sector security is also subject to the additional risks associated with its particular industry.

Asset allocation does not ensure a profit or guarantee against a loss. The ability of each fund to meet its investment objective is directly related to its target asset allocation among the underlying funds and the ability of those funds to meet their investment objectives.

The third-party trademarks and service marks are the property of their respective owners. All other trademarks and service marks are the property of FMR LLC or an affiliated company.

Fidelity Clearing & Custody SolutionsSM provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 200 Seaport Boulevard, Boston, MA 02210.

Products and services provided through Fidelity Institutional Asset ManagementSM (FIAMSM) to investment professionals, plan sponsors and institutional investors by Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield, RI 02917.

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact your investment professional or visit institutional.fidelity.com for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

789214.3.0

© 2017 FMR LLC. All rights reserved.

1 See page 5 for survey details

2 The

Fidelity Financial Advisory Community (FAC) is a panel research program

that explores various topics of interest with advisors throughout the

year. Research engagements are conducted via online surveys and are kept

blind (Fidelity not identified). This one-question poll was administered

January 17th through January 19th, 2017. Participants included 323

advisors who manage client assets either individually or as a team, and

work primarily with individual investors. These advisors are from a mix

of banks, independent broker-dealers, insurance companies, regional

broker-dealers, RIAs, and national brokerage firms (commonly referred to

as wirehouses), with findings weighted to reflect industry composition.

The panel is maintained and all research conducted by an independent

firm not affiliated with Fidelity Investments.