BOSTON--(BUSINESS WIRE)--Institutional investors worldwide are expecting to make more asset allocation changes in the next one to two years than in 2012 and 2014, according to the new Fidelity® Global Institutional Investor Survey. Now in its 14th year, the Fidelity Global Institutional Investor Survey is the world’s largest study of its kind examining the top-of-mind themes of institutional investors. Survey respondents included 933 institutions in 25 countries with $21 trillion in investable assets.

The anticipated shifts are most remarkable with alternative investments, domestic fixed income, and cash. Globally, 72 percent of institutional investors say they will increase their allocation of illiquid alternatives in 2017 and 2018, with significant numbers as well for domestic fixed income (64 percent), cash (55 percent), and liquid alternatives (42 percent).

However, institutional investors in some regions are bucking the trend seen in other parts of the world. Many institutional investors in the U.S. are, on a relative basis, adopting a wait-and-see approach. For example, compared to 2012, the percentage of U.S. institutional investors expecting to move away from domestic equity has fallen significantly from 51 to 28 percent, while the number of respondents who expect to increase their allocation to the same asset class has only risen from 8 to 11 percent.

“With 2017 just around the corner, the asset allocation outlook for global institutional investors appears to be driven largely by the local economic realities and political uncertainties in which they’re operating,” said Scott E. Couto, president, Fidelity Institutional Asset Management℠. “The U.S. is likely to see its first rate hike in 12 months, which helps to explain why many in the country are hitting the pause button when it comes to changing their asset allocation.

“Institutions are increasingly managing their portfolios in a more dynamic manner, which means they are making more investment decisions today than they have in the past. In addition, the expectations of lower return and higher market volatility are driving more institutions into less commonly used assets, such as illiquid investments,” continued Couto. “For these reasons, organizations may find value in reexamining their investment decision-making process as there may be opportunities to bring more structure and accommodate the increased number of decisions, freeing up time for other areas of portfolio management and governance.”

Primary concerns for institutional investors

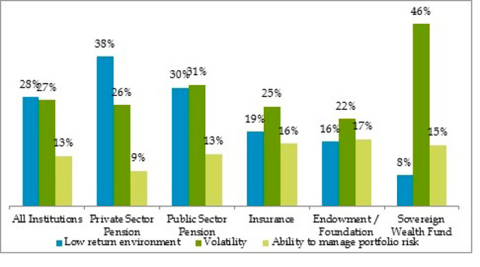

Overall, the

top concerns for institutional investors are a low-return environment

(28 percent) and market volatility (27 percent), with the survey showing

that institutions are expressing more worry about capital markets than

in previous years. In 2010, 25 percent of survey respondents cited a

low-return environment as a concern and 22 percent cited market

volatility.

“As the geopolitical and market environments evolve, institutional investors are increasingly expressing concern about how market returns and volatility will impact their portfolios,” said Derek Young, vice chairman of Fidelity Institutional Asset Management and president of Fidelity Global Asset Allocation. “Expectations that strengthening economies would build enough momentum to support higher interest rates and diminished volatility have not borne out, particularly in emerging Asia and Europe.”

Investment concerns also vary according to the institution type. Globally, sovereign wealth funds (46 percent), public sector pensions (31 percent), insurance companies (25 percent), and endowments and foundations (22 percent) are most worried about market volatility. However, a low-return environment is the top concern for private sector pensions (38 percent).

Continued confidence among institutional investors

Despite

their concerns, nearly all institutional investors surveyed (96 percent)

believe that they can still generate alpha over their benchmarks to meet

their growth objectives. The majority (56 percent) of survey respondents

say growth, including capital and funded status growth, remain their

primary investment objective, similar to 52 percent in 2014.

On average, institutional investors are targeting to achieve approximately a 6 percent required return. On top of that, they are confident of generating 2 percent alpha every year, with roughly half of their excess return over the next three years coming from shorter-term decisions such as individual manager outperformance and tactical asset allocation.

“Despite uncertainty in a number of markets around the world, institutional investors remain confident in their ability to generate investment returns, with a majority believing they enjoy a competitive advantage because of confidence in their staff or access to better managers,” added Young. “More importantly, these institutional investors understand that taking on more risk, including moving away from public markets, is just one of many ways that can help them achieve their return objectives. In taking this approach, we expect many institutions will benefit in evaluating not only what investments are made, but also how the investment decisions are implemented.”

Improving the Investment Decision-Making Process

There are a

number of similarities in institutional investors’ decision-making

process:

- Nearly half (46 percent) of institutional investors in Europe and Asia have changed their investment approach in the last three years, although that number is smaller in the Americas (11 percent). Across the global institutional investors surveyed, the most common change was to add more inputs – both quantitative and qualitative – to the decision-making process.

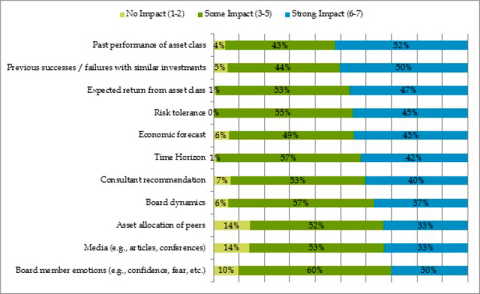

- A large number of institutional investors have to grapple with behavioral biases when helping their institutions make investment decisions. Around the world, institutional investors report that they consider a number of qualitative factors when they make investment recommendations. At least 85 percent of survey respondents say board member emotions (90 percent), board dynamics (94 percent), and press coverage (86 percent) have at least some impact on asset allocation decisions, with around one-third reporting that these factors have a significant impact.

“Institutional investors often assess quantitative factors such as performance when making investment recommendations, while also managing external dynamics such as the board, peers and industry news as their institutions move toward their decisions. Whether it’s qualitative or quantitative factors, institutional investors today face an information overload,” said Couto. “To keep up with the overwhelming amount of data, institutional investors should consider revisiting and evolving their investment process.

“A more disciplined investment process may help them achieve more efficient, effective and repeatable portfolio outcomes, particularly in a low-return environment characterized by more expected asset allocation changes and a greater global interest in alternative asset classes,” added Couto.

The complete report with a wealth of charts is available on request.

For

additional materials on the survey, go to institutional.fidelity.com/globalsurvey.

About the Survey

Fidelity

Institutional Asset ManagementSM conducted the Fidelity

Global Institutional Investor Survey of institutional investors in the

summer of 2016, including 933 investors in 25 countries (174 U.S.

corporate pension plans, 77 U.S. government pension plans, 51

non-profits and other U.S. institutions, 101 Canadian, 20 other North

American, 350 European, 150 Asian, and 10 African institutions including

pensions, insurance companies and financial institutions). Assets under

management represented by respondents totaled more than USD $21

trillion. The surveys were executed in association with Strategic

Insight, Inc. in North America and the Financial Times in all other

regions. CEOs, COOs, CFOs, and CIOs responded to an online questionnaire

or telephone inquiry.

About Fidelity Institutional Asset Management℠

Fidelity

Institutional Asset Management℠ (FIAM) is one of the largest

organizations serving the U.S. institutional marketplace. It works with

financial advisors and advisory firms, offering them resources to help

investors plan and achieve their goals; it also works with institutions

and consultants to meet their varying and custom investment needs.

Fidelity Institutional Asset Management℠ provides actionable strategies,

enabling its clients to stand out in the marketplace, and is a gateway

to Fidelity’s original insight and diverse investment capabilities

across equity, fixed income, high‐income and global asset allocation.

Fidelity Institutional Asset Management is a division of Fidelity

Investments.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$5.5 trillion, including managed assets of $2.1 trillion as of October

31, 2016, we focus on meeting the unique needs of a diverse set of

customers: helping more than 25 million people invest their own life

savings, nearly 20,000 businesses manage employee benefit programs, as

well as providing nearly 10,000 advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for 70 years, Fidelity employs 45,000 associates who are focused on the

long-term success of our customers. For more information about Fidelity

Investments, visit https://www.fidelity.com/about.

The information contained herein is general in nature, is provided for informational purposes only and is not legal advice. Fidelity does not provide advice of any kind.

The third-party trademarks and service marks are the property of their respective owners. All other trademarks and service marks are the property of FMR LLC or an affiliated company.

Fidelity Clearing & Custody Solutions provides clearing, custody or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC. Members NYSE, SIPC.

Products and services provided through Fidelity Institutional Asset Management (FIAM) to investment professionals, plan sponsors and institutional investors by Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield, RI 02917.

777378.3.0

© 2016 FMR LLC. All rights reserved.

1 Other responses: impact of regulatory and accounting changes (12 percent), rising interest rates (9 percent), Current funded status (7 percent), Ability of asset managers to generate excess return (4 percent), Other (1 percent).