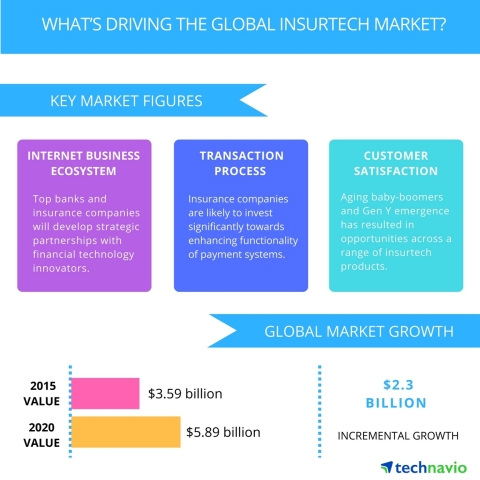

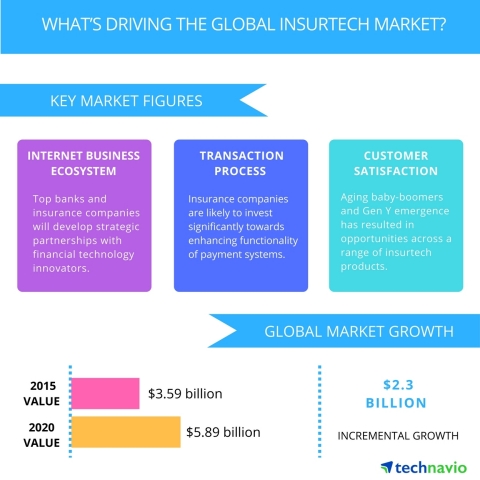

LONDON--(BUSINESS WIRE)--Technavio analysts forecast the global insurtech market to grow at a CAGR of more than 10% during the forecast period, according to their latest report.

The research study covers the present scenario and growth prospects of the global insurtech market for 2016-2020. To calculate the market size, the report has considered the investments made in insurtech platforms in the Americas, APAC, and EMEA.

Several venture capital firms are investing in insurtech start-ups. The insurtech firms are leveraging the power of software to promote different insurance products and other portfolio management tasks. These start-ups are set up with a goal to disrupt the less technologically-savvy corporations. The use of big data and powerful analytics tools have led to investment opportunities and strategies. These opportunities and strategies were available only to high-net-worth individuals with access to insurance services. These were earlier available on smartphone devices with a reach to all.

Request a sample report: http://www.technavio.com/request-a-sample?report=54539

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio analysts highlight the following three factors that are contributing to the growth of the global insurtech market:

- Growth of Internet-based business ecosystem

- Rationalization of transaction process

- Increased need for customer satisfaction

Growth of Internet-based business ecosystem

Many top banks and insurance companies are expected to enhance their offerings or develop strategic partnerships with financial technology innovators to provide innovative payment solutions to customers. The advances and innovations in technologies and different financial, technological platforms have also increased the customers' need for better online experiences. Many top banks, card issuers, app developers, insurance companies face heavy competition to reach the leading position and grow their footprints in the market.

Amit Sharma, a lead analyst at Technavio, says, “The competition among different market participants is expected to intensify during the forecast period with the rise in the use of smartphone users for entering the online space. International players are expected to grow during the forecast period through various M&A. As these start-ups attract more users and media coverage, investors are eagerly waiting for the next-generation disruptive challengers.”

Rationalization of transaction process

The payment systems show significant changes in the past two decades. Due to the emergence of several technologies about the payment systems, the transaction process became very easier for the insurance companies. For instance, electronic payment systems are widely used by the insurance companies. In addition, the integration is expected to evolve in the payment system. The evolution of payment systems is predicted to grow further during the forecast period. Many insurance companies are likely to invest significant amount toward the adoption of advanced technologies, which is enhancing their functionality of payment systems.

“Due to the rise in several cyber-attacks and security threats over the last five years, many insurance firms started to spend a significant amount of time and money towards technological risk management systems to identify, manage, optimize and mitigate risk,” adds Amit.

Increased need for customer satisfaction

The rise in the aging baby-boomer population and the emergence of Generation Y has resulted in opportunities across a range of insurtech products. With the emergence of Generation Y, who have high disposable incomes and are in the process of acquiring assets, there is a need not only for insurance security support but personalized services. The aging of the population is a prominent driver taking shape in the developed countries. This factor coupled with the high penetration for insurance firm's results in higher demand for insurtech products like life insurance and retirement product plans.

The market is expected to grow rapidly with increasing demand in the life insurance products segment through the insurtech platforms. The shift in demography has pushed many insurance firms to make use of actuarial and sales model for better pricing through the insurtech platforms. The rise in population of baby-boomers and the emerging generation Y are sparking growth opportunities for different insurance products.

Top vendors:

- Friendsurance

- Guevara

- Oscars

- Zhong An

Browse Related Reports:

- Global Microinsurance Market 2016-2020

- Global Insurance Brokerage Market 2016-2020

- Insurance Technology Market in Europe 2015-2019

Do you need a report on a market in a specific geographical cluster or country but can’t find what you’re looking for? Don’t worry, Technavio also takes client requests. Please contact enquiry@technavio.com with your requirements and our analysts will be happy to create a customized report just for you.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.