OMAHA, Neb.--(BUSINESS WIRE)--First comes love, then comes marriage, then comes the inevitable conversation about money. The TD Ameritrade Millennials and Money Survey examines the relationships between Savers and Spenders and the financial considerations taken when choosing a potential spouse. The survey also reveals some key differences in financial habits between men and women. Of the more than 2,100 American adults surveyed:

- The majority of Savers prefer a spouse who is also a Saver (61 percent Saver men, 60 percent Saver women)

- A majority of Spender women (59 percent) married a Saver spouse, as opposed to 39 percent of Spender men with a Saver spouse

- One benefit 6 in 10 Savers noted for being married to another Saver is that it prevents arguments

Does the Saver/Spender distinction matter more later in life?

- Two-thirds of Boomer Savers are married to Savers, compared to 52 percent of Millennial Savers

- Forty percent of Boomer Savers say they would not be happy in a relationship with a Spender vs. 23 percent of Millennial Savers

“It’s more about attaining the right balance than finding an identical match,” says Matt Sadowsky, director of retirement at TD Ameritrade. “It becomes more and more important over time for spouses to be aligned on how to manage their finances, especially when they are living off their nest egg in retirement. It’s not critical that both spouses be Spenders or both be Savers. But it is critical that there is an open dialogue between the two about what retirement looks like for them and a shared vision and plan for their future.”

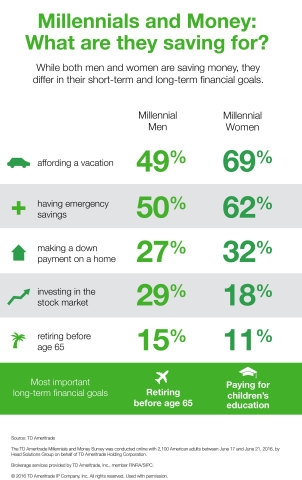

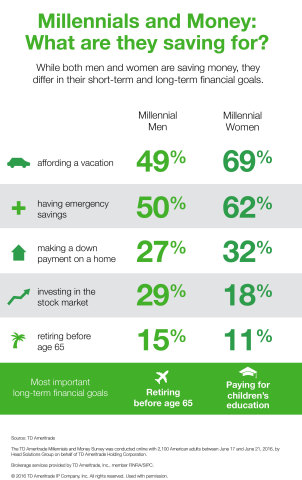

Sixty percent of Millennial Savers say they save in order to meet their financial goals. While Millennial men and women share several common long-term goals including saving for a retirement, 56 percent of Millennial women save for non-retirement items versus 46 percent of Millennial men.

- More Millennial women said saving for a vacation is top of their list (69 percent), while 49 percent of Millennial men are concerned with affording a vacation. Millennial men are more likely to put a vacation on their credit card (22 percent vs. 19 percent of women)

- Millennial women appear to be more concerned with the potential for a financial disruption with 62 percent saving for an emergency vs. 50 percent of Millennial men

- Twenty-nine percent of Millennial men are investing in the stock market, which significantly outweighs the 18 percent of Millennial women

- About one-third of Millennials are saving for a down payment on a home (32 percent Millennial women, 27 percent Millennial men)

Millennial and Boomer women have different attitudes toward money. Boomer women are more financially conservative and strict about saving, whereas Millennial women are more like men in how they save, spend and help support their families.

- Millennial women save to help their families (58 percent), while Boomer women mostly save for themselves with only 37 percent saving to help their families

- Fifty-three percent of Millennial women are most anxious about having debt vs. 39 percent of Boomer women

- Millennial women (41 percent) would choose to spend $200 on an experience they enjoy vs. 28 percent of Boomer women

Millennial men and Boomer men are similar in how they spend, however, the older men save more and allocate more money to family-related expenses. Millennial men need the most money in order to be happy and feel the greatest pressure to spend.

- At an average of $925 a month, Boomer men save the most for retirement followed by Millennial men at an average of $593

- Boomer men spend $130 more per month on groceries than Millennial men, $105 more on utilities, $45 more on technology, and $50 on eating out and entertainment

- More Millennial men (18 percent) like to spend money in order to make a good impression vs. 3 percent of Boomer men

- Millennial men need the most money in order to be happy saying they require a minimum income of $73,000

“Millennial men’s spending habits are vastly different than their female partners. Men want to enjoy life by spending money now because they’re confident they can make up the money later,” says Dara Luber, senior manager of retirement at TD Ameritrade. “Women appear to have more anxiety over spending and fear they will not be able to make up a gap in their savings. Part of this reason could be their fear of debt since they tend to earn less over their lifetime.”

TD Ameritrade’s 2016 Goal Planning Survey shows that people who have a savings plan with specific goals are more likely to make progress toward fulfilling their savings or investing targets. Not sure how to get started? Investors of any age and experience level can benefit from a free, comprehensive financial goal planning session with an investment consultant at TD Ameritrade’s more than 100 branch locations. Visit tdameritrade.com/goalplanning.

About TD Ameritrade Holding Corporation

Millions of

investors and independent registered investment advisors (RIAs) have

turned to TD Ameritrade’s (Nasdaq: AMTD) technology,

people

and education

to help make investing and trading easier to understand and do. Online

or over the phone. In a branch or with an independent RIA. First-timer

or sophisticated trader. Our clients want to take control, and we help

them decide how — bringing Wall Street to Main Street for more than 40

years. An official

sponsor of the 2014 and 2016 U.S. Olympic and Paralympic Teams, TD

Ameritrade has time and again been recognized

as a leader in investment services. Please visit TD Ameritrade’s newsroom

or www.amtd.com

for more information.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org)

About Head Solutions Group

Head Solutions Group (U.S.) Inc.,

is a leading market research partner for Financial Services companies in

North America. With offices in New York, Toronto and Montreal, Head

delivers the deep customer insights that increase institutional

knowledge and propel business action. TD Ameritrade and Head Solutions

Group are separate and unaffiliated firms and are not responsible for

each other’s services or policies.

About the 2016 Millennials and Money Survey

A 20-minute

online survey was conducted with 2,100 American adults (half Boomers and

half Millennials) by Head Solutions Group, between June 17 to June 21,

2016, on behalf of TD Ameritrade Holding Corporation. The statistical

margin of error for the total sample of N=2,100 American adults within

the target group is +/- 2.1 percent. This means that, in 19 out of 20

cases, survey results will differ by no more than 2.1 percentage points

in either direction from what would have been obtained by the opinions

of all target group members in the U.S. Sample was drawn from major

regions in proportion to the U.S. Census. Generations used in this

report are defined according to the Pew Research Center. Millennials

(born 1981 to 1997, ages 18 to 35 in 2016) and Baby Boomers (born 1946

to 1964, ages 52 to 70 in 2016).

Source: TD Ameritrade Holding Corporation