BOSTON--(BUSINESS WIRE)--Fidelity Clearing & Custody Solutions (FCCS), the division of Fidelity Investments that provides clearing and custody to registered investment advisors (RIAs), retirement recordkeepers, broker-dealer firms, banks and insurance companies, today announced the introduction of a program focused on helping advisors strengthen their prospect and client experience from the very beginning: during the sales process. Fidelity’s Mystery Shopping program, the first of its kind offered by a custodian for financial advisors, starts with firms engaging with a third-party market research firm, which uses real investors – not actors – to pose as shoppers who meet a firm’s pre-defined client profile. Without revealing their involvement with the mystery shopping program, these individuals interact with the firm as if they were a prospect and then reveal what their experience was like: both the positive aspects and the shortcomings.

According to Cerulli, an exclusive or high-end image does not impress new clients like it may have in the past, with just 19 percent of advisors saying that was a reason a new client chose their practice. Rather, today, a warm and personable image (75 percent) and high-touch service (63 percent) make the strongest impact on clients choosing an advisory firm1.

“You cannot underestimate the power of a first impression. It’s critical for firms to have a good grasp on how prospects feel about them from the first click on their websites or first steps into their offices,” said David Canter, executive vice president, practice management and consulting, Fidelity Clearing & Custody Solutions. “Once in the door, the power of listening to those prospective clients is critical. Investors have many options for financial advice, and advisors need to be keenly aware of how they may ‘fit’ with each prospect. Mystery Shopping can provide that outside perspective to firms so they improve their first interactions with clients – not only for an improved client experience, but also more complete discovery for the firm.”

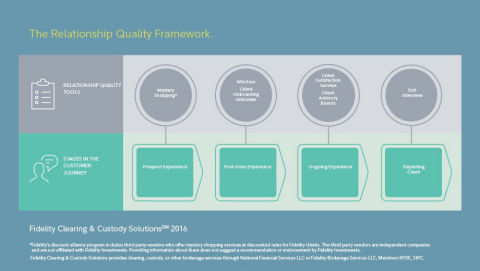

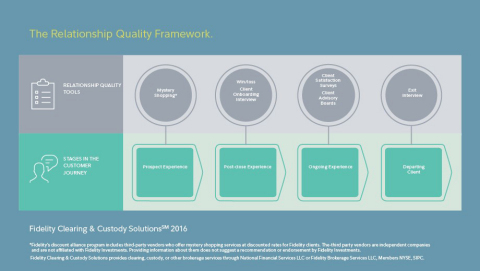

The Mystery Shopping program is part of Fidelity’s Relationship Quality Framework, an overall approach to help map a client experience to the stages of a client’s journey with a firm, starting with the prospect experience.

Fidelity’s Mystery Shopping program is a collaboration with HawkPartners and GfK, two market research firms that have extensive experience in mystery shopping for various industries outside of financial services. Firms that are existing Fidelity clients will have the opportunity to work with HawkPartners or GfK on the Mystery Shopping program at a discounted rate. In addition to the personalized feedback they receive from mystery shoppers about their firm, they will also have access to insights and case studies from other Fidelity clients that have participated, to further expand their knowledge as they evolve their client and prospect experience.

“The five firms that participated in the pilot of Fidelity’s Mystery Shopping program to date have all gained insight from the feedback and look forward to improving their closing ratios by putting key learnings into practice,” said Canter. “Firms often focus so intently on the day-to-day needs of their current clients that they may have blind spots in their business that are worth addressing.”

That outside perspective can uncover some surprising opportunities that some firm owners may miss, including:

- Missing key client details during the discovery process

- Touting a “personalized” experience while using an automated phone system

- Excluding key associates from the sales process

- Hosting a website that does not reflect the firm’s brand

- Understanding potential clients’ perceptions of an office setting

- Providing confusing directions to the firm’s office

“We have a culture of continuous improvement and learning and we're open to the feedback that could make us better,” explained Tyler Mayfield, chief operating office of Seattle-based Brighton Jones. “Fidelity’s Mystery Shopping program was an ideal research tool to uncover incredible insights that we’ve now translated into an improved approach for initial prospect conversations.”

For additional information on Fidelity’s Mystery Shopping experience with HawkPartners and GfK, visit Take the Mystery Out of Improving Your Sales Process white paper.

About Fidelity Investments

Fidelity’s

goal is to make financial expertise broadly accessible and effective in

helping people live the lives they want. With assets under

administration of $5.6 trillion, including managed assets of $2.1

trillion as of September 30, 2016, we focus on meeting the unique needs

of a diverse set of customers: helping more than 25 million people

invest their own life savings, nearly 20,000 businesses manage employee

benefit programs, as well as providing nearly 10,000 advisory firms with

investment and technology solutions to invest their own clients’ money.

Privately held for 70 years, Fidelity employs 45,000 associates who are

focused on the long-term success of our customers. For more information

about Fidelity Investments, visit https://www.fidelity.com/about.

About HawkPartners

HawkPartners

helps industry-leading businesses get more out of their marketing

efforts by exploring the factors influencing complex customer decisions

and turning insight into action. Founded in 2003, the firm is

headquartered in Boston, MA, with additional offices in New York,

Philadelphia and Washington, DC. For more information about

HawkPartners, please visit www.hawkpartners.com.

About GfK

GfK is the trusted

source of relevant market and consumer information that enables its

clients to make smarter decisions. More than 13,000 market research

experts combine their passion with GfK’s long-standing data science

experience. This allows GfK to deliver vital global insights matched

with local market intelligence from more than 100 countries. By using

innovative technologies and data sciences, GfK turns big data into smart

data, enabling its clients to improve their competitive edge and enrich

consumers’ experiences and choices. For more information, please visit www.gfk.com

or follow GfK on Twitter: https://twitter.com/GfK.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity does not provide advice of any kind.

Third party marks are the property of their respective owners; all other marks are the property of FMR LLC.

The third party service providers listed are independent companies and are not affiliated with Fidelity Investments. Listing them does not suggest a recommendation or endorsement by Fidelity Investments. The opinions expressed are those of the speakers and do not necessarily reflect those of Fidelity Investments.

Content provided and maintained by any third-party web site is not owned or controlled by Fidelity Investments. There is no form of a legal partnership, agency, affiliation, or similar relationship between HawkPartners, GfK or its affiliates or agents, and Fidelity Investments, nor is such a relationship created or implied by the information herein. An introduction to HawkPartners or GfK by Fidelity does not constitute an endorsement, recommendation, or opinion as to the appropriateness of any relationship between any financial advisors and HawkPartners, GfK, or its affiliates or agents, or any advertising, marketing, social media use, or communications as a result of a financial advisor’s decision to work with HawkPartners or GfK.

Fidelity Clearing & Custody Solutions provides clearing, custody, or

other brokerage services through National Financial Services LLC or

Fidelity Brokerage Services LLC, Members NYSE, SIPC.

Fidelity

Investments Institutional Services Company, Inc., 500 Salem Street,

Smithfield, RI 02917

778266.1.0

© 2016 FMR LLC. All rights reserved.

1 The Cerulli Report, Advisor Metrics 2015: Anticipating the Advisor Landscape in 2020. 2015 Cerulli Associates Inc., www.cerulli.com.