DENVER--(BUSINESS WIRE)--Gavekal Capital today introduced Knowledge Leaders Indexes in two new geographies, Developed World Ex-US and United States. The Gavekal Knowledge Leaders International Index is designed to capture the excess returns of highly innovative non-US companies, and the Gavekal Knowledge Leaders United States Index is designed to capture the excess returns of highly innovative US companies. In addition, the firm added two Knowledge Leaders Indexes consisting of foreign stocks in the form of American Depository Receipts (ADRs) designed for separately managed accounts: the Gavekal Knowledge Leaders Developed World ADR Index and the Gavekal Knowledge Leaders International ADR Index.

“The Knowledge Leaders Indexes are high active share, alpha-seeking indexes created to capture the excess returns of highly innovative companies. Investments tracking our indexes are ideal replacements for actively managed strategies,” said Steven Vannelli, CFA, CEO and Chief Investment Officer of Gavekal Capital. “Now there is a diversified Knowledge Leaders Index for every broad geography. And with our new ADR versions, there are also now Knowledge Leaders Indexes tailored for separately managed accounts.”

The new indexes join Gavekal’s family of Knowledge Leaders Indexes, the first indexes designed to transform the Knowledge Effect - a market anomaly discovered by academic research through which highly innovative companies tend to experience excess returns in the stock market – into portfolio alpha for investors.

The Gavekal Knowledge Leaders Indexes are designed using the firm’s proprietary process for identifying Knowledge Leaders. The firm constructs the indexes first by capitalizing corporate investment in intangible assets -- such as research and development, brand development and employee education -- for all companies in the universe to create an intangible-adjusted historical set of financial accounts going back to 1980. Based on this adjusted financial history, the companies are screened for knowledge intensity, profitability and return on capital. Those that pass the screen are identified as Knowledge Leaders and included in the Gavekal Knowledge Leaders Indexes.

Performance

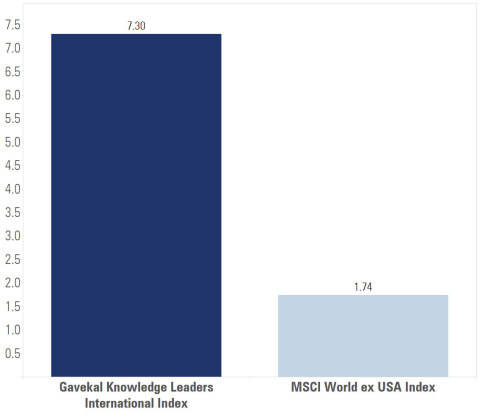

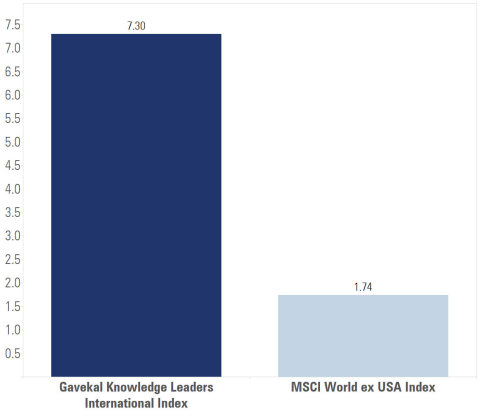

For the Gavekal Knowledge Leaders International Index, 10-year performance as of August 2016 exceeded the MSCI World ex USA Index by 5.56% on an annualized basis. The consistent outperformance resulted in an annualized multi-factor alpha of 2.95% over 10 years produced through a Fama-French regression analysis. The Gavekal Knowledge Leaders International Index presents a unique risk profile, offering a 73.85% active share compared to the MSCI World ex USA Index, an active share higher than many actively managed funds.

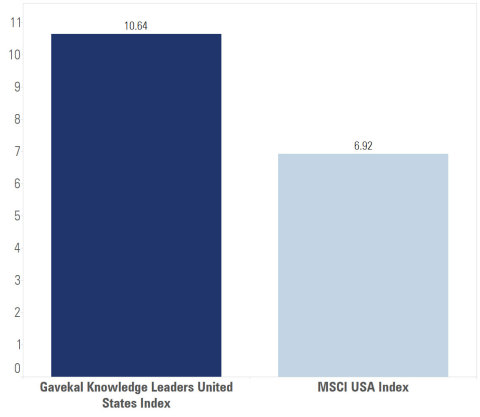

For the Gavekal Knowledge Leaders United States Index, 10-year performance as of August 2016 exceeded the MSCI USA Index by 3.72% on an annualized basis. The consistent outperformance resulted in an annualized multi-factor alpha of 2.77% over 10 years produced through a Fama-French regression analysis. The Gavekal Knowledge Leaders United States Index presents a unique risk profile, offering a 68.77% active share compared to the MSCI United States Index, an active share higher than many actively managed funds.

All Knowledge Leaders Indexes are equal-weighted and available in total return and price return formats. They rebalance twice a year, in March and September. Two exchange-traded funds track the Gavekal Knowledge Leaders Developed World and Emerging Markets Indexes. Managed accounts tracking the Gavekal Knowledge Leaders Indexes are available for individual and institutional investors that seek to capture the excess returns of the world’s leading innovators. Learn more about the Knowledge Leaders Indexes.

Full

List of Knowledge Leaders Indexes

Gavekal

Knowledge Leaders Developed World IndexGavekal

Knowledge Leaders Emerging Markets Index

Gavekal

Knowledge Leaders International Index

Gavekal

Knowledge Leaders United States Index

Gavekal

Knowledge Leaders Developed World ADR IndexGavekal

Knowledge Leaders International ADR Index

About the Gavekal Knowledge Leaders Strategy

The Gavekal Knowledge Leaders Strategy seeks to transform the Knowledge Effect into portfolio alpha. The strategy identifies Knowledge Leaders, or highly innovative companies, through a proprietary process that measures a company’s investment in its future growth. Knowledge Leaders possess deep reservoirs of intangible capital as a result of their history of investing in knowledge-intensive activities like R&D, brand development and employee education. Our proprietary model adjusts a company’s financial history to capitalize these investments – reversing the conservative accounting rule that renders a company’s innovation activities invisible in the stock market – and reveals the companies with the greatest knowledge intensity. The companies that pass our quantitative Knowledge Leaders screen comprise the Gavekal Knowledge Leaders Indexes, the first indexes designed to capture the Knowledge Effect.

About Gavekal Capital

Gavekal Capital identified the Knowledge Effect and created the first investment methodology designed to capture the excess returns of highly innovative companies. Gavekal Capital is creator and designer of the Gavekal Knowledge Leaders Strategy, indexes and investment products. Learn more at Gavekal Capital or email investmentteam@gavekal-usa.com. Follow our investment team blog via Twitter @GaveKalCapital.com.

An investor cannot invest directly in an index. The Index performance does not represent the performance of any investment product offered by Gavekal Capital, LLC. The performance of client accounts may vary from the Index performance. Index returns shown are not reflective of actual investor performance nor do they reflect fees and expenses applicable to investing. The Index data is the property of Gavekal Capital, LLC, which has contracted with SolactiveAG to calculate and maintain the indexes.

The launch date of the Gavekal Knowledge Leaders International Index (Bloomberg ticker KNLGINX) is 8/15/16 and the base date of the index calculation is 3/31/2000. The returns of the Index prior to the launch date are based on applying the rules in effect as of the launch date retroactively to historical periods to and including the base date. Such historical results are not based on an Index that was maintained in real time. To obtain additional index methodology and constituent components, please click here: KNLGINX index.

The launch date of the Gavekal Knowledge Leaders United States Index (Bloomberg ticker KNLGUSX) is 8/15/16 and the base date of the index calculation is 3/31/2000. The returns of the Index prior to the launch date are based on applying the rules in effect as of the launch date retroactively to historical periods to and including the base date. Such historical results are not based on an Index that was maintained in real time. To obtain additional index methodology and constituent components, please click here: KNLGUSX index.

Active Share is the percentage of stock holdings in a portfolio that differ from the benchmark index. Active Share determines the extent of active management being employed by mutual fund managers: the higher the Active Share, the more likely a fund is to outperform the benchmark index. Researchers in a 2006 Yale School of Management study determined that funds with a higher Active Share will tend to be more consistent in generating high returns against the benchmark indexes.

Multi-Factor Alpha is the excess returns that remain after accounting for various investment factors. In our case, multi-factor alpha is the excess returns after accounting for the Ken French factors (market factor, value factor, quality factor, low volatility factor and momentum factor).

Past performance is not a guarantee of future results. An investor cannot invest directly in an index.