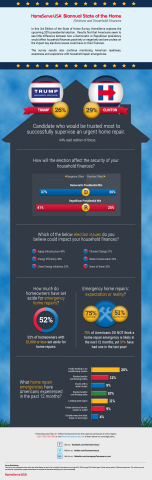

NORWALK, Conn.--(BUSINESS WIRE)--With the 2016 U.S. presidential election quickly approaching, Americans seem to see little difference between how a Democratic or Republican presidency would affect household finances – and a remarkable number currently believe both would have negative effects. When asked what effect a Republican or Democratic presidency would have on the security of their household finances, 41 percent of Americans thought a Republican presidency would have a negative effect, while 37 percent felt a Democratic presidency would have a negative effect. On the other side, opinions stacked up more closely, with 26 percent of Americans saying a Democratic presidency would have a positive effect and 25 percent believing a Republican presidency would have a positive effect.

The findings are from the Summer 2016 and third edition of the HomeServe Biannual State of the Home Survey from HomeServe USA (HomeServe), a leading provider of home repair solutions. The survey is a biannual report on the financial impact of home repairs and energy use facing Americans and was conducted online by Harris Poll on behalf of HomeServe from August 3-5 2016, among over 2,000 adults ages 18 and older. This edition of the survey additionally explored attitudes around the 2016 presidential election and how its results may affect household finances.

Changes in Americans’ Household Finances

The ability to take on unexpected expenses, such as emergency home repairs, is one of the more telling factors on the state of household finances among Americans. The survey found that, while most American homeowners had some reserves set aside to cover the costs of an emergency home repair, 23 percent had no money set aside whatsoever. The Winter 2016 edition of HomeServe’s survey also found that figure at 23 percent, while the Summer 2015 edition saw the percentage just slightly higher (25 percent). Among those who did have money set aside, 38 percent had $1,000 or less – lower than the 43 percent found in the Winter 2016 survey and the 52 percent in the Summer 2015 survey. The decrease can be attributed to more Americans having higher amounts of money set aside for home emergencies. Among those who have money set aside, for example, 37 percent have $5,000 or more saved, while 33 percent had $5,000 or more saved according to the Winter 2016 survey and 29 percent in the Summer 2015 survey.

“The trends we see across our previous and latest survey data suggests some Americans have seen improvements in the state of their household finances over the past year, which is a great sign. However, the chunk of homeowners who continue to have little to no money set aside to take on home emergency repairs remains sizable,” said Tom Rusin, CEO of HomeServe USA. “In the event of a home emergency, these homeowners can find themselves blindsided by high cost of repairs and unable to take on the unexpected financial burden.”

A lack of awareness among Americans for the prevalence of home repair emergencies in the U.S. further amplifies reason for concern over financial readiness to absorb an expensive repair. When asked about the likelihood that they may experience a major home repair emergency in the next 12 months, three-quarters of Americans (75 percent) felt it was not very – or not at all – likely. However, over half of Americans (51 percent) reported having experienced a home repair emergency in the past 12 months, suggesting a clear gap between Americans expectations and actual experience. With nearly a quarter of homeowners (23 percent) having no money set aside to shoulder the financial impact of potentially thousands of dollars in emergency repair costs, the need for awareness and education on the topic, as well as proper planning, is as important as ever.

Election Issues Impacting Household Finances

A number of key issues discussed throughout the election cycle are of concern to Americans and capable of impacting their household finances – through monthly energy and water costs, potential home repair expenses and more. However a significant percentage of Americans are unclear on how these election issues could affect their financial well-being. Findings from the HomeServe Biannual State of the Home Survey showed one out of every three Americans (33 percent) felt that neither aging infrastructure, energy efficiency, clean energy initiatives, climate change nor water conservation could have an effect on their household finances.

Alternatively, 2 in 5 Americans (40 percent) agreed that aging infrastructure is an election issue that could affect their household finances. “How the Presidential Election May Impact Water Infrastructure,” a webinar hosted by HomeServe for the American Water Works Association (AWWA) earlier this year, highlights the significant role the election could play in addressing the challenges posed by aging infrastructure. One of the ways infrastructure could impact homeowners in particular is through the significant water loss happening today across the country due to leaks affecting aged pipes. The Center for Neighborhood Technology (CNT) found that nearly 6 billion gallons of water is lost per day in the U.S. as a result of this issue. In the report “Buried No Longer: Confronting America’s Water Infrastructure Challenge,” the AWWA suggests that communities in the U.S. could expect household water bills to triple from the costs of repairing U.S. drinking water infrastructure. What’s more, water loss and infrastructure repairs on municipal systems not only affects homeowners’ water bills but could also more directly result in them facing thousands of dollars in costs when the piping systems on their property require repairs.

Energy efficiency was another election issue cited by 38 percent of Americans as something that could affect their household finances. Their views are supported by the findings of HomeServe’s Winter 2016 survey, where 66 percent of Americans said they planned to take steps to make their home more energy efficient in the following 12 months, with 84 percent among them citing savings on energy bills as the driving factor. These topics, in addition to clean energy initiatives, climate change and water conservation, all overlap and are closely intertwined – requiring attention from Americans leading up to the fall elections. Voters should have an understanding of how these issues affect their communities and wallets via home energy and water costs, as they determine which candidates will earn their support at the polls.

“It is critical for Americans to understand and connect the dots between these national issues, the 2016 presidential election and their household finances. The level of attention the next President places on issues like climate change or aging infrastructure may very well have a direct impact on homeowners’ living costs,” added Rusin. “In worst-case scenarios where home emergencies occur and urgent repairs are required, homeowners may have to face unexpected, significant expenses – which, as the survey suggests, almost 1 in 4 Americans (23 percent) may be in no position to handle. This is why it will be important for homeowners across the U.S. to pay attention to the issues related to energy and water, proactively prepare to manage home emergencies when they occur, and keep their household finances in mind when they head to the polls in November.”

Survey Methodology

This Summer 2016 survey was conducted online within the United States by Harris Poll on behalf of HomeServe from August 3-5, 2016 among 2,027 adults ages 18 and older. The Winter 2016 survey was conducted online within the United States by Harris Poll on behalf of HomeServe from February 3-5, 2016 among 2,178 adults ages 18 and older. The Summer 2015 survey was conducted online within the United States by Harris Poll on behalf of HomeServe from July 17-21, 2015 among 2,024 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact hsusa@icrinc.com.

About Harris Poll

Over the last 5 decades, Harris Polls have become media staples. With comprehensive experience and precise technique in public opinion polling, along with a proven track record of uncovering consumers’ motivations and behaviors, The Harris Poll has gained strong brand recognition around the world. Contact us for more information.

About HomeServe

HomeServe USA Corp (HomeServe) is a leading provider of home repair solutions serving over 2.7 million customers across the US and Canada under the HomeServe, Service Line Warranties of America (SLWA) and Service Line Warranties of Canada (SLWC) names. Since 2003, HomeServe has been protecting homeowners against the expense and inconvenience of water, sewer, electrical, HVAC and other home repair emergencies by providing affordable repair coverage and quality local service. As an A+ rated Better Business Bureau Accredited Business, HomeServe is dedicated to being a customer-focused company supplying best-in-class repair plans and other services to consumers directly and through over 400 leading municipal, utility and association partners. For more information about HomeServe, a 2015 Connecticut Top Workplace winner and recipient of seven 2016 Stevie Awards for Sales & Customer Service, please go to www.homeserveusa.com. For information on SLWA visit www.slwofa.com and for SLWC visit www.slwofc.ca. To connect with HomeServe on Twitter and Facebook, please visit www.twitter.com/homeserveusa and www.facebook.com/HomeServeUSA.