WALTHAM, Mass.--(BUSINESS WIRE)--Care.com (NYSE:CRCM), the world’s largest online marketplace for finding and managing family care, today announced the expansion of Care.com Benefits with a first-of-its-kind peer-to-peer benefits platform between families and caregivers that represents an important step forward in professionalizing caregiving and developing a social safety net for millions of care workers in the on-demand gig economy.

Care.com Benefits is part of Care.com’s ongoing strategy to support and grow the country’s valuable care workforce and offer professional benefits to this important sector of our economy. In January 2016, the Care.com Benefits platform was launched, offering caregivers access to affordable medical and dental insurance plans.

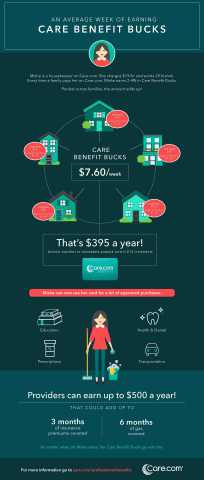

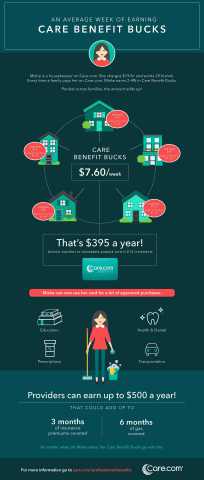

Today’s expansion of the Benefits platform enables families to contribute to their caregiver’s benefits just as traditional corporate employers do for their employees. When a family pays a caregiver through Care.com, a percentage of the transaction is added to the payment to fund the Care.com Benefits program, which helps the caregiver pay for essential family expenses, such as healthcare and transportation. These contributions are pooled with others from household employers paying that caregiver through Care.com. From the program, caregivers receive Care Benefit Bucks, which provide access to benefits that are portable – staying with the care worker even if she changes jobs working for numerous families on Care.com.

The Company first introduced professional benefits in 2012 through its payroll platform, Care.com HomePay, which is the leader in household payroll and tax facilitation. Care.com HomePay supports household employers in fulfilling their legal obligation to pay household payroll taxes and provides caregivers access to vital benefits including Social Security, Medicare, and unemployment insurance, among others. Additionally, Care.com HomePay enables household employers to purchase worker’s compensation policies for their household employees in all 50 states.

“A strong care workforce is critical to our economy and the well-being of families, yet we lack a scalable solution to provide benefits for these workers who support us all. Today is an important milestone for us to better serve the millions of caregivers in our marketplace, and to enable the families they serve to provide them support,” said Sheila Lirio Marcelo, Founder, Chairwoman and CEO of Care.com. “Caregivers constitute one of the largest segments of the gig economy and the fastest growing large job category in our country. Caregivers frequently work for multiple families and almost always work without access to professional benefits. The Care.com Benefits platform not only provides that access but now makes these benefits more affordable through the help of employer contributions to the program. Pooled, portable, peer-to-peer benefits represent a new model for household employment and an innovative step forward in professionalizing caregivers.”

Components of the Care.com Benefits Platform:

-

Pooled, Portable Contributions:

- Employer Benefit Contributions: Each time a family pays a caregiver through Care.com, a small contribution is automatically added to the payment. These contributions are pooled together across multiple employers to support the Care Benefit Bucks program. When a caregiver has earned $15 in Care Benefit Bucks, they can be redeemed for a Care.com Benefits reloadable prepaid card, which can be used towards an array of expenses, including doctor co-pays, health insurance premiums, drug store purchases, transportation (e.g., gas, bus passes), and education. Caregivers can earn up to $500 in Care Benefit Bucks annually which, for example, could cover three months of average caregiver insurance premiums or six months of gas. Care.com Benefit Bucks Infographic

- Corporate Contributions – Coming Soon: Having launched the Care Benefit Bucks program by allowing families to pool benefits for their caregivers, Care.com has taken the first step in magnifying the power of small consumer contributions to help workers in our gig economy. Care.com is also actively working with various corporations to further support caregivers by potentially participating in the Care Benefit Bucks program.

- Affordable Health and Dental Plans: In January 2016, Care.com teamed up with Stride Health to provide an array of medical and dental plans to all caregivers in the Care.com marketplace in the U.S. The service provides a fast and simple mobile enrollment platform with personalized recommendations, financial guidance and year-round navigation support for medical and dental insurance plans, and enables eligible caregivers to take advantage of tax credits to lower premium expenses. The majority of caregivers who enrolled for 2016 coverage saved on average $3,000 a year on health insurance plans by qualifying for tax credits.

- Access to Retirement Benefits, Unemployment Insurance and Worker’s Compensation: Caregivers who are paid legally may become eligible for a variety of benefits including Social Security, Medicare and unemployment insurance, among others. Care.com HomePay facilitates all aspects of payroll and tax obligations for household employers, which is required to enable their employees to have access to these critical benefits. In addition, through Care.com HomePay, families can purchase Worker’s Compensation for their household employees.

- Real-Time Payments: Peer-to-peer instant payments made by families to caregivers on the Care.com platform are powered by Stripe. Those payments arrive in caregiver bank accounts in less than 30 minutes and families no longer need to have cash on hand.

For more information, visit: Care.com/professional-benefits

About Care.com

Since launching in 2007, Care.com (NYSE: CRCM) has been committed to solving the complex care challenges that impact families, caregivers, employers, and care service companies. Today, Care.com is the world’s largest online destination for finding and managing family care, with 11.6 million families and 9.1 million caregivers* across 18 countries, including the U.S., UK, Canada and parts of Western Europe, and approximately 1.1 million employees of corporate clients having access to our services. Spanning child care to senior care, pet care, housekeeping and more, Care.com provides a sweeping array of services for families and caregivers to find, manage and pay for care or find employment. These include: a comprehensive suite of safety tools and resources members may use to help make more informed hiring decisions - such as third-party background check services, monitored messaging, and tips on hiring best practices; easy ways for caregivers to be paid online or via mobile app; and Care.com Benefits, including the household payroll and tax services provided by Care.com HomePay and the Benefit Bucks program, a peer-to-peer pooled, portable benefits platform funded by household employer contributions which provides caregivers access to professional benefits. For enterprise clients, Care.com builds customized benefits packages covering child care, back up care and senior care consulting services through its Care@Work business, and serves care businesses with marketing and recruiting support. To connect families further, Care.com acquired community platforms Big Tent and Kinsights in 2013 and 2015, respectively. Headquartered in Waltham, Massachusetts, Care.com has offices in Berlin, Austin, New York City and the San Francisco Bay area.

*As of June 2016