AUSTIN, Texas--(BUSINESS WIRE)--Attention homeowners! Raising the deductible on your home insurance policy is one proven way to save on your premiums, but it’s not always the best financial move, says a new state-by-state, comprehensive study by insuranceQuotes.

They examined three different scenarios for raising deductibles and how much each increase allows consumers to save on average:

- $500 to $1,000: 7% savings

- $500 to $2,000: 16% savings

- $500 to $5,000: 28% savings

“Choosing a higher deductible means you share more potential financial risk with an insurer and also makes you less likely to file a claim. In return, insurers charge a lower premium,” says Laura Adams, senior insurance analyst for insuranceQuotes.

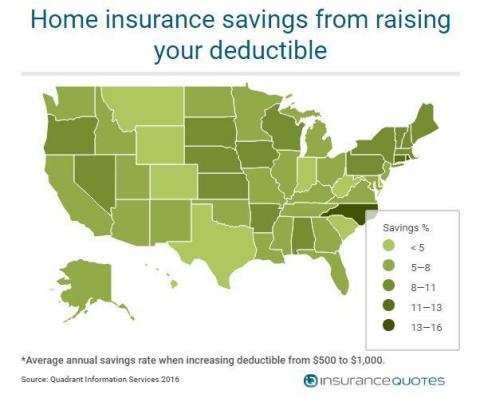

When it comes to premium savings, no two states are created equal. For instance, North Carolina homeowners see the highest savings when increasing a deductible from $500 to $2,000: 39%. Going from $500 to $5,000 saves 45%.

The lowest savings are in Texas, Hawaii and Indiana, where homeowners save less than 7% on average by increasing a deductible from $500 to $2,000.

“What you do with your home insurance deductible should depend on where you live. If there’s no significant savings, it may not make financial sense to increase your deductible. Be sure to review your coverage every couple of years to make sure your policy and insurance provider is still right for you,” says Adams.

The full report is available at http://insurancequotes.com/home/raising-homeowners-deductible-saves-money-071316.

Methodology:

insuranceQuotes.com commissioned Quadrant Information Services to measure the impact of changing a homeowner’s insurance deductible in each U.S. state and the District of Columbia. Quadrant examined data from the largest carriers (representing 60-70% of market share) in each territory. The home specifications were kept constant in all regions.

About insuranceQuotes:

insuranceQuotes provides consumers with a free, easy way to shop for and compare insurance quotes online for auto, home, health, life and business. Follow insuranceQuotes on Facebook, Twitter, YouTube, Instagram and Google Plus.