NEW YORK--(BUSINESS WIRE)--New York received more financial technology (“fintech”) venture financing than Silicon Valley for the first time during the first three months of this year, according to a new report by Accenture (NYSE:ACN) and the Partnership Fund for New York City.

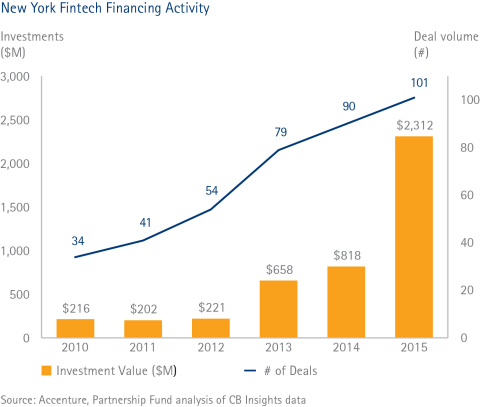

The report, “Fintech’s Golden Age,” showed $690 million flowed to New York and $511 million flowed to Silicon Valley, highlighting the city’s rapid rise as a fintech hub. Last year, fintech investment in New York tripled to $2.3 billion, accounting for nearly 10 percent of all fintech investment globally.

“We are now in a golden age of fintech,” said Robert Gach, Capital Markets managing director for Accenture Strategy and co-founder of the FinTech Innovation Lab. “Venture capital is driving major innovations. But it is difficult for fintechs – particularly in the U.S. – to grow and scale on their own, so investments are shifting to fintechs that partner with rather than compete against traditional institutions. That is positioning New York at the epicenter of the fintech boom.”

“Six years ago very few people knew what ‘fintech’ meant; now it’s a center stage topic around the world,” said Maria Gotsch, President and CEO of the Partnership Fund for New York City and co-founder of the FinTech Innovation Lab. “Within that time fintech has become a multi-billion dollar force in New York’s entrepreneurial and financial services ecosystem. Entrepreneurs are drawn in by the city’s tech talent and close access to potential customers, while Wall Street has opened up to this new avenue of innovation.”

From Competition to Collaboration

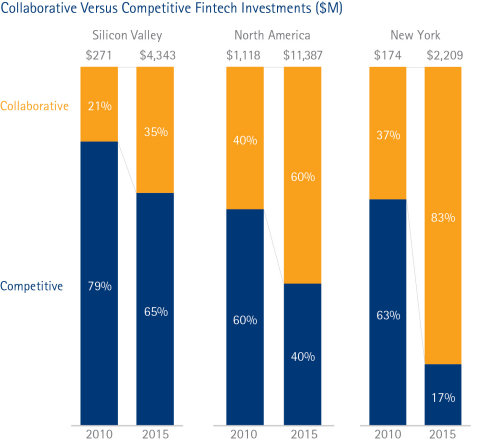

The report, which is based on an analysis of CB Insights data, also showed that fintech investment in North America has shifted away from ventures that compete against financial institutions and toward those that partner and collaborate with them. In 2010, 60 percent of North American fintech investment dollars went to ventures that compete against traditional institutions, while 40 percent went to those that collaborate with them. In 2015, the ratio was reversed.

That change was far more pronounced in New York: 37 percent of New York investment dollars went to fintech ventures that collaborate with financial institutions in 2010; and that number had increased to 83 percent in 2015.

According to Gach, “The reality of the U.S. regulatory landscape – combined with the surging demand for digital innovation – makes the fintech investment boom a watershed for banks. With friction easing and cooperation growing between entrepreneurs and institutions, financial services firms need to take the next step to deeper adoption and integration of these innovations.”

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With approximately 373,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

About the Partnership Fund for New York City

The Partnership Fund for New York City is the $115 million investment arm of the Partnership for New York City, New York’s leading business organization. The Fund’s mission is to engage the City’s business leaders to identify and support promising NYC-based entrepreneurs in both the for-profit and non-profit sectors to create jobs, spur new business and expand opportunities for New Yorkers to participate in the City’s economy. The Fund is governed by a Board of Directors co-chaired by Charles “Chip” Kaye, co-chief executive officer of Warburg Pincus, and Tarek Sherif, Chairman and CEO of Medidata. Maria Gotsch serves as President and CEO of the Fund. More information about the Fund can be found at www.pfnyc.org.